PIERER Mobility AG reports motorcycle segment growth for FY23

The PIERER Mobility Group increased consolidated sales by around 9% to a new record of EUR 2.66 billion ($2.87 billion USD) in the 2023 financial year (previous year: EUR 2.43 billion) despite difficult economic conditions and upheaval in the bicycle industry.

The preliminary operating result (EBIT) fell by around 32% to EUR 160 million (previous year: EUR 235 million), which corresponds to an EBIT margin of 6.0%. In the motorcycle segment, the EBIT margin is around 9%, which is within the company’s originally planned range of 8-10%. However, the reorganization of the bicycle segment had a significant negative impact on earnings. At EUR 324 million, the operating result before depreciation and amortization (EBITDA) is around 15% below the previous year’s figure, which is within the company’s margin of 12.2%.

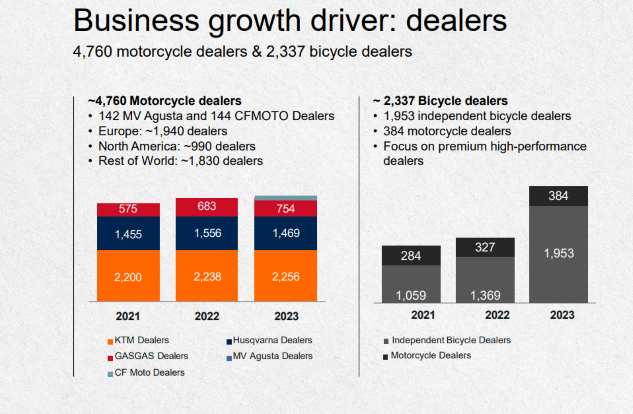

In the motorcycle segment, the cost of dealer inventories rose sharply due to significantly higher interest rates despite good demand. As a result, extended payment terms and higher discounts had to be granted to dealers in order to strengthen the dealer structure.

Due to the sufficient liquidity reserves available, PIERER Mobility AG was able to support not only its dealers but also its suppliers to stabilize their financial situation and reduce the increased burdens caused by the rise in interest rates. In addition, the level of investment in the 2023 financial year remained at a high level (EUR 284 million, +6%). In the past financial year, investments in series development projects, including tools, totaled EUR 195 million (+21%).

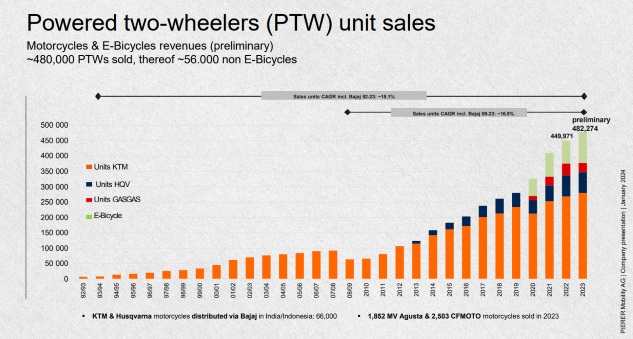

Increase in market share in the most important motorcycle markets – 381,555 (+2%)

With 280,206 KTM motorcycles sold, 67,462 HUSQVARNA motorcycles sold, and 29,532 GASGAS motorcycles sold in the 2023 financial year, in addition to the motorcycles sold by MV Agusta (1,852) and CFMoto (2,503), sales totaled 381,555 motorcycles (2022: 375,492 units). The motorcycles segment thus achieved a sales increase of 2 %.

In the sales regions of Europe, sales totaled around 140,000 motorcycles (+15%), and around two-thirds of motorcycles (around 240,000) were sold in markets outside Europe. Despite a slight decline in sales in North America, the subsidiary there still managed to sell more than 100,000 motorcycles for the second time in a row. While sales in South America (-26%) and Asia (-27%) declined in the past financial year, sales in Australia were up slightly (+1%) on the previous year with around 19,700 motorcycles sold.

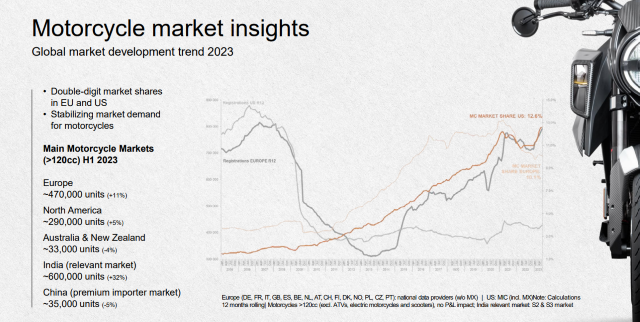

Contrary to the difficult global economic conditions, demand in the core markets of Europe grew very strongly at +11% (~820,000 newly registered motorcycles) and in North America (USA & Canada) at +4% (485,000 motorcycles). The market share of all three brands (KTM, Husqvarna, GASGAS) will, therefore, be around 10.6% in Europe and 12.6% in North America in 2023. The Australian (including New Zealand) motorcycle market declined slightly, with a 3% drop to 67,000 newly registered motorcycles. Nevertheless, the total market share of the three brands in this market increased to 21%. The Indian motorcycle market, on the other hand, is experiencing a significant upswing (+22%), as in the previous year. Bajaj sold almost 66,000 KTM and Husqvarna motorcycles in India, resulting in a market share of 5.3%.

Outlook for 2024

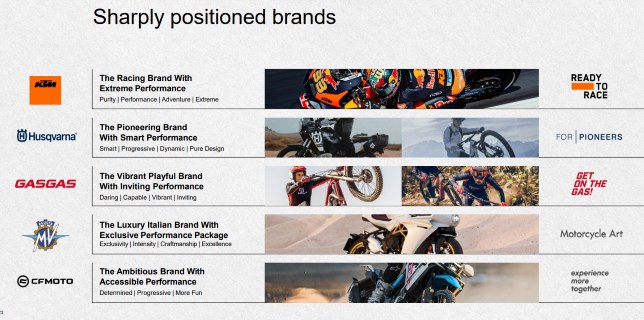

In the 2024 financial year, PIERER Mobility AG says it will focus on strengthening its core business (motorcycles and e-bicycles with KTM, Husqvarna, GASGAS and MV Agusta. In order to secure the Group’s profitability, management is implementing cost-cutting measures in the double-digit million range. A key focus will be on streamlining product development cycles and a clear alignment of the product programs.

In the motorcycle segment, parts of production for individual mid-range models and certain R&D activities have been transferred to strategic partners Bajaj Auto, India, and CFMOTO, China. This affects products (road motorcycles) in very price- and competition-intensive markets, the company notes. The model range previously produced by Bajaj (between 125cc and 390cc) will be expanded. Road motorcycles between 790cc and 950cc will be assembled by the Chinese partner CFMOTO. Among other things, this is intended to exploit cost advantages in these regions and accelerate development and industrialization processes.

Against the backdrop of difficult economic developments worldwide, the executive board expects sales to remain virtually unchanged and the EBIT margin to be between 5% and 7% for the 2024 financial year.