BMW dealers rank No. 1 in PSI study measuring service appointments

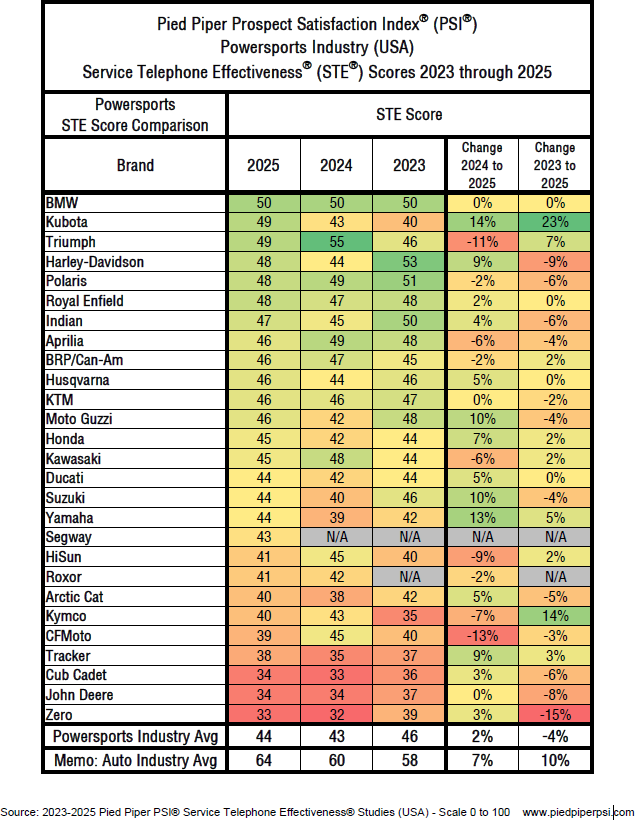

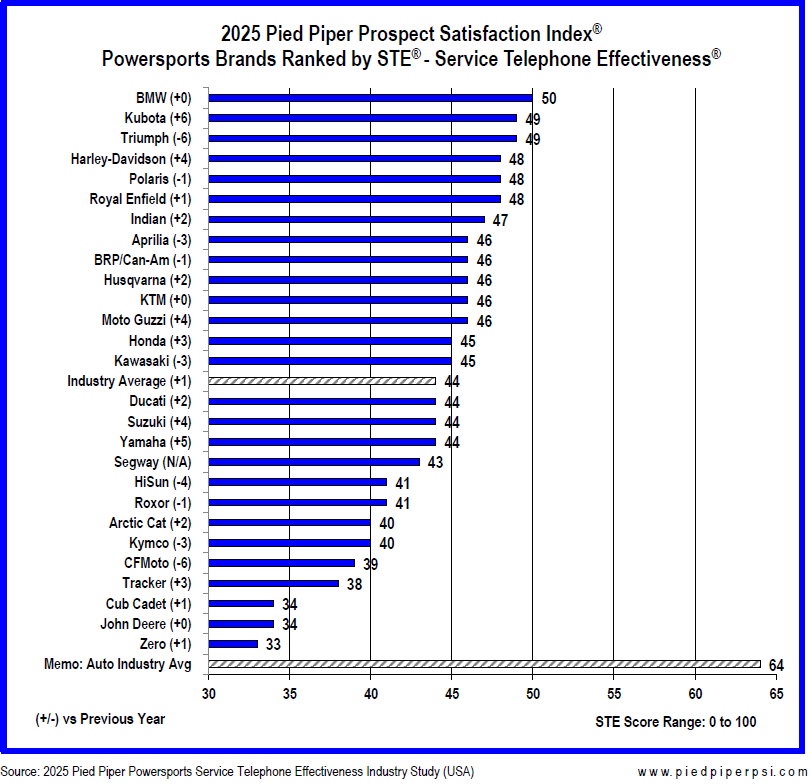

BMW Motorrad dealerships had the highest score on Pied Piper’s 2025 PSI Service Telephone Effectiveness (STE) Powersports Industry Study, which measured the efficiency and quality of customer attempts to schedule service appointments by telephone. Following BMW were Kubota, Triumph, Polaris Off-Road, and Harley-Davidson.

Pied Piper submitted service calls to 1,531 powersports dealerships representing 27 brands and evaluated the telephone interactions. Each brand’s overall STE score is a combined average of its dealer performances. Scores ranged from 0 to 100 and included over 30 differently weighted measurements tracking the best practices most likely to generate service revenue and customer loyalty.

BMW ranked highest: Consistency in challenging conditions

BMW led the 2025 STE study with an average STE score of 50, the same score BMW achieved in both 2023 and 2024.

“BMW has consistently been ranked among the top three performing brands during the three years this annual study has been conducted,” says Cameron O’Hagan, Pied Piper’s vice president of metrics and analytics. “This year, they have achieved the top position due to that consistency.”

The following are examples of behaviors that set BMW dealers apart from the industry average when customers call for service:

- Higher rate of setting appointments: 65% of BMW service calls resulted in an appointment being set, compared to only 52% for the industry overall.

- More likely to ask about other issues: BMW customers were asked if they had any other issues or needed any additional service 35% of the time on average, compared to only 22% of the time for the industry overall.

- More likely to ask if visited before: On average, BMW dealers asked service customers whether they had visited the dealership before 44% of the time, compared to 28% of the time for the industry overall.

- Reach service advisor quickly: BMW customers on average reached a service adviser within one minute 84% of the time, compared to 78% of the time for the industry overall.

Why care about service telephone experience?

O’Hagan says a well-run service department’s focus should be on building customer loyalty, and a customer calling in to schedule an appointment is a dealership’s first opportunity to build trust.

“Powersports customers who struggle to schedule service vote with their feet by moving to another dealership or independent shop. In extreme cases, due to most powersports purchases being discretionary, if ownership becomes frustrating, many customers will begin to question whether it’s worth the effort and may sell the vehicle and become sour [on] the brand.” — Cameron O’Hagan, Pied Piper

The industry’s average STE score improved by one point over the past year, reaching an average score of 44, one point higher than 2024 but trailing the 2023 high-watermark average score by two points.

Dealership performance varied substantially, with a minority of dealerships benefiting from their superior processes. Nationally, only 16% of dealerships achieved STE scores over 70, providing an interaction with their service customers that was speedy, efficient and helpful. In contrast, customers for 11% of the dealerships hung up their phones, having completely failed in their attempt to schedule service.

Performance lacking in key areas

Customer expectations for scheduling service aren’t set by the powersports industry. Nearly all powersports customers also schedule service for their cars and trucks, and over the past few years, the auto industry has significantly improved the service scheduling experience for its customers.

Fail to live up to expectations: Today, half of all auto service appointments for basic needs like oil changes are quickly booked online, and with the help of AI-powered chat. Auto customers who phone to schedule service end their call with an appointment 87% of the time — compared to 52% of powersports customers.

Too many ‘just drop it off’ demands: Powersports customers were told 41% of the time to drop their vehicle off and wait an undetermined amount of time, rather than the dealership committing to a specific date and time. In comparison, this unfavorable behavior occurs only 2% of the time in the auto industry.

Rarely ask about additional services: Across the industry, only 22% of customers were asked if they had other issues or needed additional services, significantly lower than the 40% rate seen in the auto industry.

Greatest opportunities for improvement

Turn ‘just drop it off’ into a positive: Powersports customers were told 41% of the time to just drop their vehicle off. There, the vehicle will wait — often outside in the elements — for an undetermined number of days before the dealership will get to it. This demonstrates little concern for a customer’s time or expectations.

However, this drop-it-off mentality can be transformed from a frustration into a positive experience by also offering an appointment. For example, a service department could say: “I can schedule you two weeks from today, or if you prefer, you’re welcome to bring it in and we’ll try to get to it sooner.” Framing it this way respects the customer’s time and shows that the dealership is organized and responsive, turning a traditionally negative interaction into a loyalty-building moment.

“The cliché is true: sales sells the first; service sells the rest,” O’Hagan says. “Dealerships that prioritize a superior service experience gain in both sales and service.”

Understand what customers are experiencing: In the 2025 study, 14 brands improved their STE score over the previous year. The brand with the greatest improvement was Kubota, with a six-point gain since last year, moving from a 10th-place ranking in 2024 to second this year. Kubota dealers nearly doubled their rate of setting appointments, occurring 58% of the time in 2025 compared to 31% of the time last year. Kubota dealers also cut their ‘just drop it off’ rate from 62% in 2024 to 38% this year. The key to this improvement was to show dealers what their customers experienced when calling for service

- Set an Appointment: How often did the brand’s dealerships offer an appointment for a specific date and time?

- More than 60% of the time on average: Triumph, BMW, Royal Enfield, Moto Guzzi

- Less than 25% of the time on average: Husqvarna, Cub Cadet, John Deere

- Just Drop it Off: How often did the brand’s dealerships insist that the customer drop off the vehicle without also offering an appointment?

- Less than 25% of the time on average: Triumph, Ducati, Moto Guzzi

- More than 50% of the time on average: Husqvarna, Cub Cadet, John Deere

- Average Days Out: What were the brand’s dealerships’ average number of days out until the earliest available appointment?

- Less than 5 days on average: Kubota, Triumph, Harley-Davidson, Yamaha

- More than 10 days on average: Suzuki, Zero, HiSun

- Inquire About Additional Services: How often did the brand’s dealerships ask if there were other issues or services the customer would like to have addressed?

- More than 35% of the time on average: Ducati, Husqvarna, BMW, HiSun

- Less than 15% of the time on average: Yamaha, Segway, Arctic Cat, Aprilia, Moto Guzzi, CFMoto, Triumph

- Communication Failure: How often would calling a brand’s dealerships for service result in an issue that prevented communication (placed on hold indefinitely, straight to voicemail, stuck in phone tree)?

- Less than 5% of the time on average: Segway, Husqvarna, Cub Cadet, Kubota, Polaris

- More than 15% of the time on average: Kymco, Zero, Ducati, Tracker

Why Was This Study Conducted?

For more than 15 years, Pied Piper has independently published annual industry studies that rank the omnichannel performance of brands and dealer groups. These studies track how industry performance changes over time and let clients understand how their own performance compares.

“The first service interaction that drives loyalty and service revenue is a customer’s initial phone call to schedule an appointment,” says O’Hagan. “Because these phone calls often go unnoticed in daily operations, they’re frequently neglected — and without clear visibility, improvement becomes difficult.”