Harley-Davidson reports North American sales drop in Q3

Harley-Davidson, Inc. recently reported its third quarter 2024 results, showing that North American retail sales were down 10 percent versus the prior year and global sales down 13 percent year-over-year. The Motor Company has lowered its full-year 2024 financial outlook to reflect the current environment.

“We have worked diligently through the quarter to mitigate the impact of high interest rates and macroeconomic and political uncertainty that continue to put pressure on our industry and customers, especially in our core markets,” says Jochen Zeitz, Chairman, president and CEO of Harley-Davidson. “We are very pleased with the reception of our touring launch with customers and dealers alike and are working hard to set the company up for a solid 2025. We are optimistic about our ability to make sound progress in the new year, and we are expecting further interest rate reductions and improved consumer confidence will provide the industry with a needed tailwind.”

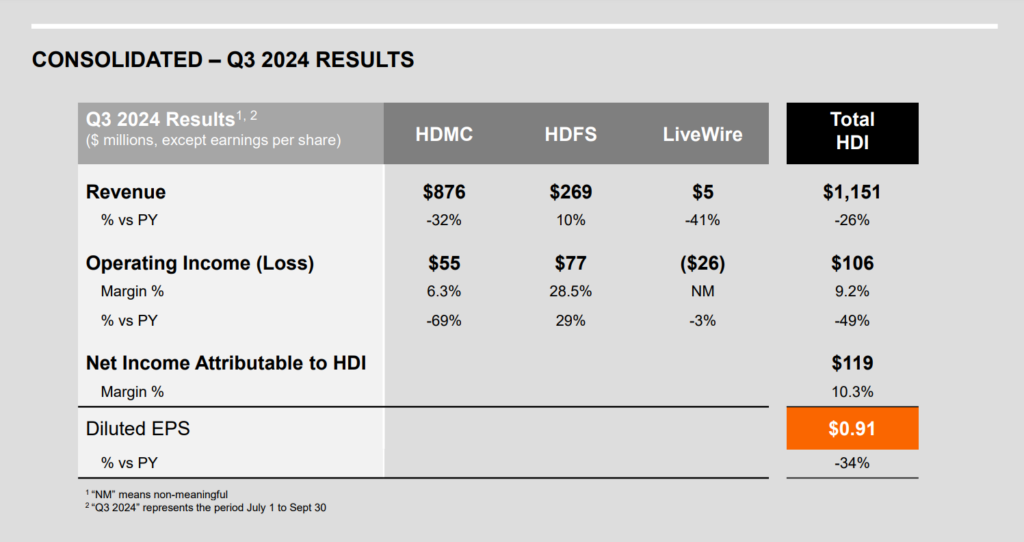

Harley-Davidson, Inc. (HDI) consolidated Q3 results

According to the report, consolidated revenue in the third quarter was down 26 percent, driven primarily by an HDMC revenue decline of 32 percent. This was partially offset by an HDFS revenue increase of 10 percent.

Consolidated operating income in the third quarter was $106 million, down 49 percent from the prior year. The result was driven primarily by an HDMC operating income decline of 69 percent, partially offset by an HDFS operating income increase of 29 percent, and a LiveWire operating loss in-line with the company’s expectations. The consolidated operating income margin in the third quarter was 9.2 percent, which compares to 13.5 percent in the third quarter a year ago.

Harley-Davidson Motor Company (HDMC)

Third-quarter global motorcycle shipments decreased by 39 percent as dealers adjusted inventory levels for the current retail environment. HDMC revenue was down 32 percent, driven primarily by a significant reduction in wholesale units shipped. Parts & Accessories revenue was down 6 percent due to lower customer traffic than the prior year. Apparel revenue was up 13 percent.

Third quarter gross margin was down 1.6 points due to lower volumes, negative operating leverage, and a less favorable motorcycle mix, partially offset by favorable net pricing, foreign exchange, and lower raw material and supply chain management costs. The third quarter operating margin was 6.3 percent, where operating expenses were down 11 percent in the period. It is offset by the larger decline in revenue at HDMC.

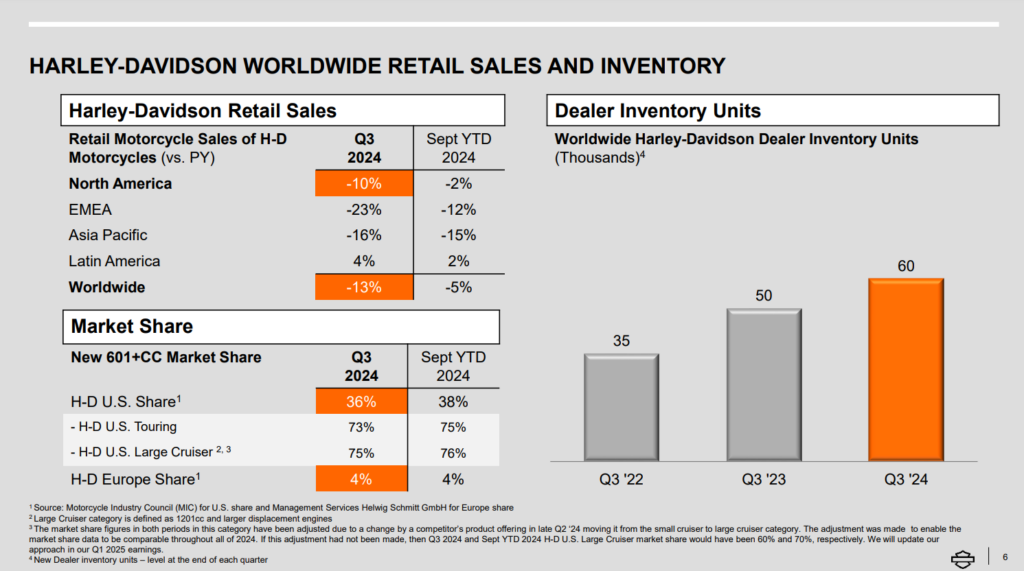

Harley-Davidson Retail Motorcycle Sales

Global retail motorcycle sales in the third quarter were down 13 percent versus the prior year. Meanwhile, North American retail performance was down 10 percent. Dealers observed a slowdown in customer traffic in North America, and customers assessed the higher interest rate environment and macro uncertainty. Although, it is noted that U.S. retail performance was only down one percent in the nine-month YTD period year-over-year.

International markets have performed weaker than Harley expected, down 18 percent in the third quarter versus the prior year. In EMEA, third quarter retail sales declined by 23 percent, with mixed performance on a country-by-country basis. In APAC, third quarter retail sales declined by 16 percent, with Japan softer than we expected and Australia & New Zealand experiencing growth. Latin America was largely flat. International retail sales were down 12 percent in the nine-month YTD period year-over-year.

Harley-Davidson Financial Services (HDFS)

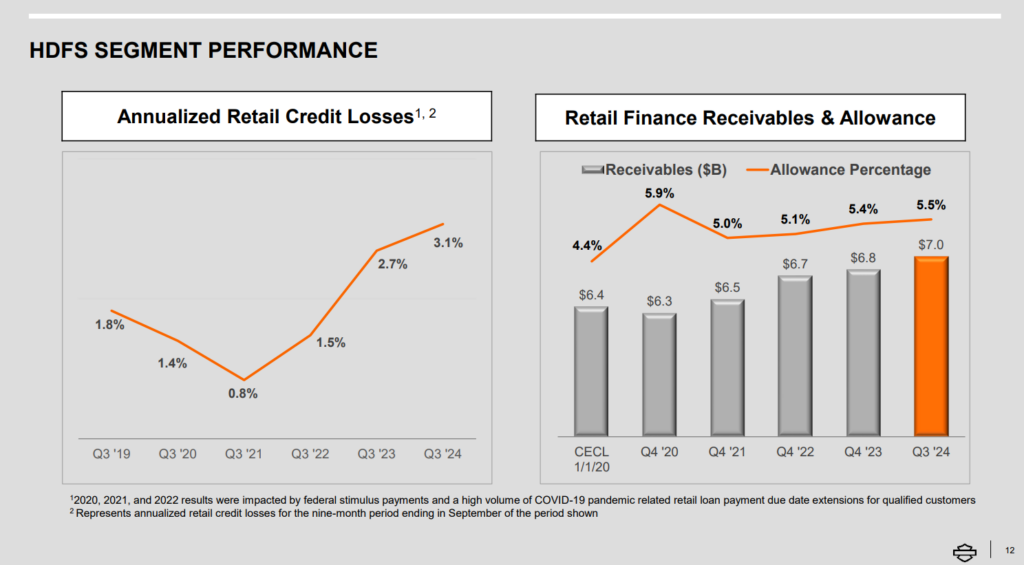

HDFS operating income increased by $17 million in Q3, or 29 percent. The result was driven by higher interest income and a lower provision for credit losses, partially offset by increased borrowing costs, where operating expenses were largely flat.

LiveWire

LiveWire revenue for the third quarter decreased by 41 percent, due to a decrease in STACYC third party branded distributor volumes. LiveWire’s operating loss of $26 million dollars was $1 million more than a year ago, largely in-line with our expectations.

2024 Outlook

For the full year 2024, the Motor Company now expects:

- HDMC: Revenue down 14 to 16 percent compared to 2023

- HDMC: Operating Income margin between 7.5 and 8.5 percent

- HDFS: Operating Income up 5 to 10 percent compared to 2023

- LiveWire: Electric motorcycle unit sales of 600 to 1,000

For the full year 2024 Harley and LiveWire continue to expect:

- LiveWire: Operating Loss of $105 to $115 million

- Harley-Davidson, Inc.: Capital investments of $225 to $250 million