BRP reports record fiscal Q3 results

BRP has reported its financial results for the three- and nine-month periods ended October 31, 2022. All financial information is in Canadian dollars unless otherwise noted. The complete financial results are available on SEDAR and EDGAR, as well as in the section Quarterly Reports of BRP’s website.

“BRP delivered record fiscal 2023 third quarter results, well ahead of expectations, driven by our team’s solid execution and our operational discipline,” said José Boisjoli, president and CEO, BRP. “Our strong product line-ups, additional production capacity and proactive approach to navigating supply chain challenges with the support of our suppliers and dealers were key factors in achieving exceptional retail growth of 43% for powersports in North America.

“Given these strong results and the visibility we have on deliveries for the rest of the year, we are increasing our full-year guidance with an expected Normalized EPS of $11.65 to $12.00. Looking ahead, we are in a strong position to sustain our growth thanks to our industry-leading brands, relentless innovation, proven performance and quality products.”

Highlights

• Revenues of $2,709 million, up 71% compared to the same period last year, a record performance for a single quarter in the Company’s history;

• Normalized EBITDA of $488 million, up 94% compared to the same period last year;

• Retail sales up for Powersports products by 43% compared to the same period last year, and market

share gains for SSV in North America;

• Normalized diluted EPS of $3.64, an increase of $2.16 per share or 146% and a record

performance for a single quarter, and diluted EPS of $1.76, an increase of $0.23 per share, or 15%,

compared to the same period last year;

• Acquisition of 80% of the outstanding shares of Pinion GmbH, and the purchase of substantially all the

assets related to the powersports business of Kongsberg Automotive ASA in Quebec, and

• Increasing full-year guidance for Revenues, Normalized EBITDA [1] and Normalized EPS – diluted

upward by $0.35, now ranging from $11.65 to $12.00 representing a growth of 17% to 21% compared to Fiscal 2022.

Third Quarter Results

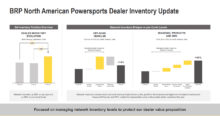

Despite the pressure on the global supply chain network, and the recent cybersecurity incident, the Company increased revenues during the third quarter of Fiscal 2023, notably by increasing its production output and the conversion rate of substantially completed units available for retail. The increase in revenues for the three and nine-month periods this fiscal year compared to Fiscal 2022 is explained by the strong consumer demand and supported by the additional available capacity, such as the new Juarez 3 facility dedicated to SSV production. However, the deliveries of PWC and 3WV in the quarter occurred after the peak in the retail season and drove an increase in the dealer network inventory at the end of the third quarter.

Revenues

Revenues increased by $1,121.3 million, or 70.6%, to $2,709.3 million for the three-month period ended October 31, 2022, compared to $1,588.0 million for the corresponding period ended October 31, 2021. The increase in revenue was primarily due to a higher wholesale volume of SSV, PWC, 3WV and snowmobile sold and the introduction of the Sea-Doo pontoon. The increase includes a favorable foreign exchange rate variation of $51 million.

• Year-Round Products (47% of Q3-23 revenues): Revenues from Year-Round Products increased by $543.5 million, or 73.8%, to $1,279.8 million for the three-month period ended October 31, 2022, compared to $736.3 million for the corresponding period ended October 31, 2021. The increase in revenues was due to a high volume of SSV and 3WV sold. The higher volume of SSV sold was due to added capacity and improved supply chain. The increase in 3WV volume was the result of the late shipment of model year 2022 which are usually delivered during the second quarter. The increase includes a favorable foreign exchange rate variation of $47 million.

• Seasonal Products (38% of Q3-23 revenues): Revenues from Seasonal Products increased by $583.6 million, or 133.5%, to $1,020.9 million for the three-month period ended October 31, 2022, compared to $437.3 million for the corresponding period ended October 31, 2021. The increase in revenues was primarily attributable to a higher volume of PWC sold due to late shipment of model year 2022 which are usually delivered during the second quarter. The increase was also attributable to a higher volume of snowmobiles sold and the introduction of the Sea-Doo pontoon.

• Powersports PA&A and OEM Engines (11% of Q3-23 revenues): Revenues from Powersports PA&A and OEM Engines increased by $14.1 million, or 5.0%, to $298.0 million for the three-month period ended October 31, 2022, compared to $283.9 million for the corresponding period ended October 31, 2021. The increase in revenues was driven by favorable pricing and the introduction of the Sea-Doo pontoon.

• Marine (4% of Q3-23 revenues): Revenues from the Marine segment decreased by $17.5 million, or 12.8%, to $118.8 million for the three-month period ended October 31, 2022, compared to $136.3 million for the corresponding period ended October 31, 2021. The decrease in revenues was primarily due to a lower volume of boats sold due to supply chain disruptions and the cybersecurity incident which delayed the new product introductions, partially offset by favorable pricing and a favorable mix of boats sold. The decrease includes a favorable foreign exchange rate variation of $2 million.

North American Retail Sales

The Company’s North American retail sales for powersports products increased by 43% [7] for the three-month period ended October 31, 2022 compared to the three-month period ended October 31, 2021. The increase was mainly attributable to PWC and SSV.

• Year-Round Products: retail sales increased on a percentage basis in the high-twenties range

compared to the three-month period ended October 31, 2021. In comparison, the Year-Round

Products industry recorded an increase on a percentage basis in the low single-digits over the

same period.

• Seasonal Products: retail sales increased on a percentage basis in the high-seventies range

compared to the three-month period ended October 31, 2021. In comparison, the Seasonal

Products industry increased on a percentage basis in the low-teens range over the same period

while the Company increased on a percentage basis in the low-sixties range when excluding

pontoons.

• Marine: retail sales for Marine products decreased by 47% compared to the three-month period

ended October 31, 2021, as a result of lower product availability.

Gross profit

Gross profit increased by $244.1 million, or 59.4%, to $654.7 million for the three-month period ended October 31, 2022, compared to $410.6 million for the corresponding period ended October 31, 2021. Gross profit margin percentage decreased by 170 basis points to 24.2% from 25.9% for the three-month period ended October 31, 2021. The increase in gross profit was primarily due to the favorable volume of SSV and PWC sold and a favorable pricing across all product lines. The decrease in gross profit margin percentage was attributable to higher logistics, commodities and labor costs due to inefficiencies related to supply chain disruptions, idle costs related to the cybersecurity incident and higher sales programs resulting from historical low levels in Fiscal 2022. The decrease was partially offset by higher volume and favorable pricing. The increase in gross profit includes a favorable foreign exchange rate variation of $29 million.

Operating expenses

Operating expenses increased by $44.8 million, or 19.9%, to $269.9 million for the three-month period ended October 31, 2022, compared to $225.1 million for the three-month period ended October 31, 2021. The increase in operating expenses was mainly attributable to an increase in selling and marketing and research & development expenses to support future growth and also from continued product investments and higher general and administrative expenses mainly for the modernization of the Company’s software infrastructure to support future growth.

Normalized EBITDA

Normalized EBITDA increased by $236.2 million, or 93.8%, to $487.9 million for the three-month period ended October 31, 2022, compared to $251.7 million for the three-month period ended October 31, 2021. The increase was primarily due to higher gross profit partially offset by higher operating expenses.

Net Income

Net income increased by $13.9 million to $141.6 million for the three-month period ended October 31, 2022, compared to the $127.7 million for the three-month period ended October 31, 2021. The increase was primarily due to a higher operating income, partially offset by an unfavorable foreign exchange rate variation impact on the U.S. denominated long-term debt.

Nine-month period ended October 31, 2022

Revenues

Revenues increased by $1,656.7 million, or 31.3%, to $6,957.1 million for the nine-month period ended October 31, 2022, compared to $5,300.4 million for the corresponding period ended October 31, 2021. The increase in revenue was primarily due to a higher volume of SSV, snowmobile, 3WV and PWC sold, the introduction of Sea-Doo pontoons and favorable pricing across all product lines. The increase includes a favorable foreign exchange rate variation of $34 million.

Normalized EBITDA

Normalized EBITDA increased by $132.6 million, or 12.7%, to $1,178.3 million for the nine-month period ended October 31, 2022, compared to $1,045.7 million for the nine-month period ended October 31, 2021. The increase was primarily due to higher gross profit, partially offset by higher operating expenses.

Net Income

Net income decreased by $84.7 million to $500.3 million for the nine-month period ended October 31, 2022, compared to $585.0 million for the nine-month period ended October 31, 2021. The decrease in net income was primarily due to the unfavorable impact of the foreign exchange rate variation on the U.S. denominated long-term debt, partially offset by a higher operating income and lower net financing costs.

LIQUIDITY AND CAPITAL RESOURCES

The Company generated net cash flows from operating activities totaling $342.3 million for the nine-month period ended October 31, 2022, compared to $61.2 million for the nine-month period ended October 31, 2021. The increase was mainly due to favorable changes in working capital, primarily driven by higher provisions.

The Company invested $397 million of its liquidity in capital expenditures to add production capacity and modernize the Company’s software infrastructure to support future growth and $209 million in business combinations. The Company also returned $344 million to its shareholders through quarterly dividend payouts and its share repurchase programs.

Dividend

On November 29, 2022, the Company’s Board of Directors declared a quarterly dividend of $0.16 per share for holders of its multiple voting shares and subordinate voting shares. The dividend will be paid on January 13, 2023 to shareholders of record at the close of business on December 30, 2022.