Kawasaki surges to No. 1 in the U.S. motorcycle market as Harley falls to third: Reports

Kawasaki has become the top-selling motorcycle brand in the United States for 2025, overtaking both Honda and Harley-Davidson amid one of the toughest sales climates in the past decade, according to New Atlas and MotorCyclesData.

MotorCyclesData’s year-to-date figures through September show Kawasaki sales up 14.2%, the strongest performance in the industry. Honda, last year’s No. 1, slipped to second with an 8% decline. In comparison, Harley-Davidson fell to third after a steep 15.9% drop—a downturn highlighted in New Atlas reporting by Utkarsh Sood, who also cited Harley’s internal turmoil and revenue challenges as contributing factors.

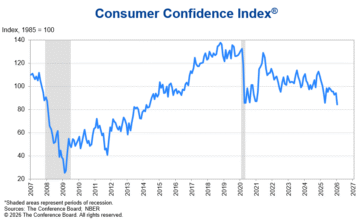

Overall, the U.S. motorcycle market remains under pressure. MotorCyclesData reports 401,035 YTD sales, down 6.5% — including the worst first half in 10 years, at –9.2%. The third quarter softened slightly but remained negative at –0.5%. This compares to the Motorcycle Industry Council’s data showing the motorcycle industry is down –7.3% YTD through September.

Despite the industry slump, Kawasaki found momentum in the U.S. even as the brand struggles globally. New Atlas credits strong demand for the Ninja lineup and the Vulcan S as key drivers of its domestic surge.

Behind the top three, Yamaha held fourth (–0.4%), while KTM suffered one of the largest declines (–23.8%). Indian Motorcycle, which was recently sold to private equity, remains a bright spot, posting 4.9% growth, followed by Suzuki (–13.7%) and BMW (–10.8%).

Both reports point to a clear consumer trend: buyers are leaning toward reliable, price-competitive models from Japanese manufacturers. The entry-level pricing gap is significant — Kawasaki, Honda and Yamaha all offer sub-$5,500 models, while Harley-Davidson and Indian’s least expensive bikes start around $9,999. To that end, Harley is rumored to be working on a sub-$6,000 bike that will be released next year.

For dealers, the shifting leaderboard underscores evolving customer priorities: affordability, dependability, and value. With the U.S. market projected to remain economically constrained into 2026, brands with competitive pricing and strong small- to mid-displacement lineups appear poised to gain further share.