NPA shares new vs. used insights at the backside of the “peak”

National Powersport Auctions (NPA) says that average wholesale price (AWP) historically dips from the March-April peak. In “normal” years (2018, 2019), late spring pricing will come in 5-7% lower than in prior months. While early May AWP trends appear to be strong, dealers typically begin to downshift their buying habits as the selling season transitions into summer. As NPA has highlighted for over six months, contending with higher inventory levels will be the biggest challenge dealers and the industry face this year.

Used units purchased – product category

Continued promotional activity and rate subvention on new products will help move units in the short term. However, it could have a massive impact on used value trends and dealership profitability in the back half of the year.

According to Tony Altieri, vice president of business development at NPA, the first part of June showed pre-owned had strong holding power vs. the previous two months. “I didn’t have that on the bingo card,” he posted on LinkedIn.

But why is it holding up so well, considering the high levels of new inventory sitting in dealerships right now? Altieri says that it is because of these five things:

- Used has always provided “value” (perceived or real) to monthly payment-conscious customers. Retail Price points are lower, so the monthly payments (even with high rates) are more digestible to customers.

- Hefty incentives cause margin compression on new. While Used pricing is influenced by promotional activity on new, Dealers still have the ability to take in and buy used units at levels where the margin can be 2-3 times that of new.

- Harder to price shop against other units/dealers. Used units tell a unique story. Dealers can explain why their vehicle (lower miles, cleaner, previous owner was a little old lady who only road it to church Sunday) is priced where it is.

- Dealers control the used inventory on their floor. They can source products they know to sell in their markets and drive door swings. No stocking requirements no minimum volumes.

- Trade-ins are challenging right now. Many customers who purchased during COVID have negative equity (upside down) on their vehicles. Dealers (despite new unit volume) are finding it harder to source trade-ins and buy off the street, so the auction remains a great avenue to find the products they need.

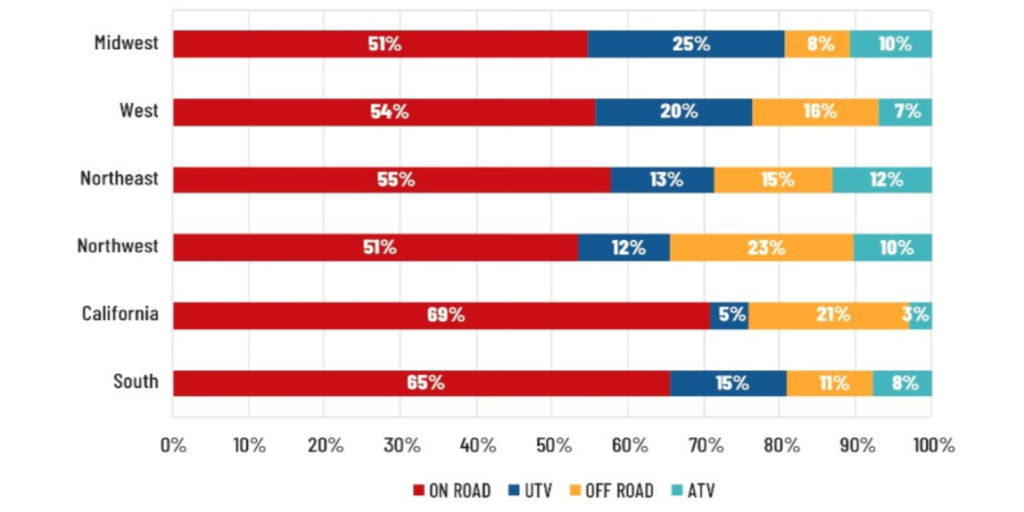

Percent of units sold by category and region

Will this trend continue throughout the month and into the summer? This may be a sign for dealers to look at what’s available at auctions rather than trying to source pre-owned units independently.