BRP reports Q4 and FY2025 results with 19.7 percent revenue drop

BRP Inc. recently reported its financial results for the three- and twelve-month periods that ended on January 31, 2025.

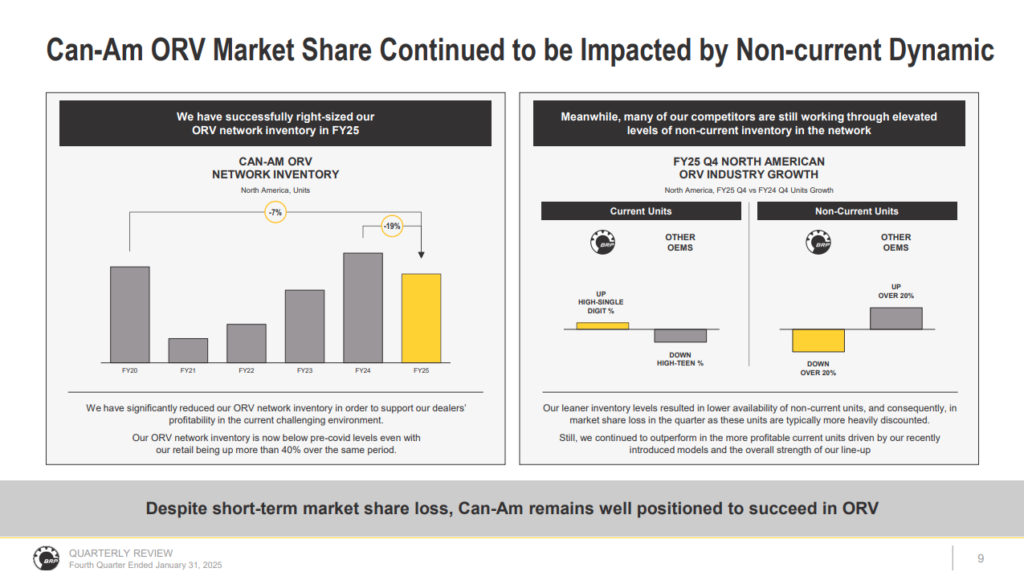

BRP reported revenues of $2,097.6 million, a decrease of 19.7% compared to last year, resulting from continued softer demand and the company’s objective to reduce network inventory. North American network inventory decreased by 13% compared to last year, or 18% when excluding snowmobiles, for which network inventory increased due to lower industry retail caused by late snowfall.

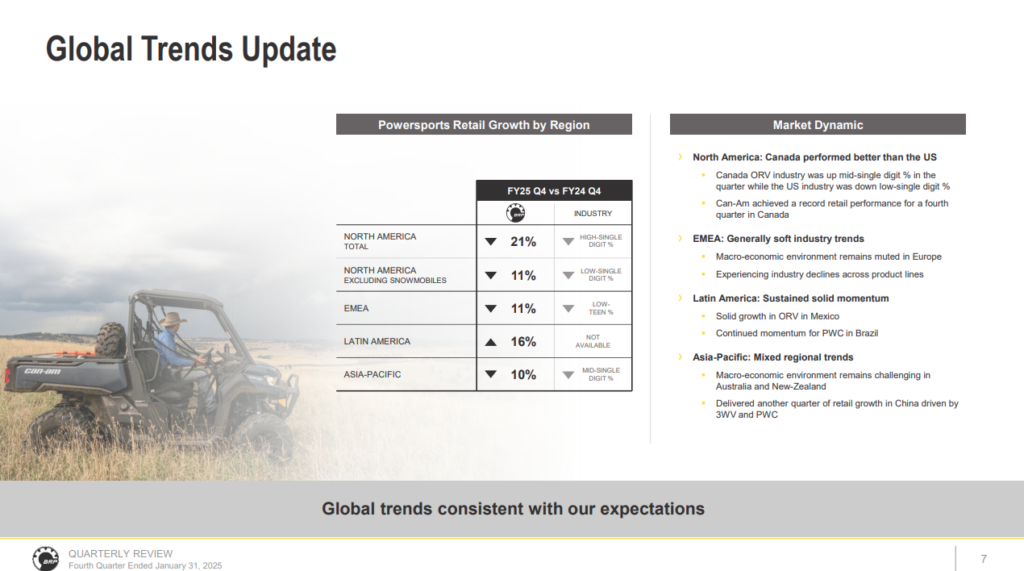

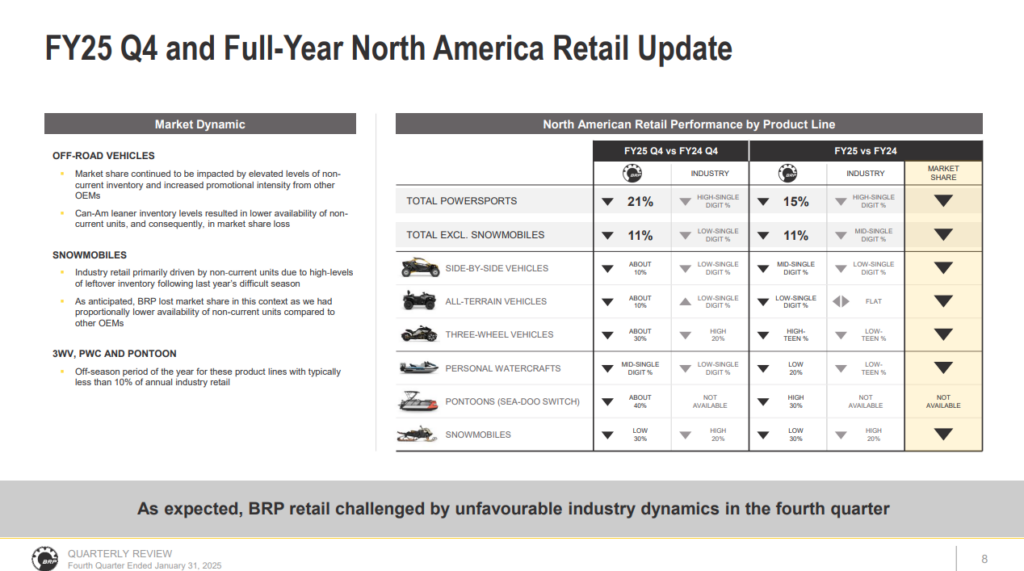

The company’s retail sales in North America also decreased by 21% compared to last year, resulting from lower snowmobile volumes and market share loss in ORV due to high non-current inventory from other OEMs.

Given the ongoing global tariff disputes and the uncertainty surrounding any potential changes to trade regulations, the BRP says it will defer providing financial guidance for FY26. The uncertainty has also hurt consumer demand, making it difficult to offer reliable projections at this time, the company explains.

“BRP demonstrated its agility throughout fiscal 2025 by rapidly adapting to softer market conditions. We were the first OEM to adjust shipments to reduce network inventory proactively and achieved our objective. As anticipated, our leaner inventory position compared to competitors resulted in short-term market share loss but protected our dealer network and the value of our brands. In this volatile context, we have outpaced the off-road industry with our current models, which speaks highly about the attractiveness of our lineups,” says José Boisjoli, president and CEO of BRP.

“Looking ahead to fiscal year 2026, the ongoing global tariff disputes have created economic uncertainty, making financial projections more challenging at this time. Over the longer term, our strategic decision to double down on Powersports should allow us to solidify our industry leadership by pushing innovation further and capitalizing on growth opportunities. With a product portfolio that is second-to-none, a strong dealer network and a healthy balance sheet, we are well positioned to sustain profitable growth,” concluded Mr. Boisjoli.

Q4 results

In the context of continued softer demand and BRP’s objective to reduce network inventory, its Q4 2025 was marked by a decrease in shipments and revenues compared to last year. The decrease in the volume of shipments, the higher sales programs due to increased promotional intensity, and the decreased leverage of fixed costs due to reduced production have led to a decrease in the gross profit and gross profit margin compared to the same period last year. This decrease was partially offset by favourable pricing and production efficiencies.

The company’s North American retail sales were down 21% for Q4 2025. The decrease is mainly explained by lower industry volumes in Snowmobile and market share loss in Off-Road Vehicles due to high non-current inventory from other OEMs.

Revenues

Revenues decreased by $513.9 million, or 19.7%, to $2,097.6 million for Q4 2025, compared to $2,611.5 million for the corresponding period in 2024. The decrease in revenues was primarily due to a lower volume sold across all product lines, as a result of softer demand, as well as higher sales programs. The decrease was partially offset by favourable pricing across most product lines. The decrease includes a favourable foreign exchange rate variation of $33 million.

Year-Round Products (54% of Q4-FY25 revenues): Revenues from Year-Round Products decreased by $236.8 million, or 17.4%, to $1,127.1 million for Q4 2025, compared to $1,363.9 million for the corresponding period in 2024. The decrease in revenues from Year-Round Products was primarily attributable to a lower volume of units sold across all product lines due to softer demand, unfavourable product mix in SSV and higher sales programs. The decrease was partially offset by favourable pricing across all product lines. The decrease includes a favourable foreign exchange rate variation of $26 million.

Seasonal Products (32% of Q4-FY25 revenues): Revenues from Seasonal Products decreased by $275.0 million, or 28.9%, to $677.6 million for Q4 2025, compared to $952.6 million for the corresponding period in 2024. The decrease in revenues from Seasonal Products was primarily attributable to a lower volume of units sold across all product lines due to softer demand, unfavourable product mix in snowmobiles, and higher sales programs. The decrease was partially offset by a favourable product mix on PWC and Sea-Doo pontoon and favourable pricing across all product lines. The decrease includes a favourable foreign exchange rate variation of $2 million.

PA&A and OEM Engines (14% of Q4-FY25 revenues): Revenues from PA&A and OEM Engines decreased by $2.1 million, or 0.7%, to $292.9 million for Q4 2025, compared to $295.0 million for the corresponding period in 2024. The decrease in revenues from PA&A and OEM engines was primarily attributable to softer demand in PA&A. The decrease was partially offset by a favourable product mix on OEM engines and favourable pricing on most product lines. The decrease also includes a favourable foreign exchange rate variation of $5 million.

North American Retail Sales

BRP’s North American retail sales decreased by 21% for the Q4 2025 compared to last year. The decrease is mainly explained by lower industry volumes in snowmobiles and market share loss in ORVs due to high non-current inventory from other OEMs.

North American Year-Round Products retail sales decreased on a percentage basis in the low-teens range compared to Q4 2024. The North American Year-Round Products industry sales decreased on a percentage basis in the low-single digits over the same period.

North American Seasonal Product retail sales decreased on a percentage basis in the low-thirties range compared to Q4 2024. The North American Seasonal Products industry sales decreased on a percentage basis in the mid-twenties range over the same period.

Gross profit

Gross profit decreased by $231.1 million, or 35.0%, to $429.4 million for Q4 2025, compared to $660.5 million for Q4 2024. The gross profit margin percentage decreased by 480 basis points to 20.5% for Q4 2025, compared to 25.3% for Q4 2024. The decreases in gross profit and gross profit margin percentage resulted from a lower volume of units sold, higher sales programs, decreased leverage of fixed costs due to reduced production, and higher warranty costs. The decrease in gross profit includes a favorable foreign exchange rate variation of $2 million.

Operating expenses

Operating expenses decreased by $12.8 million, or 3.9%, to $317.4 million for Q4 2025, compared to $330.2 million in Q4 2024. The decrease in operating expenses was mainly attributable to lower G&A expenses due to cost optimization and lower R&D expenses. The decrease was partially offset by higher restructuring and reorganization costs. The decrease in operating expenses includes an unfavorable foreign exchange rate variation of $9 million.

Net income

Net income (loss) decreased by $347.3 million, or 114.7%, to $(44.5) million for the quarter, compared to $302.8 million for Q4 2024. The decrease in net income was primarily due to a lower operating income, resulting from a lower gross profit and an unfavourable foreign exchange rate variation on the U.S.-denominated long-term debt. The decrease was partially offset by a lower income tax expense.

Net loss

Net loss increased by $60.2 million, or 52.4%, to $(175.1) million for the quarter, compared to $(114.9) million for 2024. The increase in net loss was primarily due to an impairment charge taken on the marine businesses’ assets held for sale during the last quarter.

FY2025 results

Revenues decreased by $2,133.3 million, or 21.4%, to $7,829.7 million for FY2025, compared to $9,963.0 million for the corresponding period in 2024. The decrease in revenues was primarily due to a lower volume sold across all product lines due to softer demand, the company’s focus on reducing network inventory levels, and higher sales programs. The decrease was partially offset by a favourable product mix and pricing across most product lines. The decrease includes a favourable foreign exchange rate variation of $94 million.

Net income

Net income decreased by $869.0 million, or 93.3%, to $62.7 million for the full year 2025, compared to $931.7 million for FY 2024. The decrease in net income was primarily due to lower operating income, resulting from a lower gross profit and an unfavourable foreign exchange rate variation on the U.S.-denominated long-term debt. The decrease was partially offset by a lower income tax expense.

Net loss

Net loss increased by $88.5 million, or 47.3%, to $(275.7) million for the twelve-month period, compared to $(187.2) million for 2024. The increase in net loss was primarily due to higher operating loss resulting from a lower volume of units sold due to high network inventory and softer consumer demand in the industry. Higher sales programs, production inefficiencies, and an impairment charge on the marine businesses’ assets held for sale also contributed to the increase in net loss.

Cash flow

Consolidated net cash flows generated from operating activities totaled $740.1 million for 2025 compared to $1,658.1 million generated in 2024. The decrease was mainly due to lower profitability and unfavorable changes in working capital, partially offset by lower income taxes paid. Changes in working capital resulted from maintaining higher provisions compared to last year, where more provisions were created due to a slowdown in demand and a sustained promotional intensity in the industry. The unfavorable changes in working capital resulted from reduced trade payables and accruals, which reflected reduced production. The unfavorable changes in working capital were partially offset by a reduction in inventory levels.

BRP invested $425.5 million of its liquidity in capital expenditures to introduce new products and modernize its software infrastructure to support future growth.

During the twelve months, the company also returned $277 million to its shareholders through quarterly dividend payouts and share repurchase programs.

All financial information is in Canadian dollars unless otherwise noted. The complete financial results are available in the Quarterly Reports of BRP’s website.