Harley delivers Q2 results, North America down a point

Harley-Davidson, Inc. recently reported its second quarter 2024 results. In North America, motorcycle retail sales were down 1 percent, while retail sales of Touring and CVO motorcycles were up more than 12 percent in the U.S.

“Despite a challenging market, we are pleased with our second quarter performance, in which we grew our U.S. market share in a declining market, with notable unit growth of more than 11 percent in the important core category of Touring,” says Jochen Zeitz, chairman, president and CEO of Harley-Davidson. “We continue to be focused on executing our Hardwire strategy, leveraging our innovation and product pipeline while delivering on our cost productivity goals.”

Harley-Davidson, Inc. Consolidated Financial Results

Consolidated revenue in the second quarter was up 12 percent, driven primarily by an HDMC revenue increase of 13 percent. HDFS revenue was up 10 percent in the second quarter.

Consolidated operating income in the second quarter was up 9 percent, driven by an increase of 2 percent at HDMC, an increase of 21 percent at HDFS, and a decreased operating loss at the LiveWire segment. Consolidated operating income margin in the second quarter was 14.9 percent relative to 15.3 percent in the second quarter a year ago.

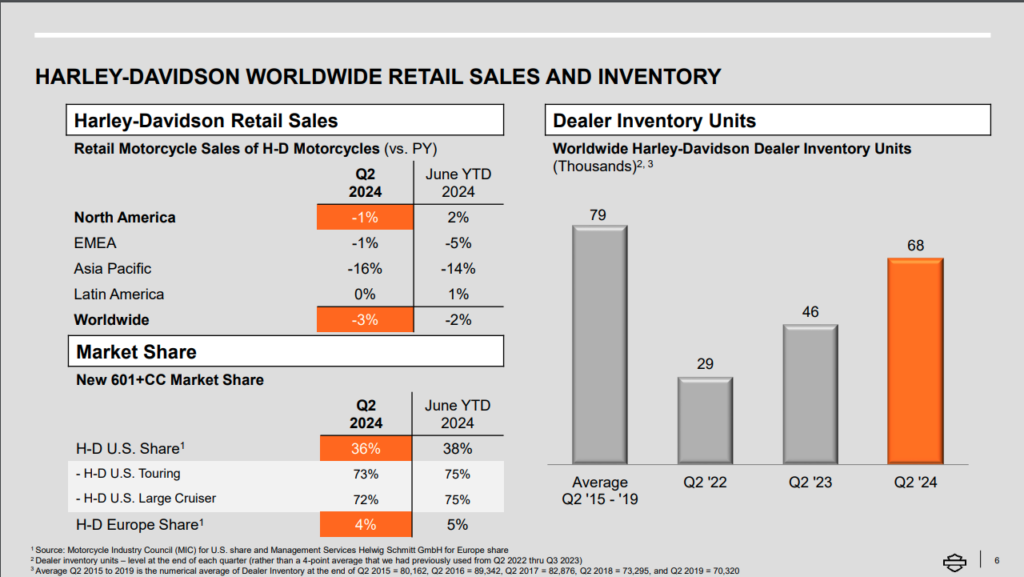

Harley-Davidson Retail Motorcycle Sales

Global retail motorcycle sales in the second quarter were down 3 percent versus the prior year. North America retail performance was down 1 percent, with U.S. retail up slightly.

The 1 percent decline in EMEA was driven by weakness in Central Europe but partially offset by growth in other markets. The 16 percent decline in APAC was driven primarily by weakness in China, and Latin America was largely flat.

Harley-Davidson Motor Company (HDMC) – Results

Second quarter global motorcycle shipments increased by 16 percent. Revenue was up 13 percent, driven by increased shipments and improved mix, partially offset by lower pricing and foreign exchange effects. Parts & Accessories revenue was down 10 percent. Apparel was down 4 percent as the prior year’s period included a greater benefit from anniversary product apparel sales.

The second quarter gross margin was down 2.7 points due to the impacts of pricing and sales incentives, higher manufacturing costs, and adverse impacts from foreign exchange. These effects were partially offset by higher wholesale volumes and improved mix. The second quarter operating income margin was down 1.5 points, and operating expenses increased modestly.

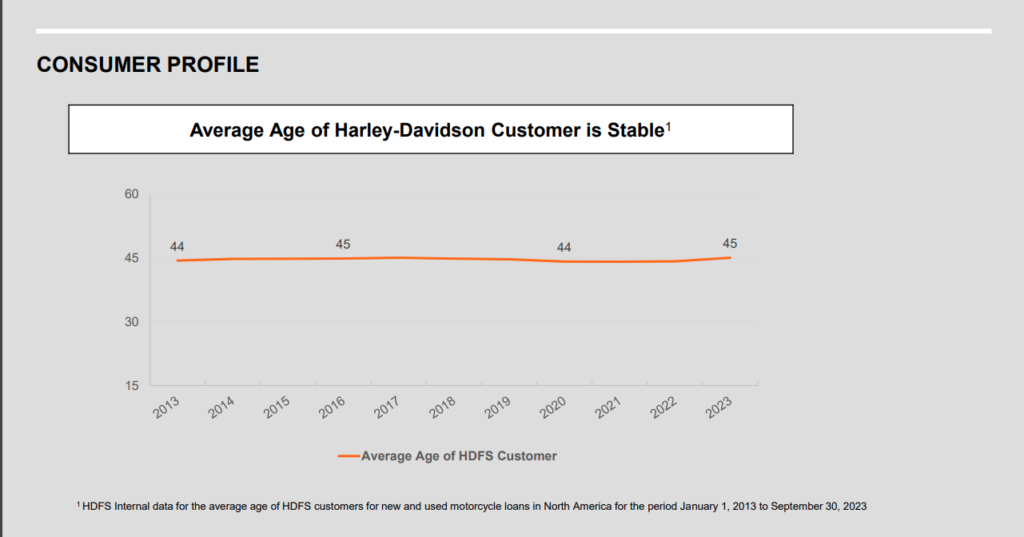

Harley-Davidson Financial Services (HDFS) – Results

HDFS operating income increased by $12 million in the second quarter, or 21 percent, driven by higher interest income and a lower provision for credit losses. Increased borrowing costs and operating expenses partially offset this. Total quarter-ending financing receivables were $8.0 billion, up 7 percent versus Q2 2023, primarily due to an increase in commercial finance receivables.

LiveWire – Results

LiveWire revenue for the second quarter decreased by 8 percent due to a decrease in STACYC third-party branded distributor volumes, partially offset by an increase in electric motorcycle unit sales. Operating loss improved by approximately $4 million (or 12 percent), driven by overall cost reduction initiatives.

Other Harley-Davidson, Inc. 2024 Results – through end of Q2

- Generated $578 million of cash from operating activities

- Effective tax rate was 19 percent

- Paid cash dividends of $47 million

- Repurchased $200 million of shares (5.5 million shares) on a discretionary basis

- Cash and cash equivalents of $1.8 billion at the end of the quarter

2024 Financial Outlook

For the full year 2024, the company now expects HDMC revenue to be down 5 to 9 percent compared to 2023 and an operating income margin of 10.6 to 11.6 percent.

For the full year 2024, the company continues to expect:

- HDFS: operating income flat to up 5 percent compared to 2023

- LiveWire: electric motorcycle unit sales of 1,000 to 1,500 and an operating loss of $105 to $115 million

- Harley-Davidson, Inc: capital investments of $225 to $250 million

Learn more at harley-davidson.com and livewire.com.

In a truly earthshaking bit of news. After riding motorcycles for 62 years I sat on a Harley for the first time last week. A lightly used XG-750 at a used motorcycle dealer. Without starting the engine it felt just like any other motorcycle. Pondering its sub 50 horsepower I decided to stay with my 1983 Kawasaki 750 Spectre which weighs the same but has an additional 30 horsepower. It will probably be the last Harley that attracts my attention.