Fox Factory releases first quarter financial results

Fox Factory, a designer and manufacturer of shocks and other products for specialty sports and on- and off-road vehicles, reported a 6.5% increase in net sales for the first quarter of its fiscal year ended April 4.

Sales increase

Net sales for the first quarter of the company’s fiscal year were $355 million, an increase of 6.5% compared to net sales of $333.5 million in the same period last year.

This increase reflects a 9.9% increase in Aftermarket Applications Group (AAG) net sales and a 3.4% increase in Powered Vehicles Group (PVG) net sales.

The company says the increase in AAG net sales from $101.9 million to $111.9 million was driven by higher up-fitting sales due to a shift in product mix and increased demand for aftermarket products. However, high interest rates impacting dealers and consumers, and high inventory levels at dealerships continue to pose challenges.

PVG net sales increased from $118.1 million to $122.1 million primarily due to the expansion of the motorcycle business, which offset lower industry demand in the traditional powersports product lines.

“Our operational improvements and strategic cost management initiatives are well underway, helping us drive strong sequential adjusted EBITDA margin improvements in both our PVG and AAG segments,” says CEO Mike Dennison. “We expect these decisive actions will yield more tangible margin improvement throughout the year.”

Expenses and net loss

Total operating expenses were $360.3 million, or 101.5% of net sales, for the first quarter 2025, compared to $94.3 million, or 28.3% of net sales, in the first quarter of the same period last year. Operating expenses increased by $266 million, driven by the impact of a decline in the company’s perceived value.

Net loss attributable to Fox stockholders in the first quarter of fiscal 2025 was $259.7 million, compared to net loss attributable to Fox stockholders of $3.5 million in the first quarter of the prior fiscal year.

Tariff impact

Fox says that while the impact of the tariff policies on demand remains uncertain, new and expanded tariffs are expected to continue to pose significant challenges for the industries that the company serves. Fox estimates the annual potential impact of tariffs to be in the range of $50 million. However, the company says it has identified countermeasures to partially offset these impacts and believes this unmitigated component can be absorbed in its current plan for 2025.

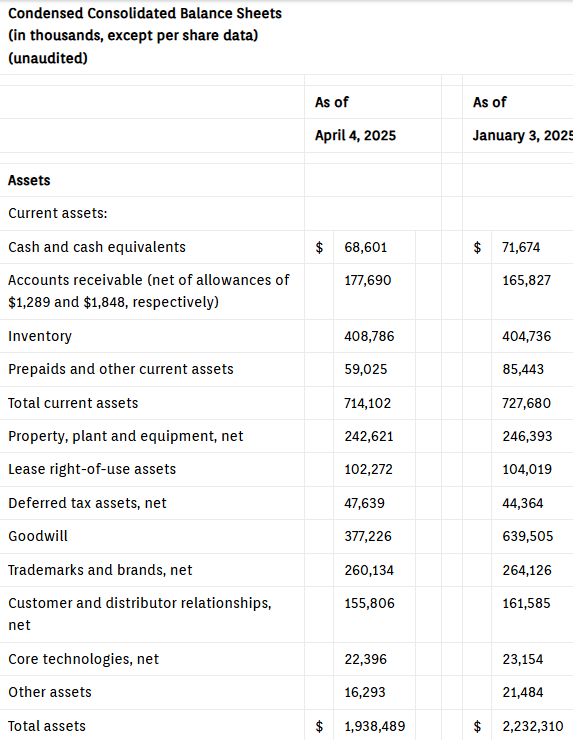

“While end market demand remains challenging and tariffs create additional uncertainty, we expect that the actions we have taken to optimize our business will allow us to generate free cash flow this year to further improve our balance sheet,” Dennison says.