Pre-owned market update: Buying smart and going back to normal

At the height of the pandemic, pre-owned powersports units were difficult to get, as was nearly any unit, new or used. While the pre-owned segment has always been a strong driver of growth for powersports dealers, it has been falling back to normal levels lately as more manufacturers have solved their supply chain woes and delivered loads of new units to dealers nationwide.

We spoke to Ryan Keefe, vice president of marketing for National Powersport Auctions (NPA), about the latest trends in pre-owned and how they may affect dealers sitting on aged inventory. He says dealers need to move their older units as soon as possible and buy “smart,” meaning they need to focus on what they can sell and transfer the rest through the auction channel to get the most from their financing.

“Pricing is more in line with the seasonal norm,” says Keefe. “So we’re seeing the typical ebb and flow of seasonal demand. The overall values are still elevated above 2019 due to inflation but have dropped significantly compared to the COVID high. Dealers are filling up with inventory and are much more selective about their used inventory.

So what does that tell us? According to Keefe, that means that dealers have more new units and haven’t sold through all of the used inventory they bought earlier this year. “The floor traffic is not what it used to be, so [dealers] are being more selective. The turn time has also returned to pre-COVID turn times regarding how long something sits on the floor.”

Keefe advises dealers aged inventory they bought at high prices in the spring to get out of it quickly. “Pricing is not going back up anytime soon, and you’re missing opportunities if you’re not getting into new products at the right price.”

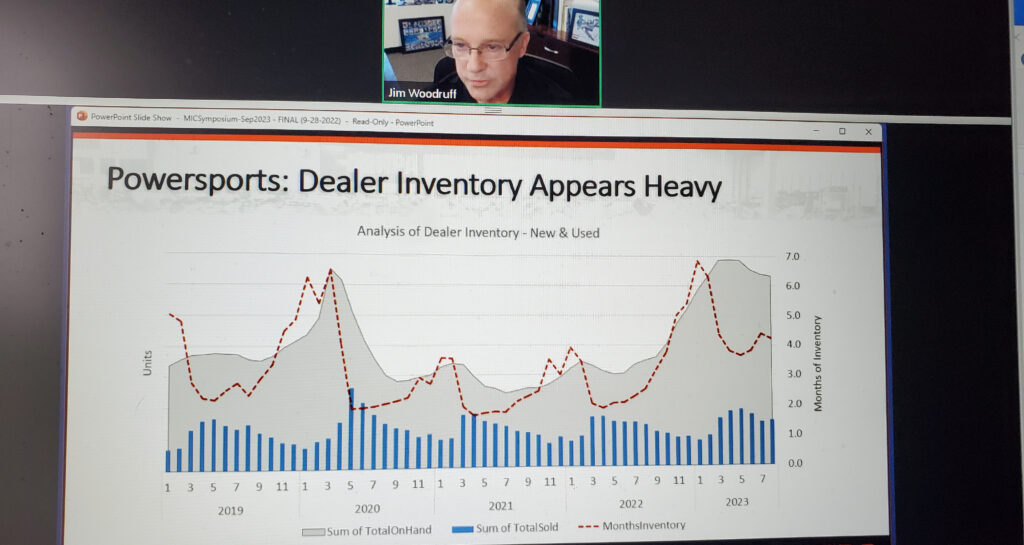

Jim Woodruff, CEO of NPA, recently spoke about the importance and value of the pre-owned market during an online MIC Symposium that PSB sat in on in late September.

Woodruff says it’s vital for the industry to have a liquid channel for consumers and lenders to move pre-owned vehicles and turn them into cash to buy a new vehicle or write a new loan. “The more efficient that channel is and the more efficient the dealer channel is, the healthier the industry can be, and the more new vehicles get sold.”

According to NPA data, pre-owned is the largest segment of the powersports industry. Woodruff says about 94 percent of the powersports vehicles population today is over a year old. But more importantly, he adds that on a transactional basis, it’s about three times as many pre-owned vehicles sold as new ones. “This is important because, in our industry, only about 3.4 percent of the population has a motorcycle. We would all sure like for more people to have one, and if we can sell them more new vehicles and sell them more used vehicles, the industry will be healthier.”

Do we have too much supply? According to Keefe, there’s not too much supply at the moment, but some key benchmarks are coming up that NPA is keeping an eye on. “Pricing is still falling, so we’re watching that close. We’re probably seeing the bottom now (September) and maybe a bit in October. Then, performance in the spring of 2024 will be the best indicator of the total supply in the market. There’s too much supply if we still see November or December pricing in the spring. If it jumps back up to the pre-COVID 5-10% above what it used to be, then I would say supply/demand, in general terms, is balanced.”

The supply and demand issue hinges on the economy and consumer confidence. Consumer debt is at an all-time high, Woodruff notes, including automotive debt and student loan debt. And consumer defaults are on the rise. Even with solid employment rates now, if it weakens, there will be some pain ahead. But the powersports industry is outperforming other recreational industries, with RV and marine markets being the two best benchmarks.

Woodruff explains: “Powersports is up 14.6 percent from 2019, which I use as a pre-COVID benchmark. Even though it is down slightly from last year… essentially, this year looks a lot like last year.”

Woodruff adds that consumers continue to spend money, and their confidence has improved. “On the flip side, though, there are some warning signs. Inflation is still too high. It’s almost double the Fed’s 2% target and is on the rise again. Interest rates are definitely high, and they’re not stopping anytime soon. Personal savings have come down. All of the money [consumers] received during COVID has been spent. They are back to equal to or slightly below what they had in their bank accounts before COVID.”

Returning to Normal

From a seasonality perspective, NPA says we’re starting to see a return to normal seasonality. And this is a good sign for normalcy within the market,” according to Woodruff. “The amount of inventory on the books has grown from last year. Dealers have inventory, and equally important is that sales volumes have remained strong. The inventory is turning. Last year, about the August time frame, inventory was turning at a rate of about seven times a year, and it’s now down to a little under four, so it’s getting closer to normal. These are all fairly normal numbers.” He adds that these are good signs that things are returning to normal.

In the current economy, as the Fed tries to control inflation, there’s typically a slowdown in retail demand. However, consumers are still buying vehicles. “Interest rates, qualifying standards, and negative equity is a challenge now,” Woodruff states. “But there’s an increase in new inventory levels, and as interest rates have increased, it’s also increasing flooring expenses, which we haven’t seen for the last several years. Many are starting to sacrifice margins to move that inventory to clear out their floor and reduce their flooring expenses.”

As for what the future may hold, Woodruff believes electric powersports vehicles coming to the market will be a good thing and may be a new growth driver down the road for those consumers who were reluctant to ride a gas-powered motorcycle or ATV.

Keefe says that NPA’s auctions are performing similarly across the board as far as pricing is concerned, but one of the exciting things is they are getting more e-bikes and electric motorcycles. “We’re getting a variety of those now coming through the doors, and dealers are buying them up.

Keefe says that low-mileage clean products are performing very well. “These units are performing near book, but higher mileage units are down. Most service departments are still full. A wave of inventory hit the market in the last 18 months. Service centers are still really full. All the normal stuff that needs to get serviced is still happening.” So, the service departments don’t have time to fix the lower condition vehicles that they used to during COVID to get vehicles on the floor.

During COVID, everybody was able to sell everything. And now, with everything adjusting back to normal, NPA is being utilized by more than just powersport companies to offload some of their overstocked inventory, says Keefe. “Golf cars, boats, RVs, campers, fifth wheels, e-bikes, are all showing up in NPA auctions nationwide. The good news is we have a vast powersports base, but we also have golf car, marine, and RV buyers that can absorb this product. So we’ve had great success growing these additional segments over the last six months.”

What NPA stressed the most was that dealers need to know the actual value of their pre-owned inventory. Keefe says that dealers should use the NPA Value Guide, NADA, Blackbook, or whatever they use to keep track of the current value of their inventory and to buy smart.

Sounds like smart advise to us.