PWC sales trends for the summer selling season

As a crossover machine that straddles the line between marine and powersports, the personal watercraft sits in the middle of the boating world as an aquatic motorcycle. And that is purposeful, as original designs of the “Jet Ski” and later PWCs became popular toys for playing on the water. However, the category has evolved in some significant ways over time.

The appeal of personal watercraft transcends age, gender and geographical boundaries, making it a universally beloved recreational activity. From adrenaline junkies seeking high-speed thrills to families looking for leisurely outings on the water, PWCs cater to a diverse array of preferences and lifestyles. High-performance models with powerful engines and agile handling characteristics deliver an exhilarating ride experience, and all three of the major manufacturers are rolling out PWCs with bigger horsepower numbers every year.

The price tag also climbs as OEMs continue to push the envelope in 4−stroke technology. Yamaha unveiled a new high-output engine that produces 25 percent more power and a higher top speed. Kawasaki has a 300−plus horsepower PWC, a stand-up “Jet Ski,” and an angler model for fishing. Sea-Doo also covers all bases with a wide range of PWCs, including an angler model, which is gaining popularity in some regions.

While the boating market generally declined a bit in 2023, coming off the post-COVID demand surge, one category that has yet to fall short is PWC. According to the National Marine Manufacturers Association (NMMA), the personal watercraft segment sold about 85,000 – 90,000 new units in 2023, up 20−25% over 2022. However, the rest of the boating industry saw declines in the mid-to-high single digits.

PWC sales have done so well because they are relatively affordable, especially compared to other types of powerboats. They are also very mobile, so owners can tow them to lakes and waterways nearby or travel further to explore new areas.

According to J.D. Power, most segments of the marine market returned to typical conditions in 2023, with supply increasing and equity and financing more of a challenge. Looking at individual segments, personal watercraft brought 5.3% less in November-December than September-October and 15.6% less in 2023 than in 2022. Expect the correction to continue in 2024 as headwinds increase.

The players

The personal watercraft market is dominated by a handful of manufacturers, including industry giants such as Yamaha, Sea-Doo and Kawasaki. These OEMs continually innovate product offerings, incorporating cutting-edge technology and design features to enhance performance, safety and user

experience. Each brand has its loyal following, with enthusiasts often swearing by their preferred manufacturer’s models.

One PWC dealer we spoke with recently says they mostly work on Sea-Doo brand products and shy away from Kawasaki products. He says Sea-Doos have better build quality and materials than Kawasaki, and Yamaha is probably the second-best brand. In terms of market share, this seems to ring true as well. Sea-Doo has a larger percentage of the market in North America, but according to our research, it’s more of a toss-up between Kawasaki and Yamaha.

Market Trends

According to the NMMA, most powerboat segments reported declines in 2023, with a 5% to 25% drop in unit sales. However, the personal watercraft segment saw a significant increase, around 20% to 25%, as the final 2023 sales data were calculated.

Due to its compact size, PWCs are considered a gateway to the larger boating segment. Given their entry-level pricing and ease of use, they make up a significant percentage of total boat sales (more than one-quarter of the 258,000 new boats sold were PWCs in 2023).

“With jumps in interest rates and inflation in 2023, we saw more boating consumers being price-sensitive and deciding to wait things out before buying their next boat and, in the meantime, picking up a personal watercraft to enrich their time spent on the water,” Frank Hugelmeyer, NMMA president, comments. “The nearly 1 million people who purchased a boat for the first time during the height of the pandemic continued to spend record time on the water in 2023, helping drive an economic impact of $230 billion. As we enter 2024, we expect Americans’ desire to be near water to continue as more people seek ways to prioritize health and wellness and enhance their quality of life, which has the industry focused on continued innovation and ensuring greater access to our public waters.”

Recreational boating remains a significant driver to the U.S. economy due to the estimated 85 million Americans who go boating each year, bringing their friends and family and spending on everything from food and marine accessories to marinas, storage and insurance.

It drives an economic impact of $230 billion, up 36% from 2018, while supporting 36,000 U.S. businesses and 812,000 American jobs, according to NMMA’s 2023 Economic Impact Study on Recreational Boating.

One thing to note about 2024 is that many dealers’ inventory levels are very high. NPA’s Tony Altieri said in a recent NPDA webinar that dealers have more inventory than they’ve had for the past few years, and the boating segment is no exception. “The preorder season was okay for most of the (marine) dealers we talked to. They had a pretty good boat show season. It wasn’t like the COVID years, but it was okay. There wasn’t as much business written at those shows as there is historically, but we’re hoping for a good retail season this year as we enter summer, when (PWC dealers) do most of their business.”

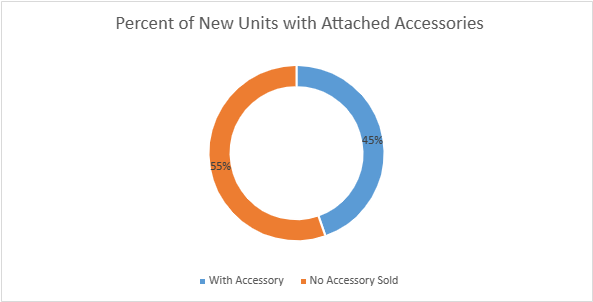

In the charts provided by Lightspeed, we looked at the accessory sales on new units sold. Of the 64,000 units sold, 55% of new were not sold with an accessory. And 45% of new units sold during this time had an accessory purchased at the time the PWC was sold.

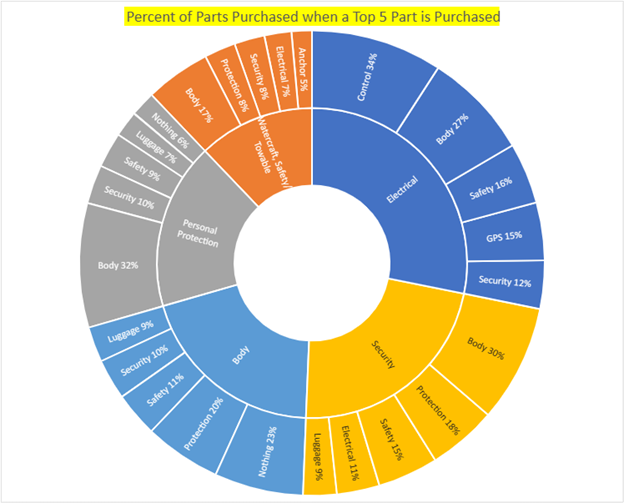

When the customer purchased a body part (Top 5 Parts Purchased): 24% of the units were sold with a body part. 23% of the buyers who purchased a body part purchased nothing else. And 20% also purchased a personal protection part. While 11% also purchased a watercraft safety or towable product, 10% a security device and 9% purchased luggage (storage).

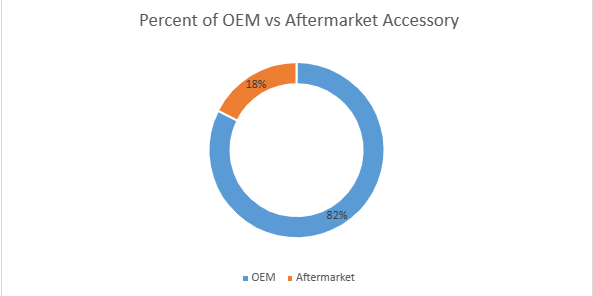

Another interesting note is that 82% of P&A sold were OEM accessories. And 18% were aftermarket accessories.

While winter is a big selling season for the recreational boating industry, with dozens of boat shows taking place around the country in January and February in major markets like New York, Miami, and Chicago, dealers typically have their biggest sales around boating season in the Spring. If interest rates begin to drop, the summer could be a big one for PWC sales.