Q2: Big banks still see resilient U.S. consumer

According to Yahoo Finance reporter Josh Schafer, big banking institutions are upbeat about how resilient the consumer and economy are in their second-quarter earnings reports. This is leading to a growing belief that a recession may come later than expected, or perhaps not at all.

“The consumer’s in good shape,” says JPMorgan Chase CEO Jamie Dimon. “They’re spending down their excess cash.”

Bank of America CEO Brian Moynihan says in the Yahoo report that “we continue to see a healthy U.S. economy that is growing at a slower pace, with a resilient job market.”

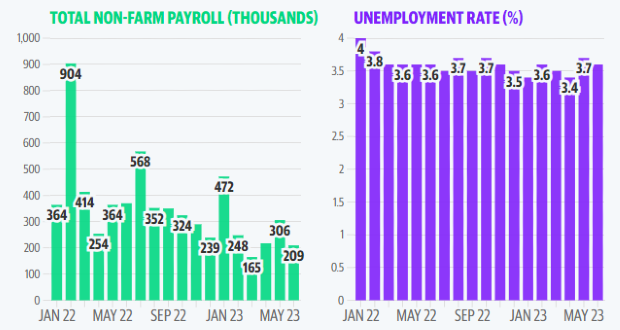

Yahoo’s Schafer says that recent economic data has supported what banks are seeing. The June retail sales report that came out this week was weaker than economists had projected but still showed overall growth of 0.2%. Economists noted the results were “fairly encouraging overall.” Other reports show that inflation is cooling while the labor market is still in growth mode.

“The big financial [institutions] have a good lens into what the consumer is doing and not only if the consumer is spending but if the consumer is still borrowing,” Liz Young, SoFi’s head of investment strategy, tells Yahoo Finance. “So what I heard generally speaking from them is that, absolutely, there’s still an appetite to spend. However, there are consumers doing it on leverage or credit. And so far, that is perfectly fine because everybody is still employed in a strong labor market, and there’s been wage growth.”

Bank of America remains positive about the economy as consumer payment spending at the bank has totaled $2.1 trillion through the first six months of the year, the report states, noting that it’s an increase of percent over the same period last year.

“The consumer is still in a pretty healthy place,” according to Bank of America’s CFO. “[The] consumer’s pretty resilient. That remains the case. And we’re benefiting it from it right now in the card experience.”

We think this news bodes well for the powersports market, as many consumers use credit to purchase vehicles as well as parts and accessories. We will have a full report on Q2 performance in an upcoming issue of PSB.

Source: Yahoo Finance