Boisjoli: ‘Robust’ demand for BRP products as quarterly results revealed

BRP on Friday reported its financial results for the three-month period ended April 30, 2022. All financial information is in Canadian dollars unless otherwise noted.

“Our first-quarter results once again demonstrate BRP’s ability to operate efficiently in a challenging environment. Demand for our products remains robust and our focus on operational execution has allowed us to extend our market leadership further,” said José Boisjoli, president and CEO.

“Given our team’s capacity to progress on our strategic priorities and our agility in managing through a tighter supply chain environment, we remain confident in delivering another strong year in FY23 with expected revenue growth of 24% to 29% and Normalized EPS growth of 11% to 14%.”

Among the highlights:

• Revenues at $1.809 billion which are similar to those of last year’s first quarter

• Revenues from Year-Round products up $11.9 million at $934.4 million compared to last year’s first quarter, a record high for a first quarter

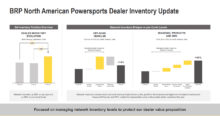

• Market share gains in SSV and ATV in North American Powersports despite limited product availability

• Normalized diluted EPS of $1.66, a decrease of $0.87 per share, while diluted EPS of $1.46, a decrease of $1.33 per share compared to the same period last year;

• Normalized EBITDA of $272.1 million, a decrease of $106.9 million or 28.2% compared to the same period last year;

• Reaffirming full year-end guidance for revenues and Normalized EBITDA and adjusting Normalized EPS – diluted upward by $0.25, now ranging from $11.00 to $11.35.

Recent events:

• On March 25, 2022, the company announced its return to the motorcycle industry with the launch of a family of electric 2-wheel motorcycles. The first models of the complete lineup are expected to be available in mid-2024;

• On April 11, 2022, the company announced its commitment to take corporate social responsibility (CSR) even further with the launch of its new CSR25 program. It includes more ambitious environmental targets than ever before, aiming to become the industry leader in corporate citizenship;

• On May 11, 2022, the company announced that it has repurchased for cancellation 2,427,184 subordinate voting shares following the completion of its Substantial Issuer Bid for a total consideration of $250.0 million.

FY23 Quarterly Outlook

The company reaffirms its initial guidance and continues to expect another solid year with a Normalized EBITDA increase ranging from 12% to 15% compared to the previous year. However, the company anticipates that its Normalized EBITDA for the second quarter could be flat to down on a percentage basis in the low single digit compared to the second quarter of Fiscal 2022 due to supply chain constraints which are expected to continue throughout the year. Still, the company intends to take advantage of an increase in planned production capacity beginning in the second quarter to increase the pace of product deliveries.

FIRST QUARTER RESULTS

The company experienced a continuing level of supply chain related disruptions and inefficiencies in an increasingly inflationary environment when compared to the first quarter of Fiscal 2022 and the fourth quarter of Fiscal 2022. As a result, this limited the company’s ability to satisfy consumer demand and replenish dealer inventories and in turn further limited product availability in the network compared to optimal seasonal levels. Such supply chain related disruptions, which are expected to last throughout Fiscal 2023, also resulted in an increased level of substantially completed units awaiting missing components.

Despite these challenges, the company optimized the shipment of missing components to its dealer network which resulted in a high conversion rate of substantially completed units available for retail and revised its production schedule based on seasonality and availability of components. The company implemented strategic pricing initiatives aimed at reducing inflationary pressures, which mitigated the impact on the company’s profitability. The slightly higher revenues achieved for the first quarter of Fiscal 2023 compared to the first quarter of Fiscal 2022 were further supported by strong side-by-side vehicle retail, demonstrating sustained consumer interest.

Revenues

Revenues remained flat at $1.809 billion for the three-month period ended April 30, 2022, compared to the $1.809 billion for the corresponding period ended April 30, 2021. These results were primarily due to favorable pricing across all product lines, mostly offset by unfavorable mix in Year-Round Products and lower volume in Seasonal Products due to supply chain disruptions. The increase was partially offset by an unfavorable foreign exchange rate variation of $27 million.

• Year-Round Products (52% of Q1-23 revenues): Revenues from Year-Round Products increased by $11.9 million, or 1.3%, to $934.4 million for the three-month period ended April 30, 2022, compared to the $922.5 million for the corresponding period ended April 30, 2021. The increase was primarily attributable to a higher volume of side-by-sides sold and by favorable pricing across all product lines. The increase was partially offset by lower volume of three-wheel vehicles sold due to supply chain disruptions, as well as an unfavorable foreign exchange rate variation of $10 million.

• Seasonal Products (22% of Q1-23 revenues): Revenues from Seasonal Products decreased by $54.7 million, or 11.8%, to $408.7 million for the three-month period ended April 30, 2022, compared to $463.4 million for the corresponding period ended April 30, 2021. The decrease resulted primarily from a lower volume of PWC sold due to supply chain disruptions. The decrease includes an unfavorable foreign exchange rate variation of $9 million. The decrease was partially offset by a higher volume of snowmobiles sold due to late shipments of model year 2022 units in the first quarter of Fiscal 2023 caused by supply chain disruptions, favorable pricing and lower sales programs in light of the strong retail environment.

• Powersports PA&A and OEM Engines (19% of Q1-23 revenues): Revenues from Powersports PA&A and OEM Engines increased by $42.8 million, or 14.2%, to $343.6 million for the three-month period ended April 30, 2022, compared to the $300.8 million for the corresponding period ended April 30, 2021. The increase was mainly attributable to a higher volume of recreational aircraft engines and Parts, Accessories & Apparel sold, favorable pricing and lower sales programs due to the strong retail environment and increased usage of vehicles. The increase was partially offset by an unfavorable foreign exchange rate variation of $7 million.

• Marine (7% of Q1-23 revenues): Revenues from the Marine segment increased by $4.8 million, or 3.8%, to $132.2 million for the three-month period ended April 30, 2022, compared to $127.4 million for the corresponding period ended April 30, 2021. The increase was mainly due to a favorable product mix of units sold, as well as favorable pricing. The increase was partially offset by a lower volume of units and PA&A sold caused by supply chain disruptions.

North American Retail Sales

The company’s North American retail sales for powersports products decreased by 9% for the three-month period ended April 30, 2022 compared to the three-month period ended April 30, 2021. The decrease was mainly driven by limited product availability caused by supply chain disruptions.

• Year-Round Products: retail sales decreased on a percentage basis in the low-teens range compared to the three-month period ended April 30, 2021. In comparison, the Year-Round Products industry recorded a decrease on a percentage basis in the mid-twenties range over the same period.

• Seasonal Products: retail sales decreased on a percentage basis in the mid single-digits compared to the three-month period ended April 30, 2021. In comparison, the Seasonal Products industry recorded a decrease on a percentage basis in the low single-digits over the same period.

• Marine: boat retail sales decreased by 47% compared to the three-month period ended April 30, 2021 also as a result of lower product availability caused by supply chain disruptions.

Gross profit

Gross profit decreased by $87.6 million, or 16.2%, to $454.4 million for the three-month period ended April 30, 2022, compared to $542.0 million for the corresponding period ended April 30, 2021. Gross profit margin percentage decreased by 490 basis points to 25.1% from 30.0% for the three-month period ended April 30, 2021. The decreases were the result of higher logistics, commodities and labor costs due to inefficiencies relating to supply chain disruptions, as well as an increase in warranty costs. The decreases were partially offset by favorable pricing combined with lower sales programs driven by the strong retail environment and limited product availability, and a favorable outcome on an inventory related insurance claim. The decreases include an unfavorable foreign exchange rate variation of $9 million.

Operating expenses

Operating expenses increased by $29.3 million, or 13.0%, to $254.8 million for the three-month period ended April 30, 2022, compared to $225.5 million for the three-month period ended April 30, 2021. This increase was mainly attributable to an increase in research & development (“R&D”) expense to support future growth. The increase is partially offset by a favorable foreign exchange rate variation of $2 million.

Normalized EBITDA

Normalized EBITDA decreased by $106.9 million, or 28.2%, to $272.1 million for the three-month period ended April 30, 2022, compared to $379.0 million for the three-month period ended April 30, 2021. The decrease was primarily due to lower gross profit due to supply chain disruptions and higher operating expenses, mostly in R&D.

Net Income

Net income decreased by $123.4 million to $121.0 million for the three-month period ended April 30, 2022, compared to the $244.4 million for the three-month period ended April 30, 2021. The decrease was primarily due to lower operating income, partially offset by a lower income tax expense, lower net financing costs and the unfavorable foreign exchange rate variation impact on the U.S. denominated long-term debt.

LIQUIDITY AND CAPITAL RESOURCES

The company used net cash flows from operating activities totalling $333.1 million for the three-month period ended April 30, 2022 compared to net cash flows generated of $164.9 million for the three-month period ended April 30, 2021. Concurrently, there was an increase in revolving facilities totaling $327.8 million.

The company invested $108 million of its liquidity in capital expenditures in order to add production capacity and to modernize the company’s software infrastructure to support future growth. The company also returned $68.5 million to its shareholders through quarterly dividend payout and its Normal Course Issuer Bid announced in Fiscal 2022.

On February 16, 2022, the company amended its Revolving Credit Facilities to increase total availability to $1,100.0 million and replace LIBOR references by SOFR references. The pricing grid and other conditions remained unchanged.

Dividend

On June 2, 2022, the Company’s Board of Directors declared a quarterly dividend of $0.16 per share for holders of its multiple voting shares and subordinate voting shares. The dividend will be paid on July 14, 2022 to shareholders of record at the close of business on June 30, 2022.