Polaris reports ‘challenging’ Q2 earnings

The second quarter proved challenging for Polaris as the industry continued to contend with elevated interest rates, inflation, and an increasingly cautious dealer and consumer. CEO Mike Speetzen says the company is focused on progressing against key priorities, including manufacturing efficiency improvements and innovation.

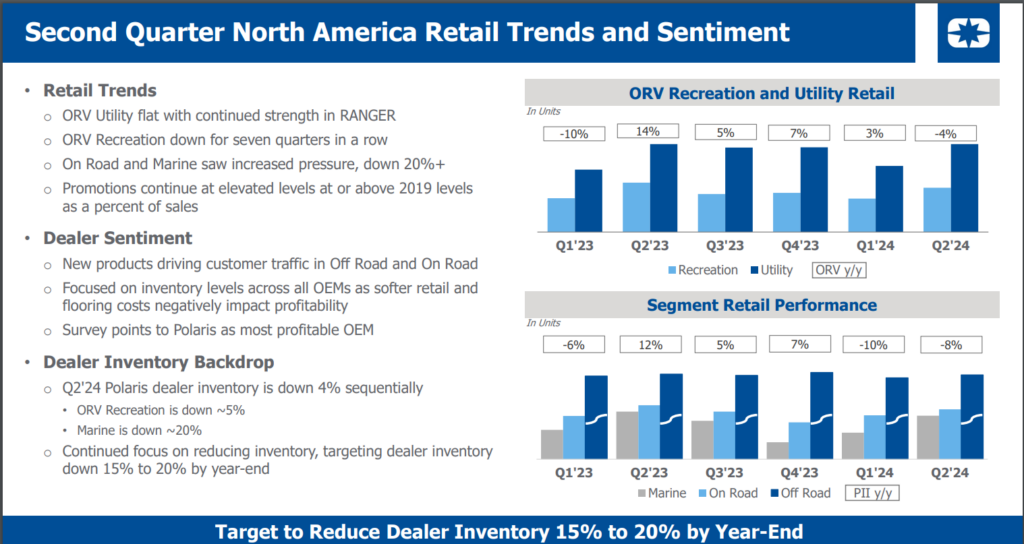

Reducing dealer inventory is a central priority for Polaris, both through intentional retail driving efforts and by adjusting production forecasts to further reduce dealer shipments. Speetzen says they have lowered the full-year guidance to reflect the decision to cut shipments and believes that current industry challenges will remain in place for the remainder of the year.

Although it might take longer than originally anticipated, I am confident in our long-term strategy and the Polaris team’s ability to emerge stronger and well-positioned to drive profitable growth, deliver value to shareholders, and capitalize on our position as the powersports industry leader.

Mike Speetzen, chief executive officer of Polaris Inc.

Polaris reported worldwide sales of $1,961 million for the second quarter, down 12 percent compared to the second quarter of 2023. North America’s sales of $1,677 million represented 86 percent of total company sales and decreased 11 percent from $1,883 million in 2023. International sales of $284 million represented 14 percent of total sales and decreased 15 percent versus the second quarter of 2023. Total sales in the second quarter of 2024 were negatively impacted by lower volume and net pricing driven by higher promotional activity partially offset by a favorable product mix.

Segment highlights

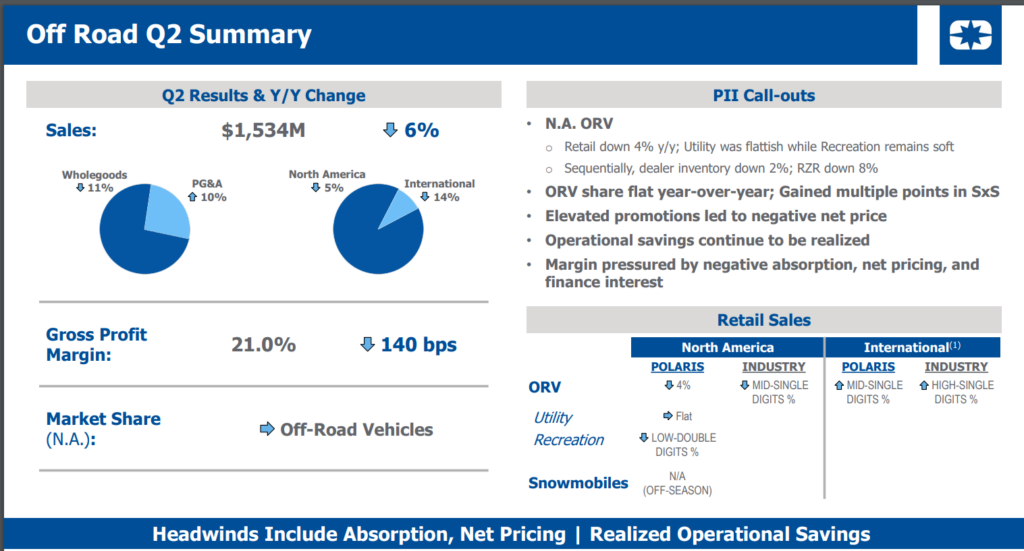

Off Road

- Sales were driven by lower volume and net pricing driven by higher promotional spend, partially offset by increased Parts, Garments and Accessories (PG&A) sales. • PG&A sales increased 10 percent.

- Gross profit margin performance was driven by lower net pricing driven by higher promotional activity and unfavorable plant absorption, partially offset by operational improvements.

- Polaris North America ORV unit retail sales were down four percent. Estimated North America industry ORV unit retail sales were down mid-single digits percent.

On Road

- Sales were driven by lower volumes.

- PG&A sales decreased 10 percent.

- Gross profit margin performance was driven by negative product mix and lower net pricing driven by higher promotional activity, partially offset by operational improvements.

- North America unit retail sales for Indian Motorcycle were down low twenties percent. Estimated North America unit retail sales for the comparable motorcycle industry were down mid-single digits percent.

Marine

- Sales results were driven by lower volumes.

- Gross profit margin performance was impacted by decreased sales volumes and lower net pricing driven by higher promotional activity.

As reported, the second-quarter net income attributable to Polaris of $69 million decreased by 49 percent, and diluted earnings per share (EPS) of $1.21 decreased 48 percent compared to the second quarter of 2023. Adjusted net income attributable to Polaris for the quarter was $78 million, down 44 percent, and adjusted EPS was $1.38, down 43 percent, compared to the second quarter of 2023.

Gross profit margin decreased 117 basis points to 21.6 percent for the second quarter, as compared to the second quarter of 2023. The adjusted gross profit margin of 21.8 percent decreased 99 basis points, primarily driven by higher promotional activity, unfavorable plant absorption, and higher finance interest partially offset by favorable operational costs, compared to the second quarter of 2023.

2024 Outlook

Polaris updated its 2024 sales outlook to be down 17 to 20 percent versus its previous outlook of down five to seven percent versus 2023. The company now expects adjusted diluted EPS attributed to Polaris Inc. common shareholders to be down 56 to 62 percent versus 2023 versus the prior outlook of down 10 to 15 percent.