Polaris UTV Dealers Top Pied Piper’s Latest Study

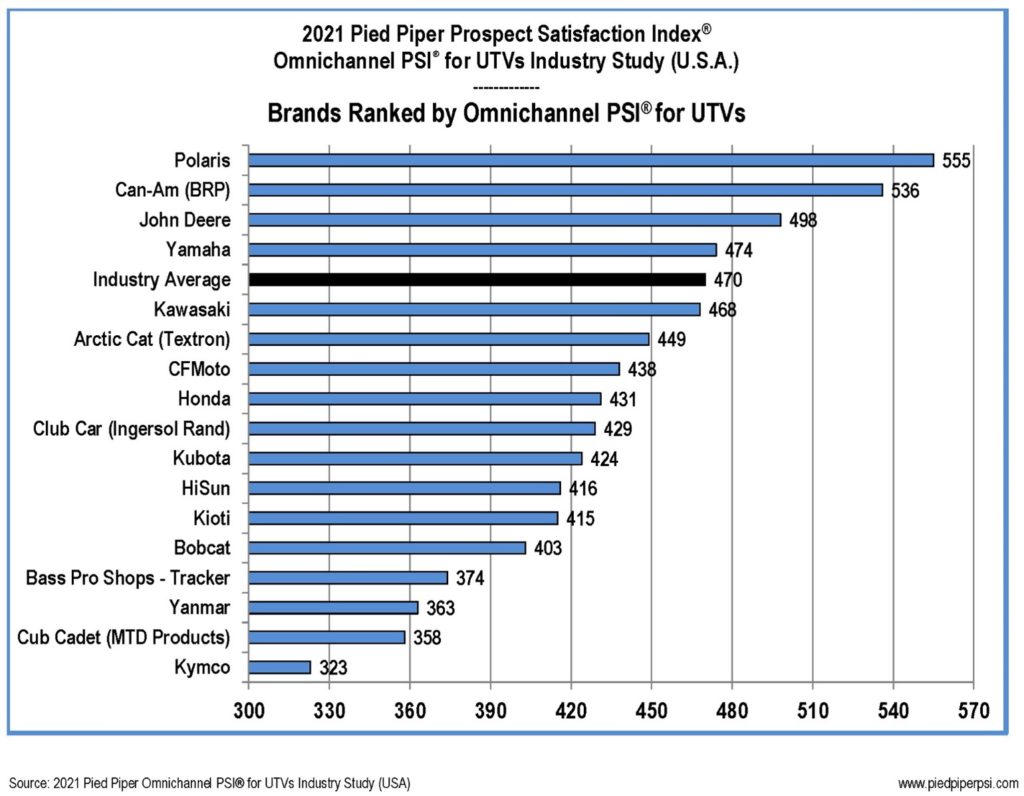

Polaris Side-By-Side/UTV dealers led the way in a recent Prospect Satisfaction Index study conducted by California-based Pied Piper, outscoring 16 other brands. BRP’s Can-Am dealers finished second, with John Deere third and Yamaha fourth as the only other brand that finished above the “Industry Average.”

For the first time, the study was “Omnichannel,” meaning it took into account the results of people who first shopped for a side-by-side online and thereafter visited the dealership in person. It was conducted over a 12-month period – from September 2020 to August of 2021.

Here’s the full release from Pied Piper.

POLARIS UTV/SIDE-BY-SIDE DEALERS RANKED HIGHEST

BY 2021 PIED PIPER PROSPECT SATISFACTION INDEX® (PSI®)2021 Omnichannel PSI® for UTVs Industry Study measured sales effectiveness throughout each brand’s customer shopping path, from brand website, to dealer website, to dealership in-person

Monterey, California – September 20, 2021 – Polaris ranked highest in the 2021 “Omnichannel PSI for UTVs” Industry Study, which for the first time included omnichannel website shopping measurements in addition to calculating effectiveness selling in-person. The study answered the question, “What happens when UTV customers shop for a vehicle by first visiting the brand’s website, or a dealership website, and then visiting a dealership in person?” BRP’s Can-Am brand was ranked second of the seventeen UTV brands evaluated, followed by John Deere.

The “Omnichannel” approach to shopping and purchase combines and integrates a customer’s online and in-store experience. A customer moves from a brand website, to a dealership website and start of communication with the dealership, to visiting the dealership in-person. The customer may then go back home again and back onto the websites before committing to buy either online or back at the dealership in person.

Two factors have driven recent growth in omnichannel selling: widespread use of smart phones and the appearance of online digital retail shopping tools. As an example, in 2007, the year the iPhone was introduced, online retailer Amazon’s sales totaled $15 billion. By last year, Amazon’s sales had grown to more than $300 billion, and customers today almost always begin their shopping online, even if they eventually visit a store in-person. More recently, industries that traditionally relied only on in-person sales have embraced new online digital retail tools. For UTV shoppers this has meant the appearance of “Buy Now,” or “Buy from Home” buttons on websites, along with other online digital retail tools like inventory search, payment calculator, trade-in value estimator, test-drive request and others.

For 17 different brands selling UTVs, Pied Piper measured whether their customer’s omnichannel path was intuitive, simple to use, easy to navigate, and effective showcasing products and making it easy to purchase. Measurements from the following four subcategories were combined into a brand score out of 1,000 points:

- Brand Website – Useful Digital Retail Tools Provided (11% total score): Were useful online digital retail tools provided for the customer? Top brands: Polaris, BRP, John Deere; Bottom brands: Kymco, Yanmar, CFMoto.

- Brand Website – Ease of Transition to Local Dealership (7% total score): Could customers on the brand website easily transition from viewing a desired vehicle over to communicating with a local dealership to take the next step? Top brands: Kawasaki, BRP, Kubota; Bottom brands: John Deere, Honda, Yamaha.

- Dealership Response to Website Customer Inquiries (38% total score): Did the local dealership quickly respond to website customer inquiries? Top brands: Polaris, BRP, CFMoto; Bottom brands: Tracker, Bobcat, Yanmar.

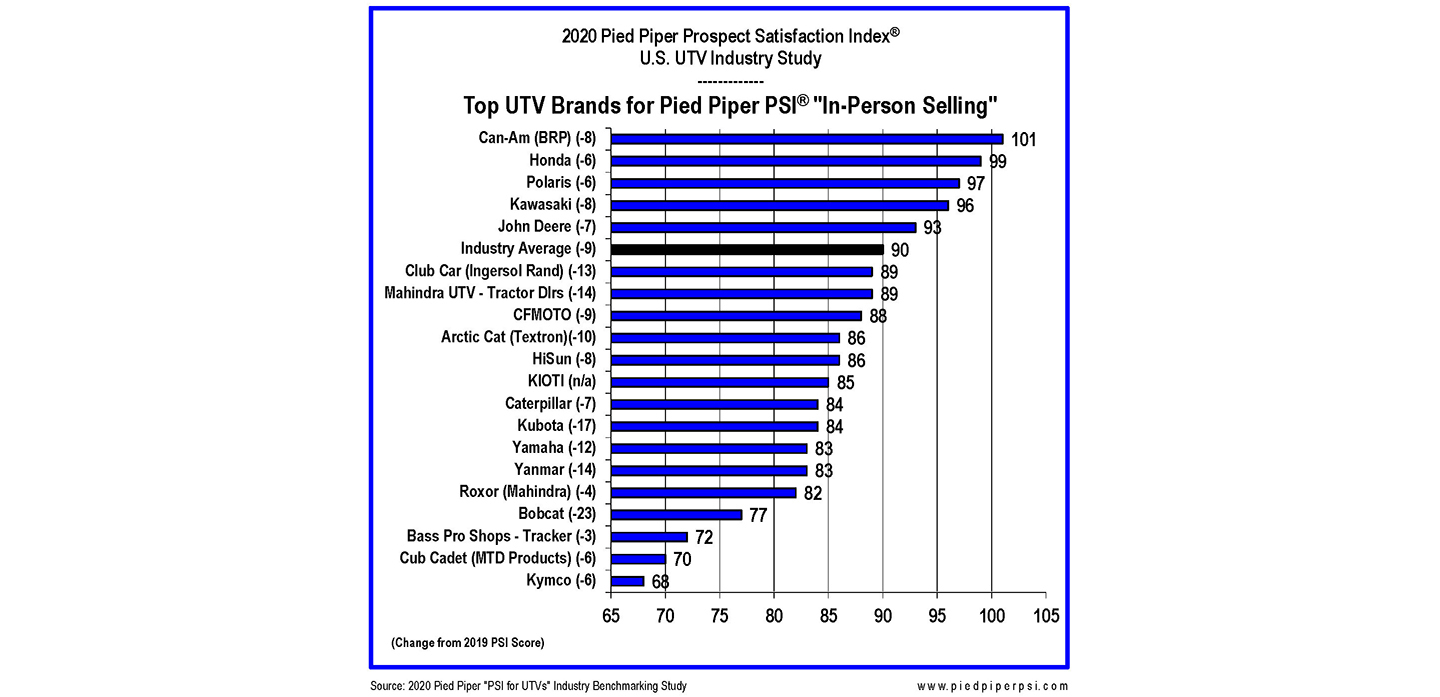

- Dealership Sales Effectiveness In-Person at Dealership (44% total score): Did the dealership employees and in-dealership processes build upon what the customer has already accomplished online, to provide a seamless, consistent, efficient, and effective customer experience in-person at the dealership? Top brands: John Deere, BRP, Polaris; Bottom brands: Kymco, Cub Cadet, Yanmar

Pied Piper measured dealer response to UTV website customers by submitting customer inquiries through a combination of brand websites and local dealership websites, asking a question about a vehicle in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone and text message over the next 24 hours. Pied Piper also sent in-person “mystery shoppers” into UTV dealerships nationwide, measuring how effectively the dealership interacted in-person, as well as whether the dealership acknowledged and built upon the online shopping that the customer had already completed.

“UTV customers today face big differences in shopping experience depending upon the brand,” said Fran O’Hagan, President & CEO of Pied Piper. “Some UTV brands have added digital retail shopping tools, and work with their dealers to encourage quick response to website visitor inquiries, while other brands have not yet embraced omnichannel selling.” Pied Piper’s Omnichannel PSI for UTVs study shows that brands and dealers who pay careful attention to all four subcategories of omnichannel selling are the ones who sell most effectively to today’s customers.

About Prospect Satisfaction Index® (PSI®)

The 2021 Omnichannel PSI for UTVs Industry Study (USA) was conducted between September 2020 and August 2021 by completing a combination of website inquiries and in-person sales effectiveness measurements for a sample of 3,584 dealerships nationwide representing all major UTV brands. Examples of other recent PSI studies are the 2021 PSI-Internet Lead Effectiveness® (ILE®) U.S. Motorcycle/UTV Industry Study (Harley-Davidson brand was ranked first for dealer response to web inquiries), and the 2021 Omnichannel PSI for EVs Auto Industry Study (Chrysler brand, selling the Pacifica plug-in hybrid, was ranked first). Complete PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations—in-person, website or telephone—as tools to measure and improve the omnichannel sales effectiveness of their dealerships. For more information about how Prospect Satisfaction Index® (PSI®) measurement and reporting is used to improve performance, go to www.piedpiperpsi.com.