Yamaha Motor announces 2024 first half results

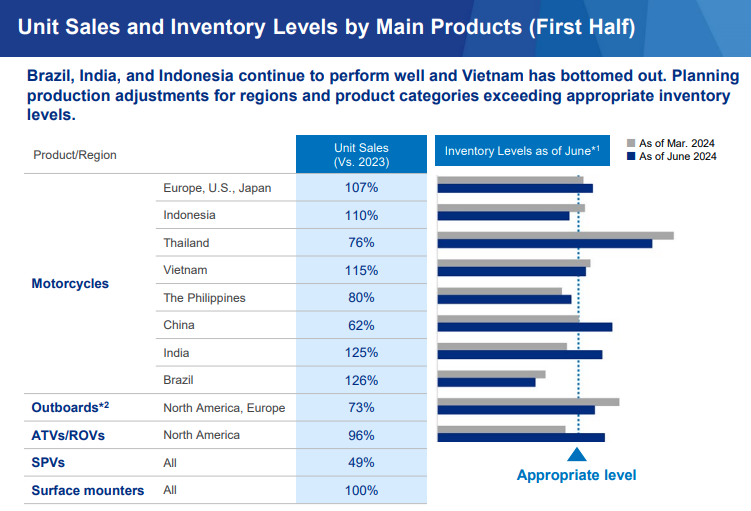

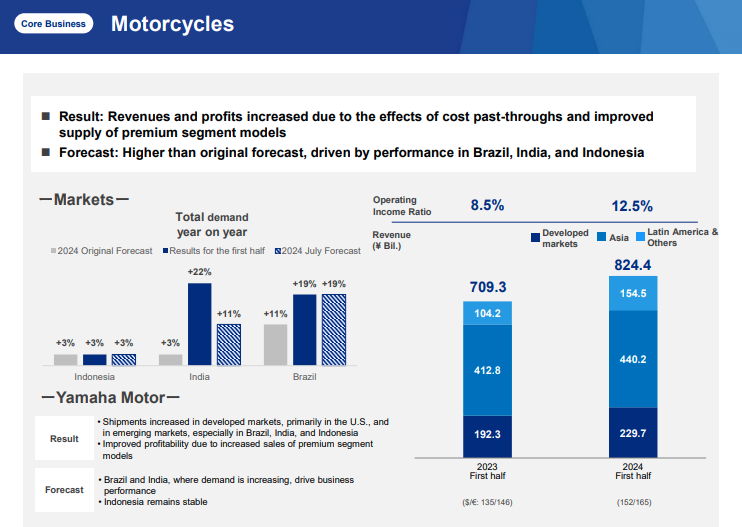

Yamaha Motor‘s core motorcycle business saw increased unit sales in Europe and the United States, resulting in higher numbers than last year. Emerging markets—primarily Brazil, India, and Indonesia—also went up, increasing the unit sales for the entire segment.

In the first half of fiscal 2024, we were able to set new records for revenue and income for the second year running. In our core business of motorcycles, increased sales of premium models in emerging markets and other factors led to us posting higher revenues and profits.

– HIDAKA, Yoshihiro, president, chief executive officer of Yamaha Motor

Yamaha says that high prices and interest rates have softened demand levels and that anticipated interest rate cuts in the United States, along with sharp fluctuations in foreign exchange rates, could further affect performance for the second half.

Also, while things vary by business segment, Yamaha expects the fiercely competitive environment to continue due to product supply improvements, declining levels of demand, and other effects. Ocean freight rates are trending upward, while raw material costs are generally in line with forecasts, excluding the effects of foreign exchange rates.

“We expect the motorcycle business to continue performing well, but for recreational vehicles and Smart Power Vehicles, inventory adjustments will lead to prolonged production cutbacks,” Yoshihiro adds. “In the Marine Products business, the new large outboard motor models we launched this season continue to receive ample customer inquiries, but we still expect demand to decline, mainly in Europe and the United States. We will continue to work toward inventory optimization, including making production adjustments that take demand levels and sales conditions into account. As for the Robotics business, we expect to see a recovery in demand in the second half of the year.”

Consolidated Business Results

In Yamaha’s core business of motorcycles, Brazil and India saw higher overall unit sales and higher prices per unit, which increased revenues. For operating income, the effects of higher revenue in the motorcycle business and cost-cutting efforts were compounded by the positives of a weaker yen, leading to higher profits for the period.

Revenues for the period were 1,348.4 billion yen (an increase of 122.0 billion yen or 10.0% compared with the same period of the previous fiscal year) and operating income was 154.4 billion yen (an increase of 12.9 billion yen or 9.1%). Interim net income attributable to owners of parent was 113.1 billion yen (an increase of 9.8 billion yen or 9.5%).

Results by Business Segment

- Land Mobility Business

For the motorcycle business, unit sales rose in Europe and the United States, resulting in higher numbers than last year. Demand in emerging markets-primarily Brazil, India, and Indonesia-went up and accordingly increased the unit sales recorded for the entire emerging market motorcycle business.

Revenues for the motorcycle business went up thanks to the higher unit sales in Brazil and India as well as higher prices per unit. For operating income, in addition to the effects of higher revenues, improved supply of premium segment models in emerging markets, cost reductions, and the benefits of a weaker yen brought in higher profits.

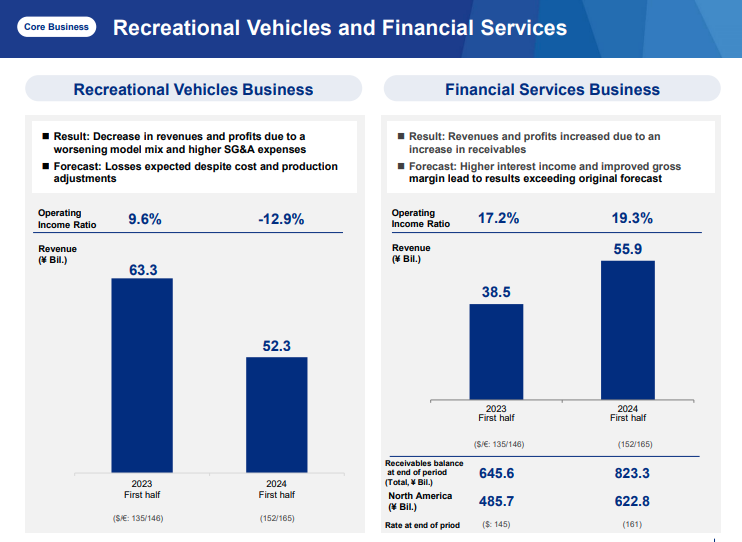

With recreational vehicles (ATVs and ROVs), demand has fallen below last year’s while unit sales remain roughly the same. However, a worsening model mix resulted in lower sales. In addition, the higher marketing, promotional, and manufacturing expenses accompanying the intensifying competition left the business with lower profits.

Revenues were 896.1 billion yen (an increase of 98.6 billion yen or 12.4% compared with the same period of the previous fiscal year) and operating income was 90.7 billion yen (an increase of 22.8 billion yen or 33.6%).

For the Smart Power Vehicles business, i.e., electric wheelchairs, electrically power-assisted bicycles (eBikes), and their drive units (e-Kits), unit sales of eBikes in Japan surpassed last year’s numbers. However, in Europe, the main market for Yamaha Motor e-Kits, market inventory adjustments have remained ongoing, leading to a decline in unit sales and lower sales overall. In terms of operating income, the lower unit sales and increase in sales promotion expenses left the SPV business posting lower profits.

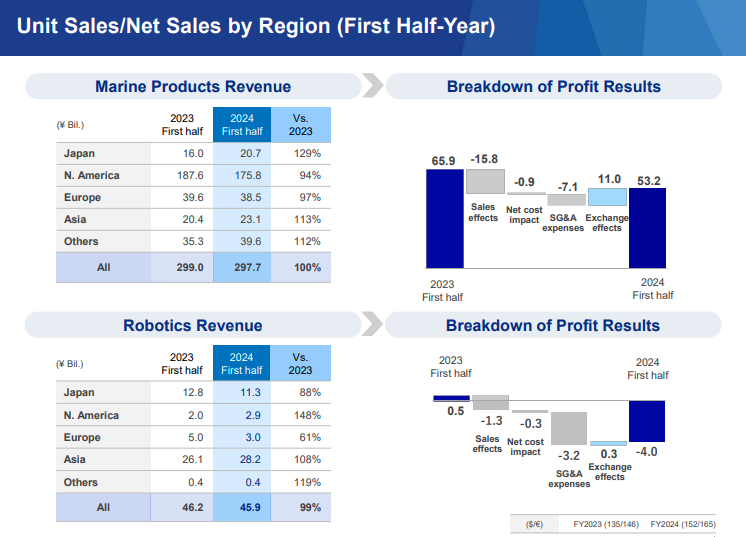

- Marine Products Business

Outboard motor demand in Central and South America continued to be strong, but in North America and Europe, rising prices and interest rates led to a decline in demand. However, demand for large horsepower outboards in North America remained stable. Unit sales of new outboard models were positive, but sales were lower for the outboard business overall.

Revenues were 297.7 billion yen (a decrease of 1.3 billion yen or 0.4% compared with the same period of the previous fiscal year) and operating income was 53.2 billion yen (a decrease of 12.6 billion yen or 19.2%).

For personal watercraft, unease about rising interest rates made customers hesitate to purchase, and demand decreased. However, unit sales increased due to improvements addressing last year’s lack of parts and supply chain disruptions, which forced the company to place limits on product supply.

As a result, sales and profits fell for the Marine Products business overall. Also, Yamaha Motor’s half-year consolidated business results include the performance recorded by German electric marine propulsion manufacturer Torqeedo GmbH during its Q2 accounting period (April-June 2024).

- Financial Services Business

As financial receivables increased, we made progress in passing procurement interest rates on to customers, which pushed revenues up. As for operating income, in addition to higher income from interest payments, the appraised losses derived from interest rate swaps last fiscal year were converted to appraisal gains this fiscal year, which upped profits for the period.

Revenues were 55.9 billion yen (an increase of 17.4 billion yen or 45.3% compared with the same period of the previous fiscal year), and operating income was 10.8 billion yen (an increase of 4.2 billion yen or 63.2%).

- Other Products Business

Higher demand for golf cars in North America was behind the rise in unit sales and resulting greater revenue brought the business both increased sales and profits.

Revenues were 52.9 billion yen (an increase of 7.7 billion yen or 17.1% compared with the same period of the previous fiscal year), and operating income was 3.6 billion yen (compared to an operating income of 0.6 billion yen).

- Forecast of Consolidated Business Results

Regarding the forecast consolidated business results for the rest of the fiscal year 2024, no changes have been made to the forecast made on February 14 when Yamaha announced its fiscal 2023 results:

- Revenue: 2,600.0 billion yen

- Operating Income: 260.0 billion yen

- Net Income: 175.0 billion yen