Polaris reports share gains, rightsizes dealer inventory as tariffs weigh on 2025 results

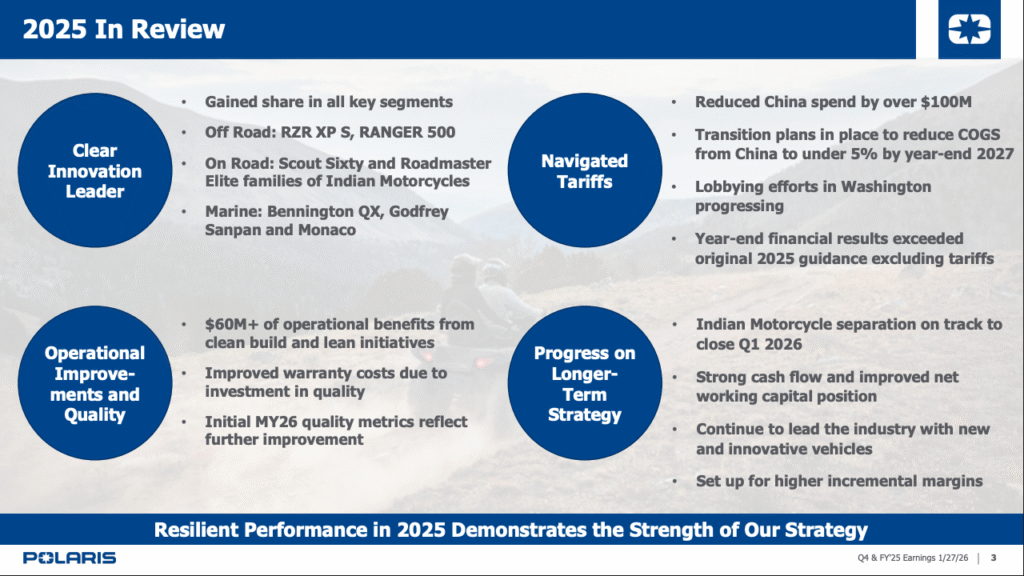

Polaris Inc. closed a challenging 2025 with flat full-year sales, fourth-quarter retail gains and improved dealer inventory health, positioning the company for modest growth in 2026 despite continued tariff pressure and a cautious consumer environment.

The company reported full-year 2025 sales of $7.15 billion, essentially flat year over year. Fourth-quarter sales increased 9% to $1.92 billion, driven by higher shipments and a favorable mix, particularly in off-road vehicles. Adjusted earnings for the quarter came in at $0.08 per share, slightly ahead of internal expectations.

CEO Mike Speetzen said Polaris delivered on its commitments despite significant external headwinds.

“While tariffs represented the most significant challenge we’ve seen since the pandemic, we delivered nearly everything we said we would do and then some,” Speetzen said during the company’s Jan. 27 earnings call. “We navigated difficult headwinds in 2025 while still delivering share gains, innovation, quality and operational improvements that position us for long-term success.”

Retail momentum, inventory alignment

North American retail sales rose 9% in the fourth quarter, excluding Youth products, a metric Polaris emphasized as a clearer indicator of business health and profitability. The company gained market share across all major segments for the full year and reported share gains in ORV, snow and marine during the fourth quarter.

Dealer inventory ended the year at just under 100 days on hand across the network, the lowest level outside of the pandemic era, according to Polaris.

“Dealer inventory is right-sized, and the mix is in great shape,” Speetzen says. “We believe Polaris has the healthiest mix of current versus non-current inventory of any OEM.”

Polaris continues to let retail demand drive production and shipment schedules, a shift the company said benefits both dealers and the balance sheet.

“This is exactly where we want to be,” Speetzen adds. “We will adjust build and ship schedules in response to market conditions to help ensure dealers have what they need to be successful.”

Segment performance

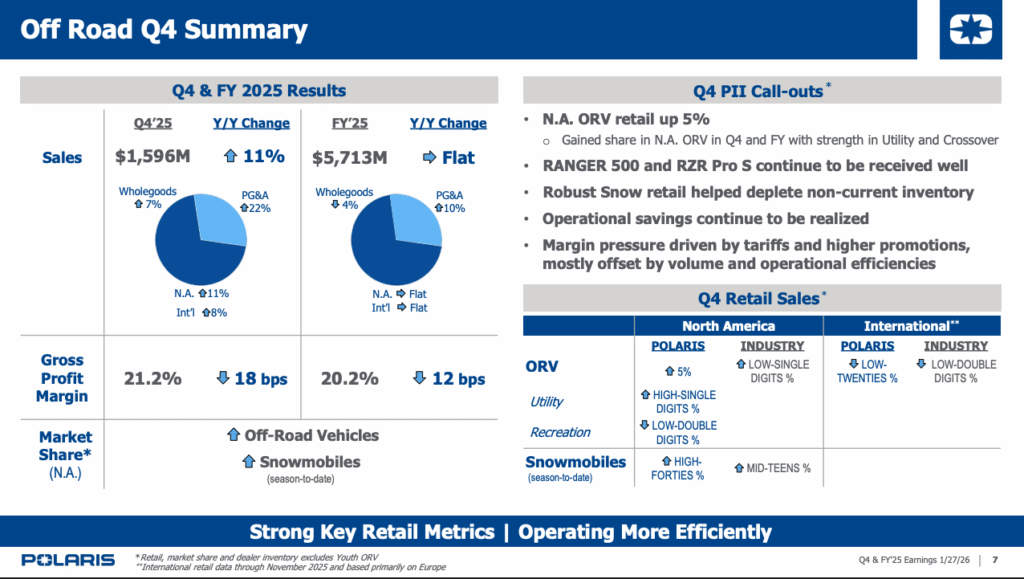

Off-road vehicle sales rose 11% in the fourth quarter, supported by strong utility demand and a 22% increase in parts, garments and accessories. Polaris said utility models led the category, with the Ranger 500 becoming the highest-retailing midsize side-by-side in the industry during the quarter.

“Our data shows the Ranger 500 wasn’t just the top seller — it wasn’t even close,” Speetzen shares.

On the premium side, the Ranger XP 1000 NorthStar posted its highest retail month ever in December, aided by agricultural and ranch-focused promotional programs.

On-road sales rose 4% in the quarter, though Indian Motorcycle retail declined year over year as the brand lapped the 2024 launch of the Scout platform. Polaris expects its planned separation of Indian Motorcycle to close by the end of the first quarter of 2026.

Marine sales increased 1%, with Polaris reporting stronger dealer order books for the 2026 season, particularly for entry-level Bennington pontoons and the redesigned Bennington QX lineup.

Snowmobile retail started strong due to early snowfall in flatland regions but moderated later in the season amid lighter mountain snowfall. Polaris said it will keep snowmobile production conservative heading into the 2026–27 season.

Tariffs, cost control and cash flow

Tariffs weighed heavily on results, pressuring gross margin by $37 million in the fourth quarter alone. Still, Polaris delivered more than $60 million in operational savings in 2025 through manufacturing transformation initiatives and reduced warranty expense by $25 million due to quality improvements.

“If you adjusted out the tariff impact, we would have exceeded the guidance we set at the beginning of the year,” Speetzen notes.

CFO Bob Mack highlighted Polaris’ progress in cash generation and balance sheet strength. The company generated $605 million in free cash flow in 2025 and paid down approximately $530 million in debt.

“That’s a testament to strong execution and controlling what we can control in an extremely dynamic environment,” Mack adds.

Polaris also continues to reduce its exposure to China-based sourcing, ending 2025 with approximately 14% of the material cost of goods sold tied to China, down from 18% in 2024. The company’s goal is to reduce that figure below 5% by year-end 2027.

Outlook for dealers

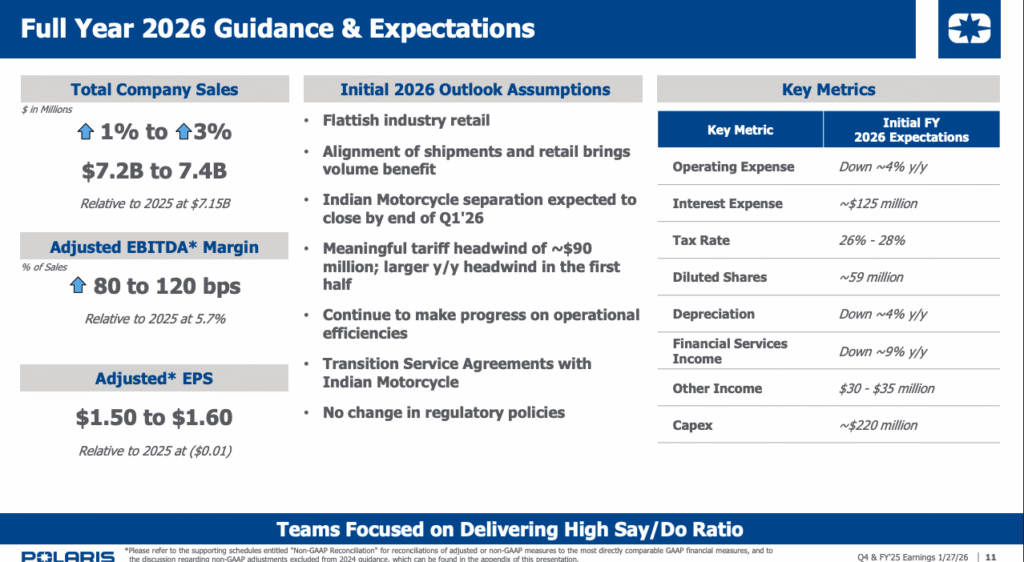

For 2026, Polaris forecasts sales growth of 1% to 3% and adjusted earnings per share of $1.50 to $1.60, assuming no material changes to current tariff policies. Excluding Indian Motorcycle, the company said the outlook equates to 7% to 9% organic growth.

“We’re entering 2026 from a position of strength,” Speetzen concludes. “As Polaris succeeds, our dealers succeed, and our customers continue to enjoy the best products in the industry.”