Polaris down 10 percent in North America in Q1 (but up 3 percent excluding snowmobiles)

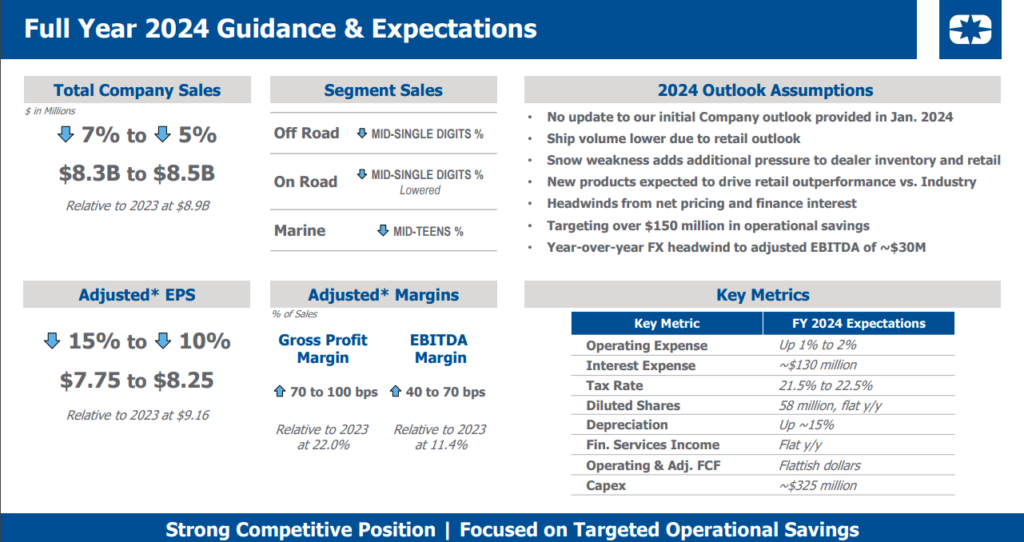

Polaris Inc. reported that worldwide sales were $1.7 billion in the first quarter (Q1) of 2024, down 20 percent from Q1 2023.

North America saw sales of $1.4 billion, representing 83 percent of Polaris’ total sales, which fell 22 percent from $1.8 billion in 2023. International sales reached $292 million, 17 percent of total sales, a decrease of 13 percent versus Q1 2023.

Total company sales in Q1 were negatively impacted by lower volume and net pricing driven by higher promotional activity partially offset by a favorable product mix. As reported, Q1 net income attributable to Polaris of $4 million decreased 97 percent compared to 2023, and adjusted net income of $13 million was down 89 percent compared to 2023.

“Our sales results for the first quarter were in line with our expectations,” Mike Speetzen, CEO of Polaris, comments. “With our competitive product portfolio, we gained share in ORV, motorcycles and marine, and the recent launches in our best-selling full-size Ranger and Indian Scout lineups reflect our strategic focus on rider-driven Innovation. While we continue to see strength within our Off-Road Utility business, Snow was particularly challenging given poor winter conditions, and trends in more recreational categories continued to be soft. Looking forward to the year, our focus remains on sound execution despite the uncertain macro environment, from managing dealer inventory and delivering for customers to making continued progress with operational improvements and driving profitable growth.”

Speetzen says the focus in Q1 was mainly on improving delivery, increasing efficiencies, and driving down operating costs in manufacturing facilities. They experienced the worst snowmobile season in 13 years, driven by a lack of snow across much of North America.

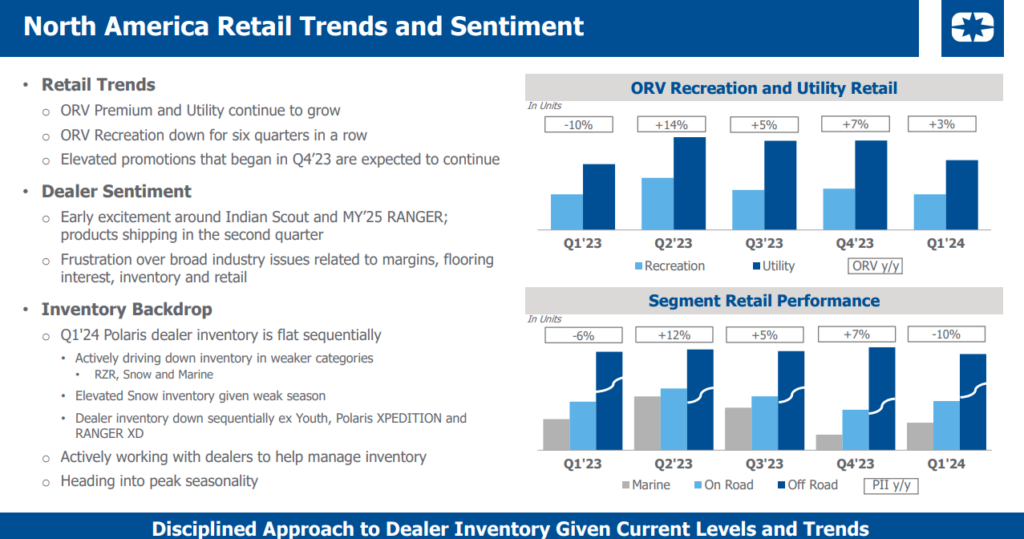

North America retail was down 10%, driven by a weak snow season, but was up 3% when you exclude snow, according to Speetzen. Utility, off-road vehicles continue to have strong demand (i.e., Ranger line-up), Recreation was down and On-Road was up for the quarter, driven by strength in North American markets, somewhat offset by international market weakness.

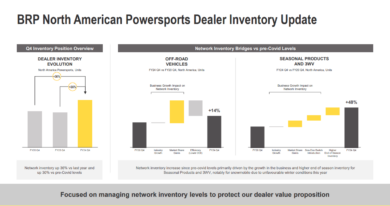

“We also reduced shipments to help better manage dealer inventory in categories that have been underperforming, such as Off-Road, recreation, and marine,” Speetzen adds. “I’d also remind you that we’ve been doing this for several quarters. This approach is driven by our ability to adjust to trends we’ve seen materializing over multiple quarters, aided by our Retail Flow Management system, which is one of the most sophisticated dealer inventory tools in the industry, allowing us to quickly adapt our production and delivery system to current demand environment.”

The system gives Polaris near real-time access to dealer inventory by region, product, and dealer. “We use this data in conjunction with conversations with our dealers to actively manage inventory to enable dealers to have the right inventory to efficiently run their business,” Speetzen notes.

As expected, promotions were elevated across the industry during Q1, and Polaris expects higher discounting to continue through 2024. The company says it impacts each segment as the industry grapples with elevated interest rates. For Polaris and the industry, this impact is more noticeable within the Marine and Off-Road recreational categories that have seen weak retail for several quarters, resulting in elevated inventory.

“Hearing from dealers, they continue to view all powersports inventory as too high and are actively looking for opportunities to manage inventory with strategies ranging from reducing the number of OEMs they carry to adding additional promotional dollars from their own wallets as well as taking fewer shipments from OEMs.”

– Mike Speetzen, CEO of Polaris

According to Speetzen, dealers have their own unique version of these industry issues. “While we can’t influence other OEMs, we do believe that we are doing our part to assist dealers. We’re reducing shipments in product segments most challenged and adding promotional dollars where necessary to assist them with moving products.”