RumbleOn reports record full year ’22 and Q4 powersports unit sales

RumbleOn recently announced its operational and financial results for the fourth quarter and full year that ended December 31, 2022. Powersports Business has highlighted the report and edited it for brevity and clarity. You can read the full report here. Also, key company shareholders recently published an open letter voicing concerns about the company’s management and stock performance.

Full year 2022 unit sales from RumbleOn stores were 73,413 units, with pre-owned unit sales of 31,764. The company’s powersport segment revenue was reported to be $1.4 billion for FY 2022, which includes the elimination of $71.0 million it said was a corrected “gross up” of internal revenue and costs.

The full-year gross profit of $429.9 million was hit with a loss of $261.5 million which reflects a $350.3 million non-cash impairment charge. Excluding the effects of the non-cash impairment charge and other non-recurring items, but including stock-based compensation expenses, the adjusted net income was $37.3 million.

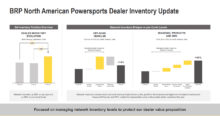

Marshall Chesrown, RumbleOn’s chairman and CEO commented, “We are aggressively addressing macroeconomic uncertainties as we operate in an environment of normalized inventory levels and associated margin pressures. We are building a solid foundation for long-term profitable growth, all while making prudent, timely and disciplined investments in technology and customer experience improvements online and in our stores. Further, the fulfillment process being rolled out will enable our operations and teams to become more agile to meet customer demand through diligent on time inventory management and customer selection and service.”

Fourth Quarter 2022 results

Total unit sales of 18,419 units across RumbleOn’s powersports and automotive segments were impacted by the exit of its automotive business. The company’s total powersports unit sales of 17,550 new and 6,917 pre-owned units, resulted in a new to used ratio of 1.54x, which increased slightly from the prior quarter.

The company’s gross profit of $89.7 million in the powesports segment for the fourth quarter was impacted from a lower gross profit contribution from the automotive segment combined with modest gross margin compression in the rowersports segment, resulting in an adjusted EBITDA of $18.7 million.

Other notes from the financial report were that RumbleOn signed an engagement letter with JP Morgan for 2023. And the company completed three “Tuck-In” acquisitions: (2) Polaris, and (1) Honda franchise, in Texas. These acquisitions were funded from operating cash for a total purchase price of $4.8 million. And they also paid down $15 million of long-term debt.

“With an ongoing focus on maintaining financial health and a strong balance sheet, we remain committed to a completely self-funded business model for growth,” Chesrown stated. “In the fourth quarter, we pre-paid $15M in principal and recently signed an engagement letter with JP Morgan to review our balance sheet initiatives and options for 2023. As we look to 2023 and beyond, we are continuing to implement our five-pillar strategy to achieve our near and long-term financial targets, driving sustainable shareholder value.”