BRP reports 5% retail drop in FY 2025 Q1 results

BRP Inc. has reported its financial results for the first quarter of its fiscal year 2025, which ended April 30, 2024. (Financial information is in Canadian dollars unless otherwise noted).

BRP’s Q1 FY25 saw a reduction in inventory at dealerships in reaction to soft demand trends. North American retail sales were down 5% y/y in Q1 FY25, in line with the industry’s decline. However, according to analysts, promotional intensity has increased and is more aggressive than planned.

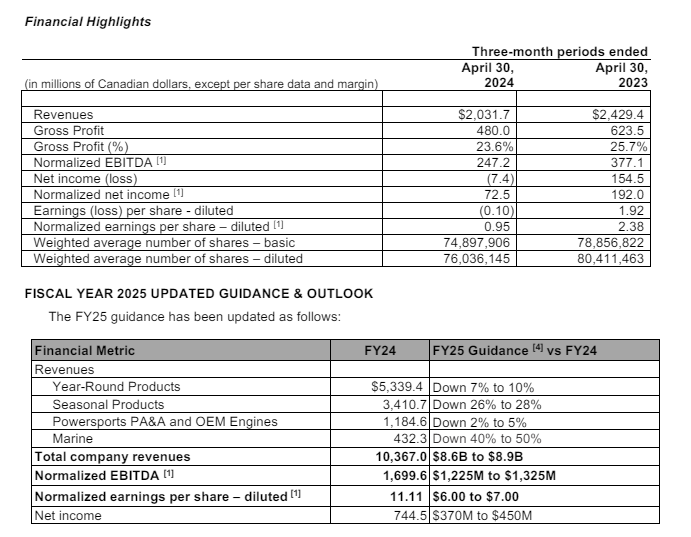

BRP reported Q1FY25 revenues of $2,032 million, down 16% year over year but slightly higher than some estimates. The revenue decline was driven by lower shipment volume due to a softening consumer demand environment, higher sales programs, and the company’s decision to reduce dealership inventory levels. This was partly offset by a favorable product mix and higher pricing.

“Our first quarter results were in line with expectations and reflect our focus on managing network inventory to protect our dealer value proposition. Our strong product portfolio performed well at retail, especially in the Year-Round Products category, where we gained market share across all product lines. We are particularly pleased with our Can-Am SSV business, which had its strongest first quarter ever at retail.”

José Boisjoli, president and CEO of BRP

“As the year unfolds, our dealers’ profitability is under more pressure than anticipated given the current macroeconomic context, a more competitive landscape and high interest rates. For these reasons, we have decided to adjust our production to further reduce network inventory while continuing to maximize retail sales. Looking ahead, given our strong business fundamentals, we are confident in our long-term strategy, and committed to investing in the development of market-shaping products to remain the leading OEM in the industry,” concludes Boisjoli.

Q1FY25 results

As mentioned previously, the soft demand resulted in reduced inventory throughout BRP’s retail channels. The company’s North American quarterly retail sales for Powersport Products were down 5% due to Seasonal Products given lower industry volumes. This decrease was partly offset by an increase in Year-Round Products driven by continued market share gains in SSV and ATV.

Revenues

Revenues decreased by $397.7 million, or 16.4%, to $2,031.7 million for Q1, compared to $2,429.4 million for Q1FY24. The decrease was primarily due to a lower volume across most product lines, driven by the focus on reducing network inventory levels and higher sales programs. The decrease was partially offset by a favorable product mix across most product lines and favorable pricing across all product lines. The decrease includes a favorable foreign exchange rate variation of $17 million.

Year-Round Products (57% of Q1-FY25 revenues): Revenues from Year-Round Products decreased by $175.5 million, or 13.2%, to $1,157.8 million year over year, compared to $1,333.3 million Q1-FY24.

Seasonal Products (26% of Q1-FY25 revenues): Revenues from Seasonal Products decreased by $156.8 million, or 22.7%, to $535.1 million for Q1, compared to $691.9 million in Q1-FY24.

Powersports PA&A and OEM Engines (14% of Q1-FY25 revenues): Revenues from Powersports PA&A and OEM Engines increased by $4.2 million, or 1.5%, to $289.1 million for Q1 compared to $284.9 million last year. The increase was mainly attributable to a higher sales volume, favorable pricing, and product mix. Higher sales programs partially offset the increase.

Marine (3% of Q1-FY25 revenues): Revenues from the Marine segment decreased by $69.2 million, or 56.6%, to $53.1 million for Q1 compared to $122.3 million last year. The decrease was mainly attributable to a lower volume due to high dealer inventory, softer consumer demand and higher sales programs.

North American Retail Sales

BRP’s North American retail sales for powersports products decreased by 5% in Q1 compared to last year. The decrease was due to Seasonal Products driven by lower industry volumes, partly offset by an increase in Year-Round product retail sales driven by continued market share gains in SSV and ATV.

North American Year-Round Products retail sales increased on a percentage basis in the low-teens range compared to last year. The Year-Round Products segment increased on a percentage basis in the low-single digits over the same period.

North American Seasonal Products retail sales decreased in percentage terms in the low-thirties range compared to last year. The segment decreased in percentage terms in the high-twenties range over the same period.

BRP’s North American retail sales for Marine Products increased by 16% compared to last year, given the low retail volume period as a comparison.

FY25 Quarterly Outlook

Given its focus on managing network inventory levels, the company expects Q2 Fiscal 2025 normalized EBITDA to be down approximately mid-20 % versus Q1 Fiscal 2025.