Fox Factory reports second-quarter financial results

Fox Factory, a designer and manufacturer of shocks and other products for specialty sports and on- and off-road vehicles, released its second-quarter financial results on Aug. 8, with year-over-year net sales up 7.6%.

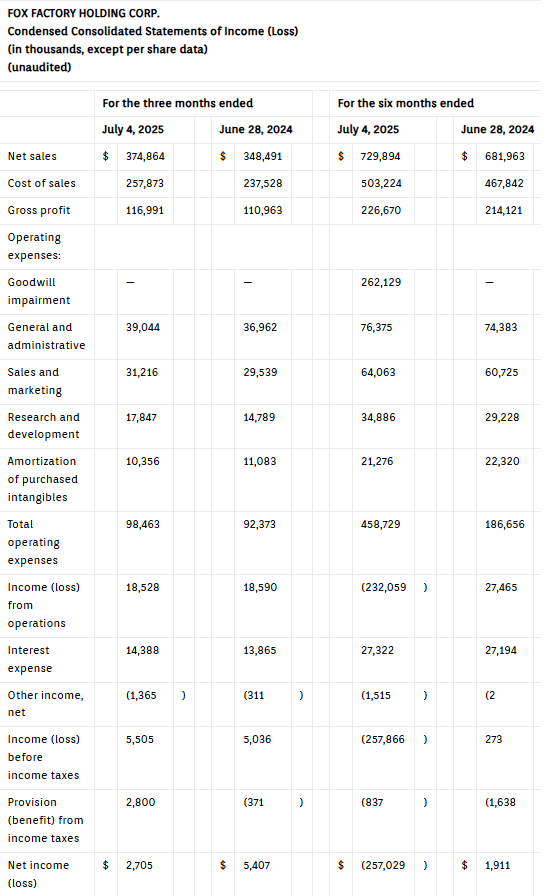

Although the company saw revenue increases compared to the same period last year, Fox Factory reported just $2.7 million in net income, down from $5.4 million it took in the second quarter of 2024.

“We delivered significant progress in the second quarter with $375 million in net sales, representing growth across all three segments, both sequentially and year-over-year,” says Mike Dennison, Fox’s CEO. ““We’ve built a strong foundation for enhanced profitability as we navigate an evolving tariff landscape. Our proactive cost reduction and working capital improvement initiatives are helping us manage through this period.

Q2 financial results

Net sales for Q2 were $374.9 million, an increase of 7.6%, compared to $348.5 million in Q2 last year. The company says the increase reflects an 11% increase in Specialty Sports Group sales, a 6.5% increase in Aftermarket Application Group sales, and a 4.9% increase in Powered Vehicles Group sales.

The increase in SSG sales is related to the stabilization in bike sales. The increase in AAG sales is driven by increased demand for aftermarket products, while high interest rates, high vehicle costs, and macroeconomic conditions continue to impact dealers and consumers. The increase in PVG net sales is primarily due to the expansion of the motorcycle business, which offset lower industry demand in the automotive original equipment product lines.

Total operating expenses were $98.5 million, or 26.3% of net sales, for Q2, compared to $92.4 million, or 26.5% of net sales in Q2 2024. Operating expenses increased by $6.1 million, driven by organizational restructuring initiatives, R&D, and sales and marketing to support future growth and product innovation.

Net income in Q2 was $2.7 million, compared to $5.4 million last year.

Q3 guidance

For the third quarter of fiscal 2025, the Fox Factory says it expects net sales in the range of $370 million to $390 million.

For the fiscal year 2025, in consideration of the company’s year-to-date performance and current visibility to tariff impacts, it says it expects net sales in the range of $1.45 billion to $1.51 billion.

While the impact of the tariff policies on demand remains uncertain, new and expanded tariffs are expected to continue to pose significant challenges for the industries that the Fox serves. For 2025, the company says its pre-mitigated tariff expense has increased from prior expectations of approximately $38 million to upwards of $50 million. However, Fox has identified countermeasures to partially offset these impacts and believes it can absorb this unmitigated component in its updated guidance for the full year 2025.