Survey: Sales stabilize in November, but inventory and dealer confidence slip

Sales trends showed modest improvement in November, but excess inventory and growing dealer fatigue continue to pressure the powersports retail landscape, according to the latest BMO Capital Markets/PSB Dealer Survey.

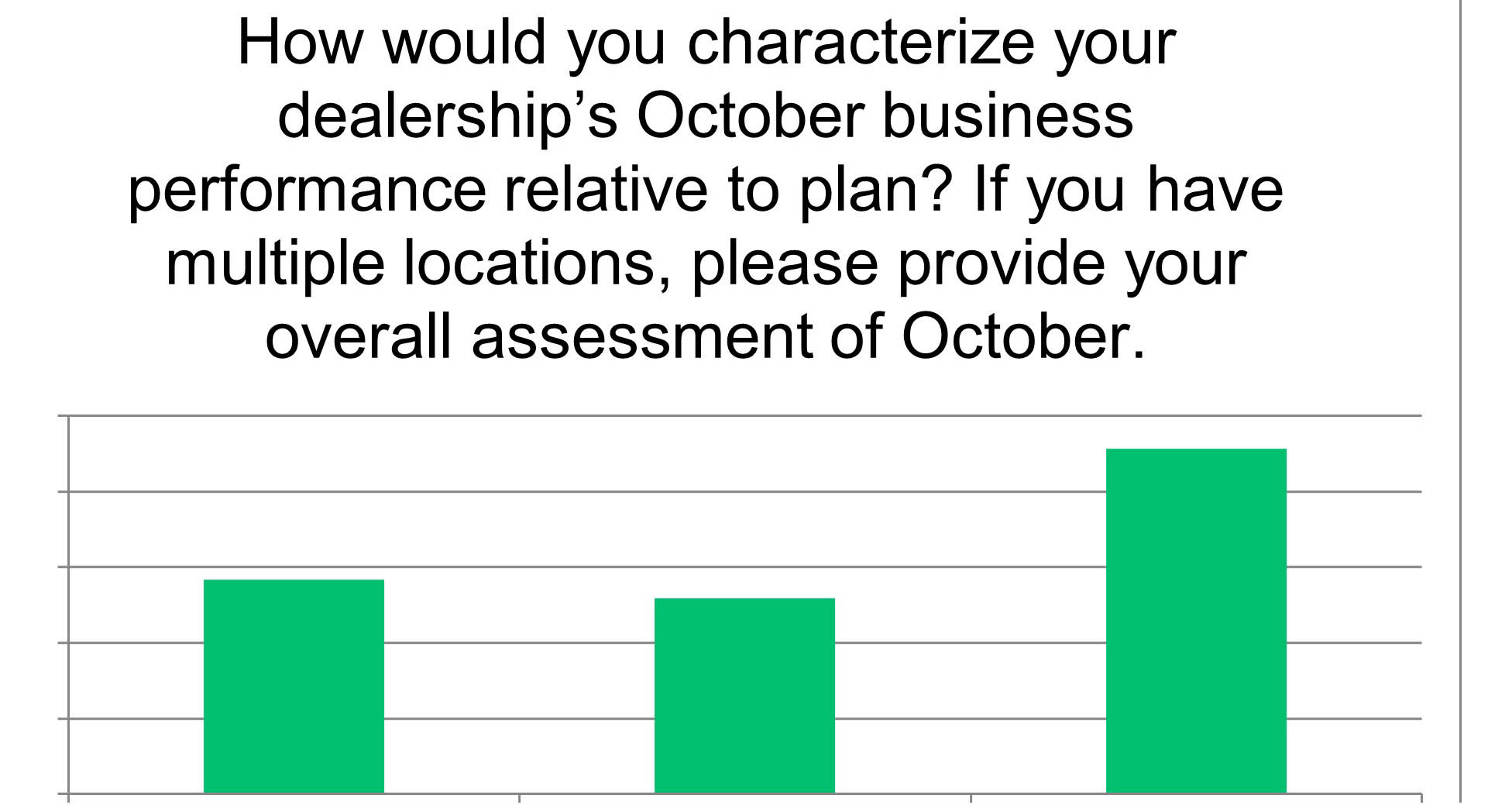

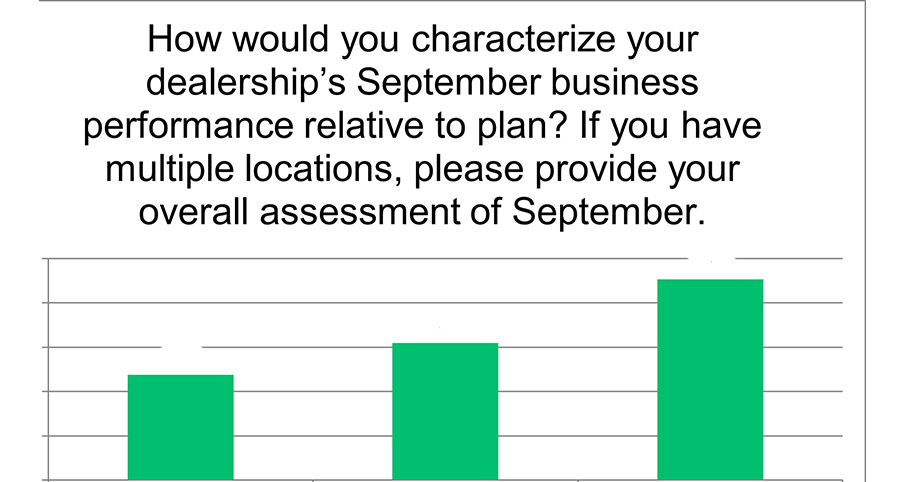

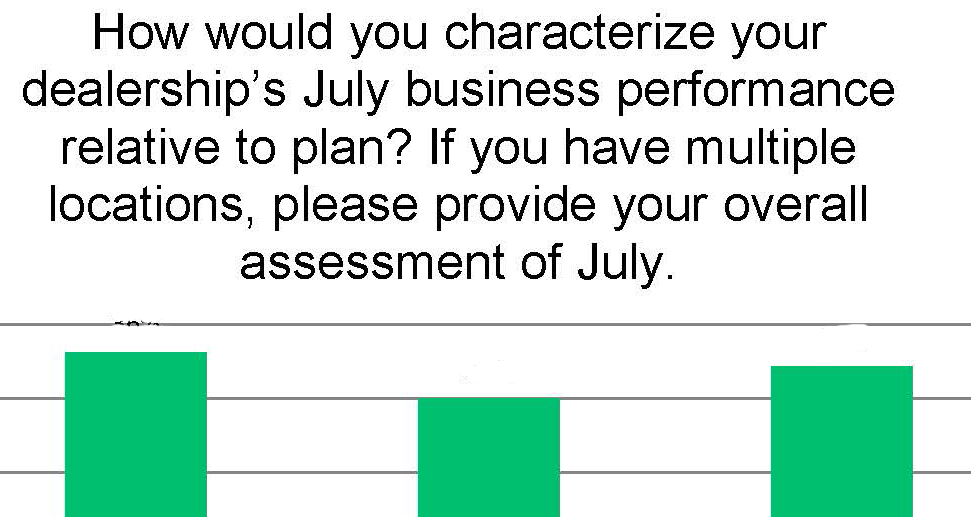

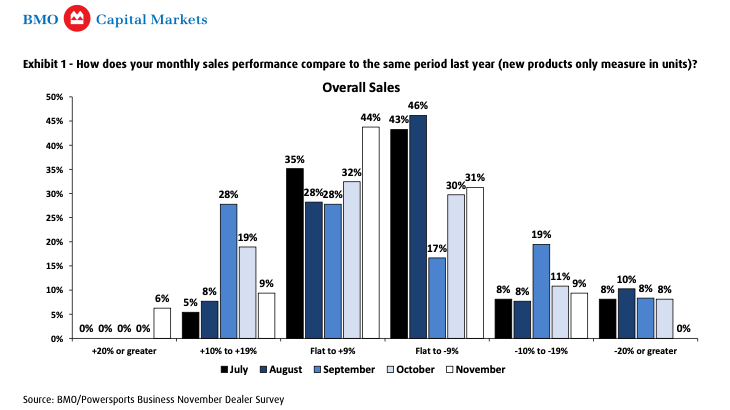

The monthly survey, conducted by BMO Capital Markets in conjunction with Powersports Business, reported average year-over-year dealer sales growth of +2.2%, rebounding from -0.7% in October. Despite the uptick, 41% of dealers said inventory levels remain too high—particularly in PWC and snow—and overall dealer outlook weakened month over month.

“Regardless of some of the vendor messaging, dealers are still struggling with two core issues: too much inventory, especially non-current, and the pressure to chase vendor bonus programs,” says Mark Sheffield of Woods Cycle Country and frequent PSB contributor. “Some dealers are giving away margin or selling units at a loss just to hit a bonus that barely moves the needle. That race-to-the-bottom pricing may help in the short term, but long term it damages brand equity for everyone.”

Brand performance

According to BMO Capital Markets, performance varied significantly by segment and brand:

- ORV: Kawasaki led the category with +13.3% y/y growth, followed by CFMOTO (+9.3%), Polaris (+6.7%) and BRP Can-Am (+5.0%). ATV growth remained soft overall.

- Motorcycles: Harley-Davidson outperformed expectations at +7.5% y/y, with Indian close behind at +5.0%.

- Snow: Polaris snowmobile dealers reported strong momentum (+8.8% y/y), while Ski-Doo declined (-5.0% y/y).

BMO noted that 59% of dealers reported sales growth in November, compared to 40% who saw declines. However, only 24% of dealers said their overall outlook improved during the month, while 41% said it worsened — down from October levels.

Vendor relationships

Sheffield said dealer commentary in the survey points to a growing need for retailers to rethink which OEMs and vendors truly function as long-term partners.

“Every conversation I have with dealers comes back to identifying who their real business partners are versus vendors,” Sheffield says. “Dealers need to focus on brands that can carry their own weight without forcing retailers into wholesale pricing and bonus-driven behavior.”

Bottom Line

While sales appear to be stabilizing, confidence across the dealer network is not. Inventory discipline, margin protection and smarter brand alignment remain top concerns as dealers head into 2026 with mixed consumer demand.

Dealers can access the full November BMO/Powersports Business Dealer Survey, including detailed open-ended dealer commentary, for a deeper look at the trends shaping the market.