700Credit streamlines prequalification, credit application processes

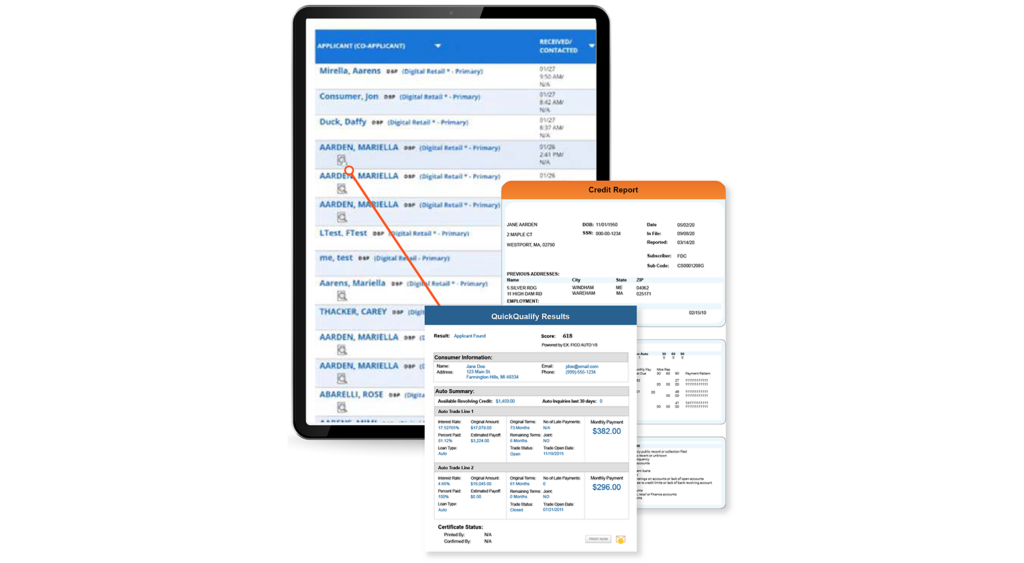

700Credit is partnered with MyApproval to streamline its prequalification and credit application processes. MyApproval automates a dealership’s finance processes, allowing F&I managers to focus on developing stronger consumer relationships. By using the platform, managers can get deals done faster, generating quicker revenue for time spent on each deal and offering higher gross profits.

Prequalification data dealers receive:

- Full Credit File

- FICO Score

- Summary of Auto Trade Lines including:

- Current Monthly Payments

- Current Auto Loan Interest Rates

- Remaining Balance/Payoff

- Months Remaining on Auto Loans

700Credit, in partnership with RouteOne, introduces an innovative approach for prequalifying consumers that eliminates the need for a consumer’s SSN or DOB, and without a negative impact on their credit score.

Integrated seamlessly into the RouteOne platform, 700Credit’s soft pull prequalification solution allows consumers to be prequalified at the top of the sales funnel. With the prequalification integration, when dealers receive their leads through RouteOne, they include the consumer’s complete credit report and FICO score. This insight equips the sales team with the information needed to discuss qualified payment options during their first call with the customer.

For each consumer that fills out the form, dealers receive Auto Summary results, a FICO Score and a full credit file. This integration with RouteOne provides the following benefits to both dealers and consumers:

- Dealers receive a full credit report including a live FICO Score to provide dealers with important data points to help close deals faster.

- Consumers receive more accurate payment quotes at the top of the sales funnel, without impacting their credit score.