Consumer signals split in January as inflation concerns linger

Consumer sentiment sent mixed signals in January, offering a complicated backdrop for powersports dealers as the industry heads deeper into 2026. According to the MIC Ride Report, drawing on data from the University of Michigan and the Conference Board, shoppers remain cautious, price-sensitive and increasingly selective — even as some measures show modest improvement.

The University of Michigan’s Index of Consumer Sentiment rose to 56.4 in January, a 6.6% increase from December and the highest reading since August 2025. Gains were broad-based across demographic groups, with modest improvements in views of personal finances and buying conditions for durable goods. Even so, overall sentiment remains more than 20% below January 2025 levels and well below historical norms.

“Concerns about the erosion of personal finances from high prices and the elevated risk of job loss continue to be widespread,” says Joanne Hsu, director of the surveys of consumers. She noted that recent improvements remain small and within the margin of error.

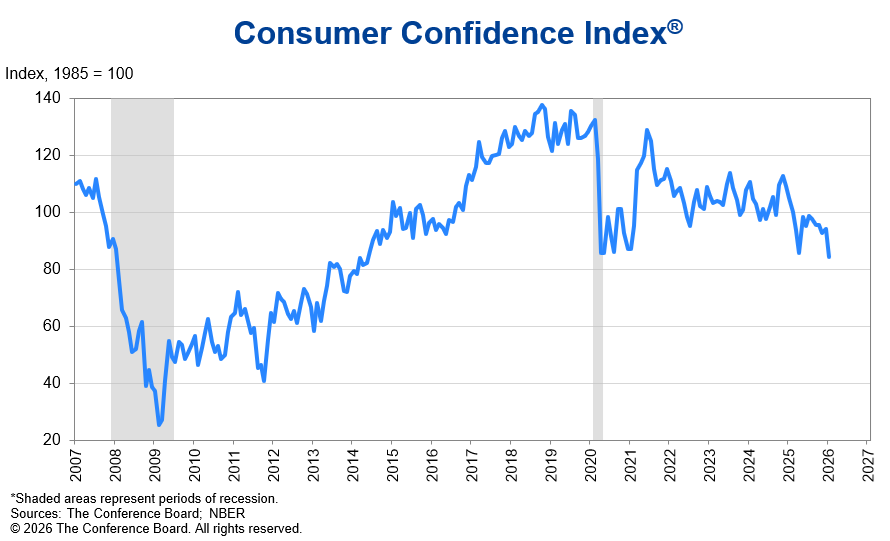

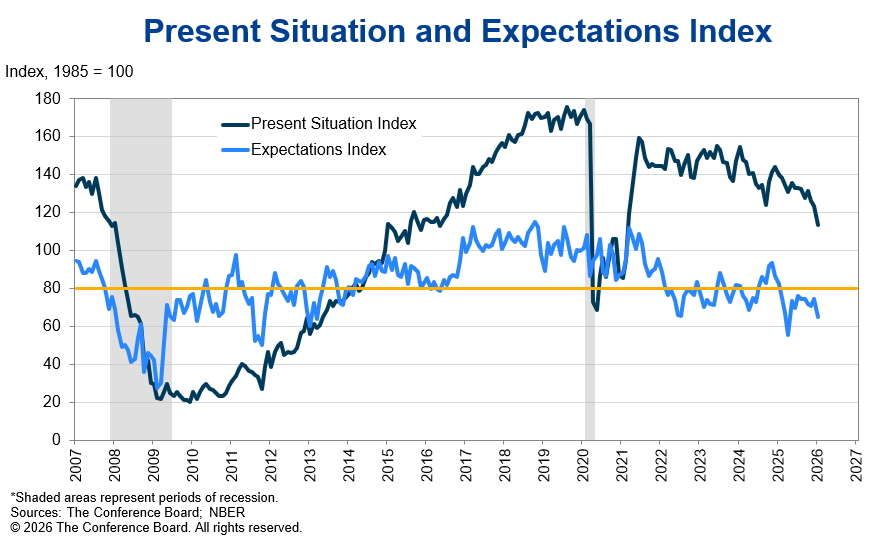

By contrast, the Conference Board’s Consumer Confidence Index moved sharply in the opposite direction, falling 9.7 points to 84.5 — its lowest reading since 2014. The Present Situation Index dropped to 113.7, while the Expectations Index slid to 65.1, a level often associated with recessionary caution. Consumers cited inflation, high prices, tariffs and labor market uncertainty as their top concerns.

Inflation expectations continue to play a central role in consumer behavior. Year-ahead inflation expectations fell to between 3.5% and 4.0%, depending on the survey, marking the lowest readings since early 2025. Long-run inflation expectations edged higher to roughly 3.3% to 3.4%, still above pre-pandemic norms but well below peaks reached in mid-2022 and spring 2025.

University of Michigan data shows long-run inflation expectations surged to 4.4% in April 2025 before trending downward through the end of the year. While expectations have moderated, uncertainty remains elevated compared to 2024 and pre-pandemic levels.

For dealers, the practical takeaway is restraint — not retreat. Spending intentions for big-ticket purchases weakened in January, particularly for homes and new vehicles, while interest in used vehicles remained more resilient. Consumers continue to favor essential and affordable spending, with service categories such as dining, take-out and personal travel holding up better than discretionary retail. Planned spending on hotels and airfare increased slightly, even as overall vacation plans declined.

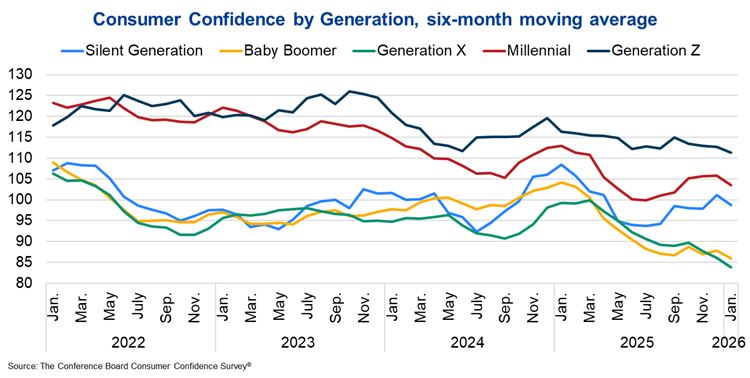

The divergence between sentiment and confidence underscores what many dealers are already seeing: customers are still buying, but they are taking longer to decide, trading down in price or displacement, and focusing heavily on value.

The MIC Ride Report notes that these trends align with broader powersports sales patterns, where affordability, versatility and lower total cost of ownership are increasingly shaping purchase decisions.

Sources: MIC Ride Report; University of Michigan Surveys of Consumers; Conference Board’s Consumer Confidence Index