Polaris reports Q2 up 14 percent for powersports segment

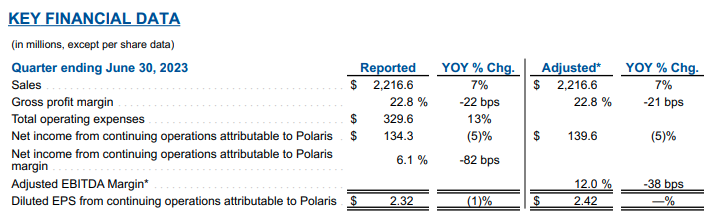

Polaris Inc. recently released its second quarter 2023 results, showing were up seven percent versus the second quarter of 2022 to $2.2 billion. North America sales of $1.8 billion represented 85 percent of total company sales and increased eight percent from 2022.

International sales of $333 million represented 15 percent of total company sales and increased six percent versus the second quarter of 2022. Total sales growth in the second quarter of 2023 was driven by higher shipment volumes, primarily driven by Off Road and Indian Motorcycle, as well as favorable net pricing.

Second-quarter net income from continuing operations attributable to Polaris of $134 million decreased by five percent compared to the second quarter of 2022. Adjusted net income from continuing operations for the quarter was $140 million, down five percent compared to the second quarter of 2022.

Gross profit margin decreased 22 basis points to 22.8 percent for the second quarter. An adjusted gross profit margin of 22.8 percent decreased by 21 basis points, primarily driven by higher finance interest and warranty costs, as well as foreign exchange headwinds, partially offset by favorable net pricing.

Operating expenses were $330 million in the second quarter of 2023 compared to $292 million in the second quarter of 2022 due to higher marketing, general and administrative expenses, as well as higher R&D expenses. Operating expenses, as a percentage of sales, of 14.9 percent were up 74 basis points in the second quarter of 2023 compared to the second quarter of 2022.

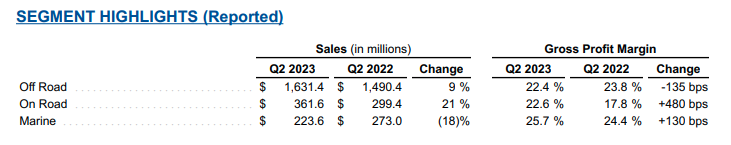

Off-road segment results were primarily driven by these factors:

- Sales were driven by higher volume partially offset by higher finance interest.

- Parts, Garments and Accessories (PG&A) sales increased 17 percent.

- Gross profit margin performance was driven by increased warranty costs and lower margin product mix.

- Polaris North America ORV unit retail sales were up 14 percent. Estimated North American industry ORV unit retail sales were up high-single digits percent.

On-road segment results were primarily driven by these factors:

- Sales were driven by higher volume partially offset by higher finance interest. PG&A sales decreased 12 percent.

- Gross profit margin performance was driven by favorable product mix, lower logistics costs, and higher volumes.

- North America unit retail sales for Indian Motorcycle were up over 40 percent. North America unit retail sales for the comparable motorcycle industry were up low-single digits percent. Marine segment results were primarily driven by these factors:

- Sales results were driven by softer demand and unfavorable product mix, partially offset by positive net pricing.

- Gross profit margin performance was largely driven by higher net pricing and prudent cost management, partially offset by higher promotional costs.

2023 Outlook

Polaris updated its 2023 sales outlook from three percent to six percent versus its previous outlook of flat to up five percent versus 2022.