PSB looks forward with BRP’s Sandy Scullion, president of Powersports and Marine

This interview took place in February and can be listened to on our Power Hour podcast.

Sandy Scullion, located in Sherbrooke, QC, Canada, has been with BRP for 30 years as of this spring. “I started as a DSM 30 years ago,” he says. “Just the idea of selling snowmobiles and having magazines in my portfolio to sell to the dealers was magic at that age. Never tell HR, but I could have worked for free for the first year,” he laughs.

“It’s been pretty much clockwork every three years, moving in different roles and different parts of the organization touching sales, marketing, a little bit of development, distribution, logistics and so on.”

From 2007 to 2014, he took charge of the P&A business. He mentions his role overseeing the Western Europe and Middle East regions for two years before honing in on global retail and services. In 2016 he represented all BRP brands except Marine. About a year and a half ago, he became president of the Powersports Group, including all manufacturing in Mexico, Canada and Finland and about 15,000 employees.

Scullion’s new role

Recently, BRP announced changes to its organizational structure and Scullion was named president of Powersports and Marine while CEO Jose Boisjoli directly oversees manufacturing.

“Manufacturing is now a service to the division, R&D is a service to the division and the chief marketing officer is a service to the division. But, in charge of Powersports and Marine, I have full P&L responsibilities,” Scullion says.

He says that he directly oversees everything that falls under retail and services, which includes parts, accessories and apparel, product planning, distribution, salespeople, sales programs, network strategy, support of the network and call centers. “Everything that touches those channels, whether a dealer, distributor or even D2C for the P&A business, that’s under my direct oversight,” he says.

Operations during Covid-19

“We made it look like we had less issues with the supply chain, but it was the same for everyone,” Scullion says. He explains that, because it became difficult to get parts to manufacturing plants, the company made a strategic decision to produce units without all necessary parts and ship them to dealers incomplete.

“We also had this opportunity, we saw, of getting the holeshot. In our business, this is really important. We deal with Asian competitors, we deal with American competitors and obviously, we’re Canadian. We’ve got manufacturing plants pretty much everywhere in the world, but the majority of our production is from Mexico. We don’t have any labor issues like most of our competitors, so we saw this big opportunity to get that holeshot and be in the market faster than anyone.”

He says BRP introduced the concept of shipping incomplete units owned by the company to dealers. “As parts were coming in from our suppliers, instead of restarting the line, rebuilding these units and then the transfer from our plants to the dealers, we just shipped air all these parts to the dealers so that they were able to assemble and retail these units. I believe this was one ofthe big moments that made us gain so much market share I would say in the last year, year and a half. We were pretty happy with that strategy.”

“Hats off to the dealers because we put a lot of burden on these folks,” Scullion adds. “It’s teamwork. We got there because of our dealers and our desire to always win. That’s a part of our culture.”

BRP in 2024

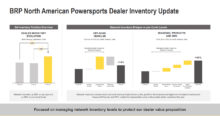

Scullion shares that now, all OEMs are shipping to dealers and supply outweighs demand. Coinciding with this, he says the economy is softer than planned, powersports consumers are buying less, and interest rates are high. So, although the company has momentum coming out of Covid−19, BRP will possibly readjust inventory levels to better benefit dealers and the company over the next quarter or two.

“The idea is to get to next fall as clean as possible so we can focus on model Year ‘25 and get that holeshot once again. That’s the bigger picture,” he says. “In the transition, we want to make sure that we support the dealers, and we are investing significantly in the engagement funnel: getting that traffic going and having quality traffic walk into the showrooms.”

He says that, with eight product lines, it is expected to be wrong in terms of planning sometimes and that this is a normal course correction for the company. “We adapt to the context a little more carefully these days because we understand the pressure that the dealers are living right now. But this is not a short-term strategy. We’re going for the long term, so we need to keep the family happy.”

Expect electric

Scullion states that BRP is committed to offering 50 percent of its products as electric by 2035. “That doesn’t mean that 50 percent of today’s products are going to be EV, but in the overall portfolio of BRP in 2035, that’s the possibility; that’s the opportunity,” he says.

He explains that some powersports products are more difficult to electrify than others and that certain uses for electric products are more realistic than others. “If there’s a farmer working around his farm that’s one thing. But when you’re going 100 or 200 miles out in the woods, the range is going to be an issue,” Scullion says. The company strategically electrified its snowmobile first, what he says is the most difficult product to electrify, and has begun shipping the Ski-Doo Grand Touring Electric Snowmobile to dealers.

“When you’re talking about a deep snow snowmobile, while in the mountains your first enemy is weight and the power density that you need on the summit and the power-to-weight ratios you need to have a performing unit,” he says. “That’s not going to be possible with today’s electric technologies… We might see breakthroughs five years from now and 10 years from now, but for now, there is a place to electrify powersports.”

He says that the electrification of powersports will be an evolution as companies learn who new consumers may be and what the average consumer will want. “But where we’re all in, is the technology itself,” Scullion says. “BRP decided to go all in, in kind of a vertical integration of these technologies from the charger, the inverter, the battery, the motor… We understand at the end of the day what will make a difference with our products is the perfect integration of these components that do not compromise the vehicle dynamics or the vehicle benefits we want it to have.

“When you design yourself,” he continues, “you can have a much more modular approach, but then you can choose the right components, the right sizing, the right hp, the right everything so that we have the perfect product out there. We believe that we will be the leaders in the electrification of powersports. There is no doubt in our mind.”

He shares that electric snowmobiles will not be a large business, but that the idea is to use the line to develop robust components and power packs. And BRP will officially unveil its electric motorcycle models in August at Club BRP in Anaheim, California. Scullion says that the electric motorcycles will start shipping to dealers at the end of 2024.

A premium brand

“Seven years ago in Texas, we had a three percent market share and today, we’re the number one market share in Texas. This is the biggest state in the U.S. for off-roading. The momentum is actually phenomenal, and this is the category we are investing the most in, both in product and obviously in the consumer engagement funnels. And we are a clear contender to be the number one position in the world for ORVs and mark my words, it’s a question of time.”

As BRP invests in the ORV segment, it will continue to deliver premium units. Scullion says BRP’s premium products have protected the company as consumer spending has slowed. “Our packages are probably more premium than anything else out there and the first, I would say, trance of customers that have been affected by somewhat of a slowdown are not the premium, but more of the entry levels,” he says. “The value brands are struggling a bit more and they want to play in premium because they see this very clearly.

“With bigger platforms, and we’re looking at this, side-by-sides are now getting in the $35,000 to $40,000 [USD] range,” he continues. “The question for us is, ‘Where is that limit?’ It’s one thing as a premium brand to be in that area, but I believe it may be another discussion for a value brand to be in that area. The future will tell us but don’t worry, we have our eyes on everything going on in the industry.” And he says if the company ever seems to be behind, its position as an innovative leader will be evident shortly after.

“The latest launch of the Maverick R, the technology in that unit, that’s an engineering marvel with the DCT on there and 240 horsepower,” he says. “I don’t know if you realize that there’s no production car that has that power per production.”