Harley Q3 retail sales down 15 percent in North America

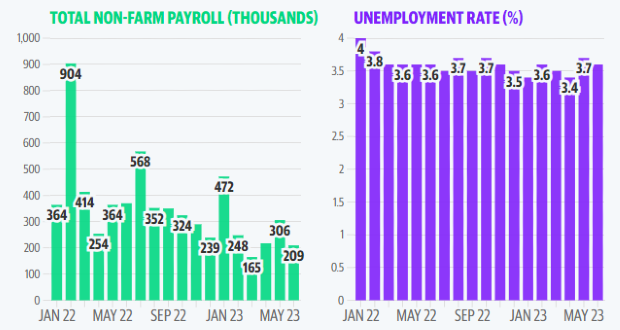

With the discontinuation of the Sportster in ’22 and challenging economic headwinds, demand was stagnant for Harley as it had lower profits and fewer shipments in Q3. The Motor Company reported a decline in Q3 profit of 24%, as customers cut back on discretionary spending.

“Against a challenging macro and consumer backdrop, we have achieved a result that preserves profitability at an industry-leading level. In addition, we successfully launched our pinnacle CVO motorcycles, with CVO retail sales up 25%,” says Jochen Zeitz, chairman, president and CEO of Harley-Davidson.

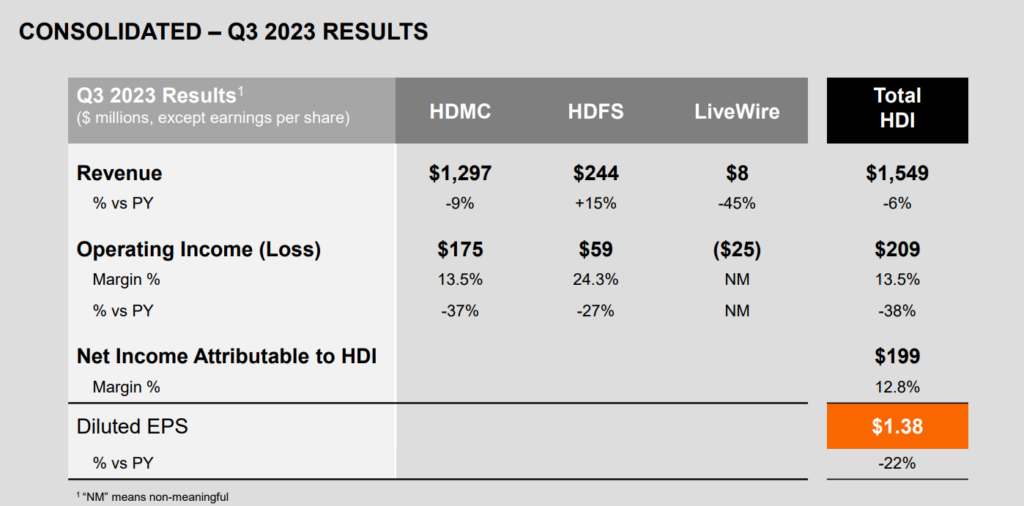

Third-quarter global motorcycle shipments decreased 20 percent due to the production suspension announced in late Q2 2023, prudent dealer inventory management and market conditions. Revenue was down 9 percent, with improved mix and global pricing partially offsetting unit declines. P&A revenue was down 8 percent, largely in-line with revenue from motorcycles. Apparel revenue was down 29 percent, driven by lower volumes in North America.

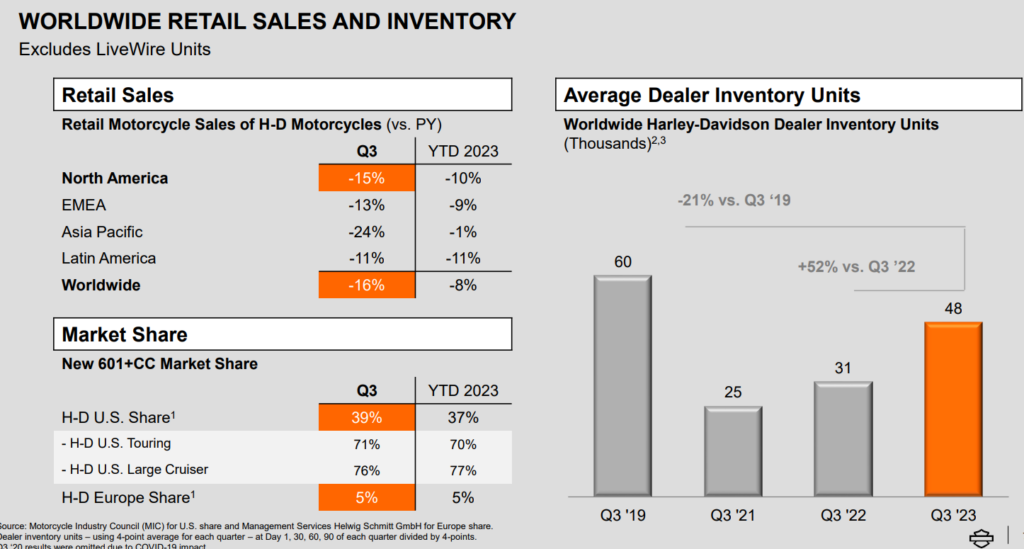

Harley-Davidson Retail Motorcycle Sales

Global retail sales of Harley-Davidson motorcycles in Q3 were down 16 percent versus the prior year, adversely impacted primarily by macro conditions in key geographies. North America retail performance was down 15 percent, impacted by both the high-interest rate environment in North America and the discontinuation of legacy Sportster at the end of 2022.

The decline in EMEA of 13 percent was driven by weakness in the German regional market and the planned unit mix shift towards the profitable core product segments. The decline in APAC of 24 percent was primarily driven by weaker-than-expected demand in China. Latin America sales declines were driven by weakness in Brazil, partially offset by growth in Mexico.

Financial Services

HDFS revenue was up $32 million in Q3, an increase of 15% versus the prior year, driven primarily by higher interest income, says the company. HDFS operating income decline was down 27 percent, driven by an increased provision for credit losses and higher interest expense. The increase in the provision for credit losses was driven by several factors relating to the current macroeconomic environment. Total quarter-ending net finance receivables were $7.7 billion, up 4 percent versus the prior year, driven primarily by increased wholesale commercial lending receivables.

LiveWire

With most Del Mar shipments landing in Q4, LiveWire revenue for the third quarter was down versus the prior year. LiveWire’s operating loss of $25 million in the third quarter is in-line with expectations and was driven by product development and other spending associated with the launch of the Del Mar electric motorcycle, according to the company.

“Harley-Davidson remains committed to its Hardwire strategy with a focus on both desirability and profitability, and we will do everything possible to achieve our goals while being realistic that current market conditions are complex. We are gearing up for ’24 and will ensure that we are fully aligned and ready as we close out the year with Q4,” adds Zeitz.

For the full year 2023, the H-D reaffirms its most recent guidance and continues to expect:

- HDMC: Revenue growth of flat to 3% and operating income margin of 13.9 to 14.3%

- HDFS: Operating income decline of 20 to 25%

- LiveWire: Motorcycle unit sales of 600–1,000 and operating loss of $115 to $125 million

- Harley-Davidson, Inc.: Capital investments of $225 to $250 million