Polaris delivers ‘mixed’ results in Q423

Polaris came into 2023 confident and riding high on its strong product mix that enabled the company to gain market share during the pandemic era. However, investors are probably grumbling a bit now as the performance came in below expectations due to some operational challenges. The company is confident it has identified the problem areas and has begun making progress on its efficiency and margin initiatives for 2024.

“As reflected in our outlook, segments of our industry are expected to remain challenged in 2024, but we believe we will continue to capture market share with our robust lineup and new products coming later this year,” comments Mike Speetzen, CEO of Polaris. “The Polaris team’s relentless efforts remain focused on delivering the most innovative products in the industry, unmatched customer experiences and stronger operating fundamentals.”

Polaris reported that Q423 for North American retail was up 7%, driven mostly by the utility and snow segments. The company said they expected positive snow performance relative to last year, but they were weaker than expected given the lack of snowfall in most regions. “It was encouraging to see our side-by-side retail up low double digits, driven by continued strength in our range of vehicles,” says Speetzen. “While utility saw strength, our recreational business continues to see pressure given higher interest rates and economic uncertainty. We ended the year gaining slightly over one point of share in Off-Road more if you exclude used vehicles that have little profitability associated with them.”

Speetzen says the company has stabilized dealer inventory, removing the challenges of product availability they’ve been dealing with for several years, but other operational challenges need to be addressed. “Our largest challenge centered around our manufacturing facilities. We did not achieve the efficiencies we planned, which resulted in margin pressure throughout the year. It’s important to note that operational costs did start to improve later in the year, but not to the level we had expected them to. This, coupled with lower manufacturing volumes and difficulty producing new products led to significant margin pressure… We are focused on addressing the root causes of the inefficiencies with a focus on driving improved processes within sales, inventory, operations and planning.”

Another interesting tidbit from the conference call was Speetzen’s note that their dealers are becoming a lot more discerning about the brands they carry. “We know that they’re pushing out a lot of those weaker brands and that really benefits us because we continue to demonstrate that we are the leader, and there’s a reason behind that. And I think that the dealers appreciate the adherence we have to making sure that the dealer inventory stayed at an appropriate level.”

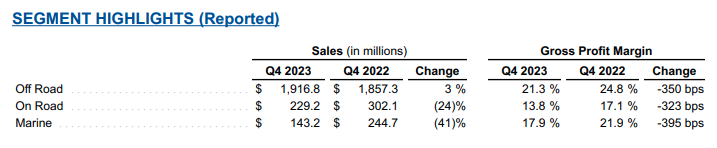

Polaris reported worldwide sales of $2,289 million, down five percent versus the fourth quarter of 2022. North America sales of $1,995 million represented 87 percent of total company sales and decreased five percent from $2,108 million in 2022.

International sales of $294 million represented 13 percent of total sales and decreased one percent versus the fourth quarter of 2022.

Total company sales in the fourth quarter were negatively impacted by lower volume, net pricing driven by higher promotional activity and higher finance interest.

Net income from continuing operations attributable to Polaris of $103 million decreased 47 percent, and diluted earnings per share from continuing operations (EPS) of $1.81 decreased 46 percent compared to the fourth quarter of 2022. Adjusted net income from continuing operations attributable to Polaris for the quarter was $113 million, down 44 percent, and adjusted EPS was $1.98, down 43 percent, in each case as compared to the fourth quarter of 2022.

Operating expenses were $357 million in the fourth quarter of 2023 compared to $331 million in the fourth quarter of 2022 due to higher general and administrative expenses. Operating expenses, as a percentage of sales, of 15.6 percent were up 182 basis points in the fourth quarter of 2023 compared to the fourth quarter of 2022.

Off-road segment highlights:

- Sales were driven by volume growth in snow, utility side-by-sides, and commercial partially offsetting continued weakness in recreation.

- Parts, Garments and Accessories (PG&A) sales increased 16 percent.

- Gross profit margin performance was driven by lower net pricing driven by higher promotional activity, higher finance interest, and unfavorable product mix.

- Polaris North America ORV unit retail sales were up seven percent. Estimated North America industry ORV unit retail sales were up mid-single digits percent.

On-road segment highlights:

- Sales were driven by lower volumes.

- PG&A sales decreased four percent.

- Gross profit margin performance was driven by increased warranty costs.

- North America unit retail sales for Indian Motorcycle were down high-teens percent. Estimated North America unit retail sales for the comparable motorcycle industry were down low-double digits percent.

Marine segment highlights:

- Sales results were driven by lower volumes.

- Gross profit margin performance was impacted by a decrease in sales volumes and lower net pricing resulting in decreased leverage of manufacturing costs.

2024 Outlook

Polaris says it expects 2024 sales to be down five to seven percent versus 2023. The company also says it expects adjusted diluted EPS to be down 10 to 15 percent versus 2023.