Harley beats Wall Street revenue estimates in Q2 despite sales drop

Harley-Davidson exceeded revenue expectations in Q2 2025, but profits and motorcycle sales fell sharply as the company navigates soft demand, elevated tariff costs, and cautious consumer spending.

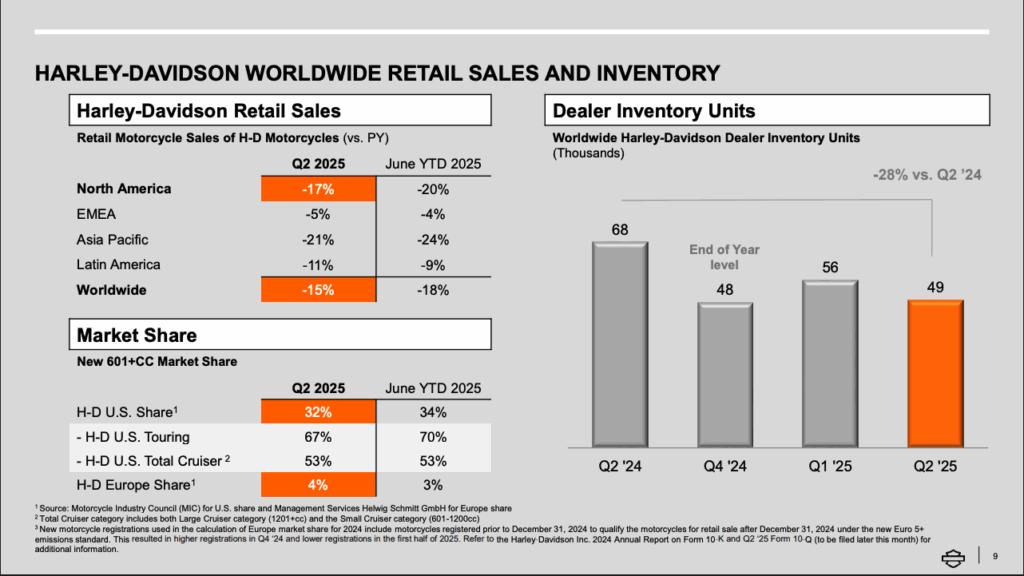

While revenue came in ahead of expectations for Wall Street investors, Harley’s profit margins were under pressure. Global shipments declined 28%, and the company’s net income fell to $108 million—down over 50% year-over-year.

CEO Jochen Zeitz said retail trends improved sequentially each month through Q2 and into July, despite overall softness:

“If you look back all the way from February, retail trends for new motorcycle unit sales improved every month. We expect that to continue in July as well—with significant improvement expected.”

Harley continued cutting dealer inventory, now 28% lower than a year ago. Zeitz added:

“We expect to end the year with very healthy levels of dealer inventory… definitely a double-digit decline [YoY] is our target.”

Tariffs & withheld guidance

Tariff-related costs totaled $13 million in the quarter, representing a projected $130–$ 175 million impact for the full year. Management again withheld full-year guidance for the core motorcycle business due to uncertainty around global tariffs and consumer spending patterns.

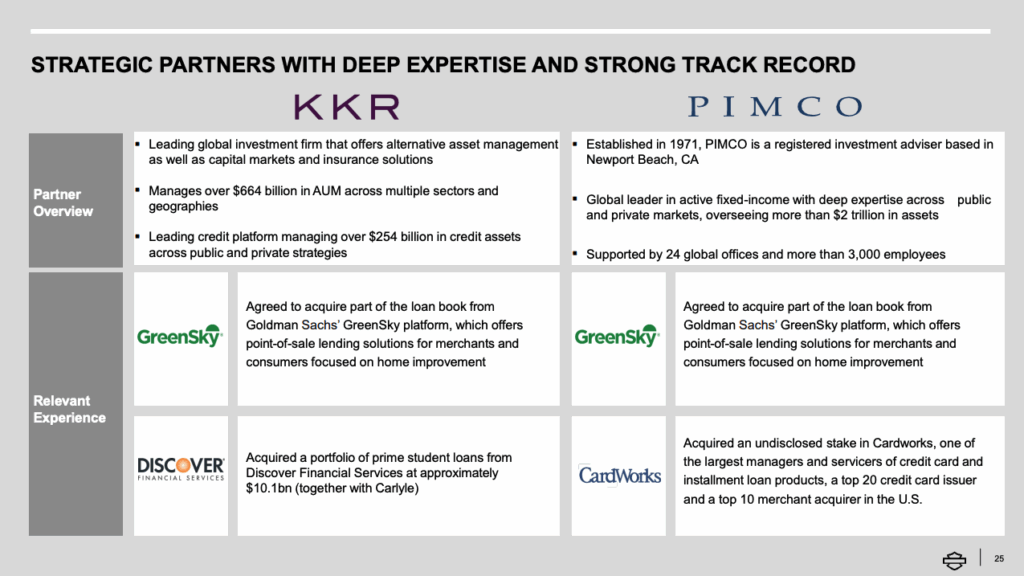

KKR & PIMCO Deal Unlocks $1.25 Billion

Harley sold a 4.9% stake in its financial services arm (HDFS) to KKR and PIMCO, unlocking $1.25 billion in cash. The deal will fund $450 million in debt reduction and $500 million in share repurchases later this year. CFO Jonathan Root explained the 4.9% stake was designed to remain under FDIC ownership caps:

“The 4.9% threshold is something that the FDIC has a comfort level with… Beyond that, it becomes more complex from a regulatory standpoint.”

Electric segment falls further

LiveWire’s deliveries plummeted 65% to just 55 units. Revenue was $6 million, and Harley capped future investment at a $100 million credit facility. Full-year LiveWire losses are expected to reach up to $69 million. Zeitz acknowledged infrastructure and policy headwinds:

“Charging infrastructure is still lagging, and the lack of purchase incentives makes it hard to compete with internal combustion.”

Model year shift & dealer implications

Harley is pulling forward its model year launch to this fall to reinvigorate showroom traffic. Root said:

“You’ll continue to see special iterations and vehicle drops throughout the year. It helps us drive excitement and extend the selling season.”

New product momentum

Demand for recent limited releases, such as the Gray Ghost Softail and CVO Road Glide RR, has been strong. Harley plans to expand its reach with more affordable and smaller-displacement models in 2026.

Low-cost gamechanger

During the Q2 call, Zeitz confirmed a new entry-level model called the Sprint, which is expected to launch in 2026 with a starting MSRP below $6,000. The model will be showcased to dealers in October.

He emphasized the heritage and appeal angle:

“Inspired by our heritage and the spirit of the iconic Harley‑Davidson Sprint motorcycle, this new bike embodies boldness, irreverence and fun, capturing the rebellious energy that defines the Harley‑Davidson experience.”

He further noted:

“This bike has been in development since 2021… We believe this motorcycle will not only be highly accessible, but also profitable, marking a significant step forward in driving Harley‑Davidson’s future profitable growth and opening up a new path… in future years for its key markets.”

Related reports add that the Sprint will revive a name used in the 1960s under Harley’s Aermacchi partnership and reflect a broader plan to release both the Sprint and a second entry-level cruiser in 2026.

Takeaway for dealers

- Upside: Upcoming affordable entry-level products (Sprint).

- Pressure areas: Declining consumer demand, compressed margins, tariff costs, and uncertain full-year outlook.

- Watch: Sprint and entry-level cruiser launches, LiveWire’s strategic adjustment, and product pipeline execution, especially toward younger, value-driven riders.

- New CEO Artie Starrs begins his role on October 1, 2025, and will bring a fresh perspective to the Motor Company.

Make all of your products in America and H-D will not have to pay tariffs, AND customers will love you because you actually made it in the USA.