Off-road market growth presents opportunity for dealers

AI-powered stock analysis website AInvest has pegged U.S. off-road vehicles as an emerging market in 2025, driven by surging demand for specialized hunting vehicles and recreational off-road equipment.

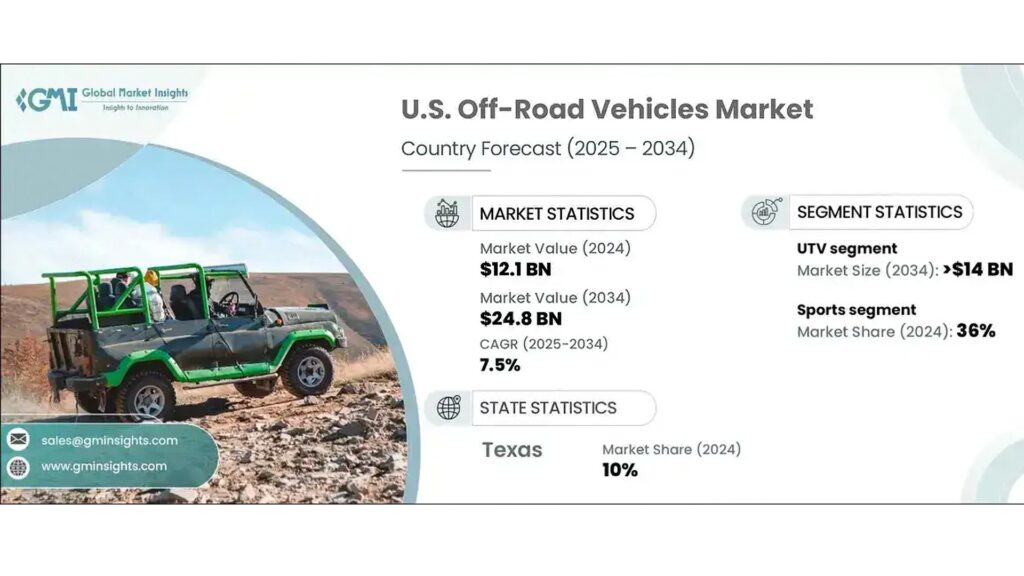

Global Market Insights’(GMI) 2025 Off-Road Vehicle Market Growth Forecast projects the U.S. ORV market to grow from $11.82 billion in 2025 to $17.72 billion by 2034, at a compound annual growth rate of 4.6%. Data from the GMI shows the major contributors to the ORV growth are from the regions where hunting and outdoor recreation intersect with robust economic activity.

Regional demands

States with high hunting activity, such as Alaska, Texas, Wyoming, and others, are experiencing significant off-road vehicle market growth. With two-thirds of its state open to hunting, Alaska leads in hunting participation, with 12.3% of its residents holding licenses in 2020. Texas, on the other hand, accounts for 10% of the national off-road vehicle market revenue share, making both regions an off-road vehicle hotspot. This is all according to World Population Review.

Dealer strategies

The Southwest and Pacific Northwest are attractive for off-road vehicle use, with UTVs accounting for 60% of the U.S. ORV market share in 2024, according to GMI. Dealers in these regions and in high-hunting areas are meeting the demand, offering vehicles with features such as high ground clearance, durable suspension, and noise-reduction features tailored for hunting. Accessories such as LED lights, winches, and camouflage covers are also in demand, with dealers pushing these modifications to enhance the hunting experience.

The market is also being reshaped by technological innovations. Electric and hybrid off-road vehicles, such as Polaris and Can-Am , are gaining traction due to fuel efficiency and reduced environmental impact. These models align with growing consumer preferences for eco-friendly alternatives, particularly in regions like California, where environmental regulations are stringent. For instance, Honda’s new FourTrax Rubicon 700 4×4 Automatic will be available this fall in 49 states, excluding California, due to emissions regulations.

Recent data suggest Texas, Alaska, and Wyoming present strong opportunities due to their existing infrastructure, tourism industries, and regulatory environments that support off-road recreation. For example, Texas’s $1.2 billion annual hunting equipment market underscores the potential for cross-selling off-road vehicles and accessories, per the USA Hunting Equipment Market Size & Forecast 2025-2035.

AInvest concludes that the U.S. ORV market is poised for sustained growth, driven by recreational hunting, industrial utility, and technological innovation. By targeting high-demand regions, adopting customer-centric strategies, and embracing sustainability, powersports dealers can unlock significant value.