Harley-Davidson pledges stronger dealer support after Q3 earnings call

Harley-Davidson, Inc. reported a strong third quarter marked by major financial gains from its Harley-Davidson Financial Services (HDFS) transaction and a clear shift toward strengthening dealer profitability, retail traffic, and brand accessibility.

CEO Artie Starrs, in his first quarterly report since joining the company, said the results “demonstrate the positive impact of the HDFS transaction” and reinforced his belief that the brand’s long-term health depends on its dealer network.

“Our success begins with our dealers — when they thrive, Harley-Davidson thrives,” Starrs says. “You can expect an intensified focus on the key drivers of sustainable growth: strong and profitable dealerships, growing the powerful connection riders have with our brand, locally relevant marketing, and capital-efficient growth.”

Financial overview

On the investor side, Harley delivered diluted EPS of $3.10, a 241% increase from the same period last year. Consolidated revenue rose 17% to $1.34 billion, while operating income jumped 349% to $475 million.

That performance was largely fueled by the HDFS transaction with KKR & PIMCO, which the company described as a “transformative milestone.” The deal converts HDFS into a capital-light, de-risked business model, releasing over $1.2 billion in discretionary cash by early 2026 while allowing Harley-Davidson to retain majority ownership and control.

“This transaction unlocks significant value while transforming HDFS into a capital-light business,” notes Jonathan Root, chief financial officer. “Importantly, there’s no change for our dealers or customers — we believe this continues to drive long-term value creation.”

Motor Company performance

The Harley-Davidson Motor Company (HDMC) posted a 23% increase in revenue to $1.07 billion, driven by a 33% rise in global motorcycle shipments to 36,500 units. Motorcycle revenue climbed 34%, offset slightly by a 4% decline in Parts & Accessories.

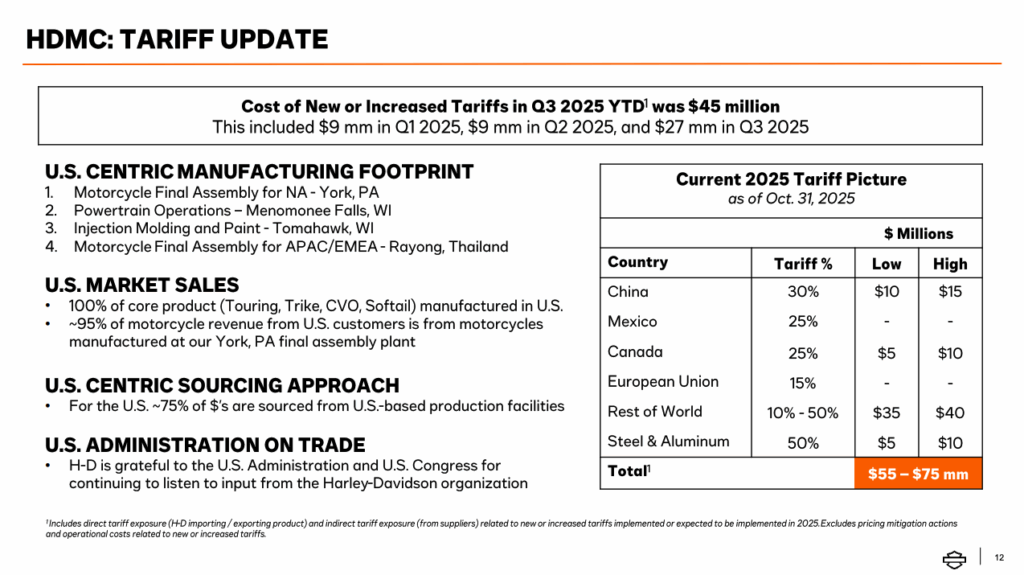

However, the gross margin declined 3.7 points to 26.4%, and the operating margin slipped to 5.0% due to tariffs, foreign-exchange headwinds, and higher operating costs. Harley reported a $27 million impact from new or increased tariffs in the quarter, with full-year tariff costs expected between $55 million and $75 million.

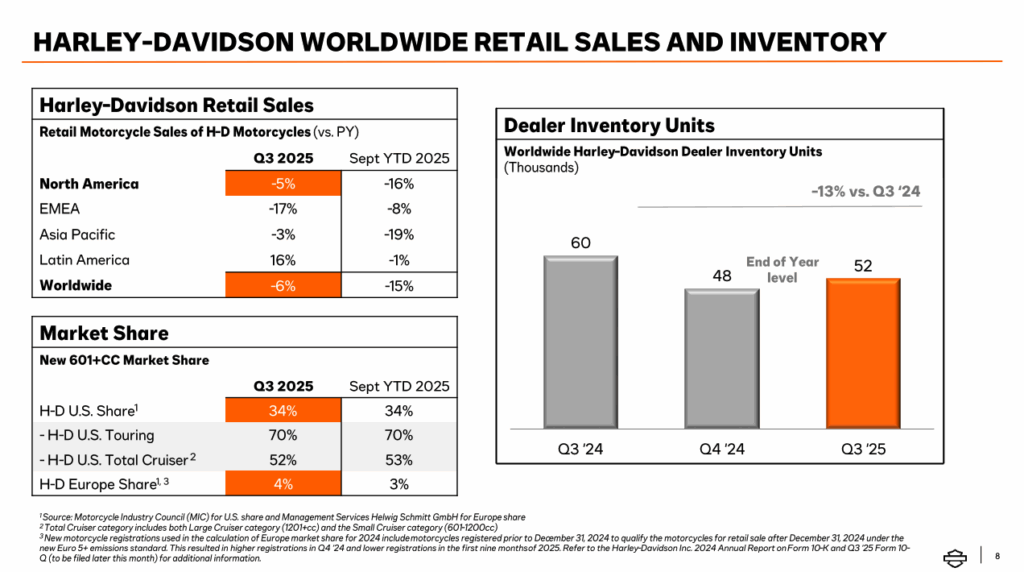

Global retail motorcycle sales fell 6% year-over-year, with North America down 5% and international markets down 9%. Dealers continue to face headwinds from high interest rates and soft consumer confidence. Despite that, Harley said dealer inventories were down 13% versus Q3 2024, showing progress toward leaner, more disciplined stocking levels.

Dealer network focus

Throughout the earnings call, Starrs made clear that Harley’s turnaround depends on strengthening the dealer network.

“A healthy Motor Company depends on a healthy dealer network,” Starrs shares. “We’re introducing market-responsive promotions to drive traffic to dealers, accelerating improvements in inventory management, and reviewing facility guidelines — with penalties for non-compliance suspended for the next 12 months.”

The company also plans to re-evaluate its e-commerce strategy to better balance online convenience with dealer engagement and profitability.

“Our exclusive dealer network is a powerful differentiator,” Starrs says. “We’ll continue to invest in supporting and strengthening it as we all navigate the evolving commercial environment.”

LiveWire update

Harley’s electric motorcycle division, LiveWire, grew Q3 revenue 16% to $6 million, with unit sales up 86%. Operating losses narrowed 30% to $18 million, in line with company expectations. LiveWire now forecasts a full-year operating loss of $72–$77 million and total cash use of $50–$60 million.

Cash actions

Harley ended Q3 with $1.8 billion in cash, after generating $417 million in operating cash flow. The company repurchased 6.8 million shares for $187 million and announced a $200 million accelerated share repurchase (ASR) program with Goldman Sachs — part of its $1 billion repurchase plan through 2026.

What it means for dealers

- Improved liquidity from the HDFS transaction could free up resources for dealer and retail initiatives.

- Retail promotions and inventory alignment are expected to ramp up heading into 2026.

- Compliance relief facility penalties are suspended for 12 months, giving dealers breathing room.

- Customer engagement focus signals more support for local marketing and new-rider outreach.

- Cautious production amid soft demand means dealers should closely monitor wholesale allocations.

“There is no other brand that inspires the same level of passion, pride, and pure enthusiasm as Harley-Davidson,” Starrs told investors. “Every dollar we invest, every penny we spend must drive value, growth, and sustainability for the long term.”

Sources: Harley-Davidson Q3 2025 earnings release and investor call, Reuters, and Barron’s