Ducati tops PSI rankings for second year in a row

Test rides, information collection improve across the U.S.

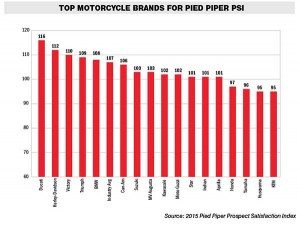

For the second consecutive year, Ducati dealers led the industry in the annual Pied Piper Prospect Satisfaction Index (PSI).

PSI measures how dealerships treat motorcycle shoppers in 50 different sales process categories. Though Ducati led the pack at 116 points, with a 4-point lead over second-place Harley-Davidson, the overall industry improved as well. The industry average increased 3 points to 107. Thirteen of the 17 brands studied increased their scores over 2014, while the four that saw decreases dropped by only 1 point each.

“It’s very encouraging,” Fran O’Hagan, president of Pied Piper Management Company LLC, told Powersports Business.

Overall industry improvement

Collectively, motorcycle dealers from across the U.S. contributed to a 107 average score, the highest the industry has achieved since Pied Piper began tracking motorcycle dealer PSI in 2007. But there are certain areas where the dealers especially stood out in the 2015 survey.

“There are specific examples of where the industry has improved dramatically, and I would say the headline, the most compelling change has been the increase of test rides,” O’Hagan reported.

PSI measures if salespeople offered an immediate test ride, or if they offered a future test ride. In 2011, salespeople offered immediate test rides 15 percent of the time and future test rides 19 percent of the time, meaning 34 percent of the time some sort of test ride was offered. However, as of 2015, test ride offers skyrocketed, with 35 percent of dealers offering an immediate test ride and 28 percent providing a future demo, for a total of 63 percent of the salespeople studied offering test rides.

“Almost two-thirds of the time some sort of test ride is mentioned. That’s brilliant!” O’Hagan said. “Who in the motorcycle industry would have believed me, if I told them in 2011 that test rides would double over the next five years?”

Test rides have been a source of controversy, O’Hagan says, as dealers try to balance the sales opportunity that comes with offering demos versus the risk of adding miles onto and possibly damaging new motorcycles. On top of that, dealerships that carry several brands can have a hard time prepping each model for test rides, and demo insurance can be hard to find or costly.

“What I definitely can tell you — and we’ve seen this over the years — the dealerships that figure out a way to make it happen outperform the dealerships that do not. Difficult or not difficult, it is worth it; there’s no question,” he said.

For dealers who don’t have models prepped for demos at all times, offering future rides is a viable and worthwhile option, O’Hagan reported.

“We have found that on average, when dealerships offer future test rides, and customers make the effort to come back for a specific test ride appointment, they go on to purchase from the dealership 8 times out of 10,” he said.

Securing contact information

Another area in which dealers bettered their score was collecting a shopper’s contact information. In the 2015 survey, Pied Piper found dealers collect contact information 57 percent of the time. In 2008, they only did so 38 percent of the time, and the number has been gradually growing since 2012.

“No dealership general manager or dealership principal is going to want to have customers walk out of the door at their dealership without having given contact information. But yet if nobody’s measuring whether it will happen, a lot of times it just doesn’t happen,” O’Hagan explained.

Harley-Davidson dealers led the pack in this category, collecting customer information 67 percent of the time. Ducati dealers did so 61 percent of the time, a 21-percentage-point improvement from 2013.

Though they didn’t meet the industry average, a couple of Japanese OEMs also increased their collecting contact information scores. Kawasaki grew to 48 percent from 34 percent in 2014, and Suzuki upped its score to 42 percent from 32 percent the prior year.

More salespeople in 2015 also suggested writing up a deal, with 41 percent attempting to write up a deal, an improvement from 33 percent three years previously. Leaders in this category were Triumph, Honda, Harley-Davidson, Suzuki and Aprilia, while Indian, Husqvarna, Can-Am, Yamaha and Star dealers were least likely to suggest writing up a deal.

Industry wide, the score for selling the dealership, not just the product, increased to 45 percent, which was an improvement from 41 percent three years ago. The brands at the top of this category include Ducati, Harley-Davidson, Indian, Star and Can-Am, while Honda, Yamaha, Suzuki, KTM, Moto Guzzi and Husqvarna dealers were least likely to sell their customers on their dealerships.

Room to increase scores

Though many scores were positive, O’Hagan points out that there are still a number of areas in which the industry can improve. For one, motorcycle dealers are seven times more likely to undersell their product than oversell it. The study also found 87 percent of shoppers were greeted with, “Can I help you?” upon arrival at the dealership.

“That doesn’t mean that they don’t build rapport also, but the problem with ‘Can I help you?’ as your first words is ‘I’m just looking’ comes after that, and then you have a hole to dig yourself out of,” O’Hagan said.

And even improving numbers could be better. For example, if only 41 percent of salespeople suggest writing up a deal, 59 percent don’t.

“Industry wide, ask for contact information is at 57 percent, and that’s substantial improvement, but that still means that half of the customers walk out the door, and the dealership has no idea who they are, which is terrible, if you look at it that way. So there’s plenty of room for improvement,” O’Hagan said. “And if you look at any of these measurements that we talk about, the same applies. Test rides — there’s some mention of test rides call it two-thirds of the time, but that still means for one in three customers, there’s no mention.”

PSI also measures how frequently salespeople push their customers toward a different brand than first requested. PSI mystery shoppers are sent in inquiring about a specific brand of motorcycle, so PSI tracks if those customers are persuaded to look at a competing brand. Harley-Davidson, Victory and Can-Am salespeople are loyal to their brands more than 97 percent of the time. However, one in four Kawasaki salespeople lead customers to another brand, and one in five Yamaha, Suzuki, MV Agusta, Indian, Husqvarna and Aprilia salespeople do the same.

“For Kawasaki, if you walk into dealership and say, ‘Hey, I’m interested in this Ninja 600,’ and the salesperson says, ‘You should really consider this CBR600 instead,’ that’s a real problem for Kawasaki because Kawasaki spends all this effort and money on advertising and building their brand, generating floor traffic, and then when they find the floor traffic, the dealers are sending the customers to buy something else,” O’Hagan said. “Maybe the dealership has solid reasons to be selling them something else, but that has to really irk Kawasaki.”

He added, “Kawasaki isn’t the only one; there are a couple brands that are nearly as bad. It kind of gets to what we found in the RV industry [in previous years], where just the very act of showing those Kawasaki dealers that this is what your salespeople are doing, there are going to be some instances where salespeople are behaving in a way that isn’t even good for the dealership, let alone the OEM, so it’s something that we find fascinating.”

Despite finding room for improvement in a number of categories, O’Hagan says improved scores overall show many dealerships’ sales processes are becoming more refined over the years.

“I wish I could say it was something magic about PSI, but really PSI just measures the dealership’s sales process, so really what it’s saying is dealerships that care about and focus on how the way their team sells outperform the dealerships that do not,” he said.

The PSI study found that the dealers that are ranked in the top quarter of the country according to PSI score sell 22 percent more motorcycles than those who are not.

Ducati dealers talk uniqueness

Ducati and Harley-Davidson have jockeyed for the first and second positions, with each brand taking one or the other, since 2012. For the second year in a row, Ducati bested Harley-Davidson, but the score reflected a lot of effort on the parts of Ducati and its dealers.

“You’ve got to give the OEM credit. They came up with this idea on their own. Their approach to their dealership’s sales process is to have their dealerships take responsibility for it,” O’Hagan said. “Ducati encourages the dealerships to use PSI, but Ducati doesn’t hold the dealers accountable to a particular score. There isn’t a certain benchmark that they’re trying to hit.”

Pied Piper has found over the years that the best strategy is to have dealers own their sales processes, rather than just copying what works for someone else.

“With Ducati the secret to their success is that they have managed to bring up their average score by improving the performance across the board, dealer by dealer,” O’Hagan said, adding that Ducati has been able to boost its overall score by not only bringing up the top performing dealerships, but by also focusing on the traditionally poor performers. The same has worked for Harley-Davidson as well.

Two categories in which Ducati leads all brands include discussing features unique from the competition and test rides. Ducati dealers talk to customers about unique vehicle features 77 percent of the time. As far as test rides of any kind, they’re offered 79 percent of the time.

Ducati also stands out when it comes to focusing a shopper on three to five memorable features and benefits, which O’Hagan says shows the salesperson is listening to the customer’s needs and highlighting those aspects that appeal most to his or her lifestyle.

Ducati salespeople are also less likely to undersell their bikes when compared to the rest of the industry.

Other notable brands

The brands that saw the most improvement in 2015 include Aprilia, which rose 10 points, and BMW and KTM, which grew their scores by 8 points each.

With its 8-point jump, BMW brought its score above the industry average for the first time since 2012. And like Ducati, BMW pushed for this improvement.

“If we go through question by question, that 8-point jump, most of the sales process areas, BMW improved,” O’Hagan said. “I know that BMW as a manufacturer was working on this last year. It’s not a fluke that the dealerships all of a sudden woke up and decided to do things differently. I know BMW was working with the dealers last year to improve sales processes.”

Like the industry overall, BMW increased its test ride scores, offering immediate test rides 37 percent of the time in 2015, compared to 22 percent in 2014. With immediate and future test rides combined, BMW offered demos 70 percent of the time in 2015, putting the brand in third place for that category, just behind Ducati and Harley-Davidson.

BMW dealers also built rapport with customers 43 percent of the time in 2015, which is above the industry average. In 2013 and ’14, BMW dealers were only building rapport about a quarter of the time.

“You know the saying ‘You only have one chance to make a first impression?’ That’s so true when it comes to a salesperson, and if you think about it, what you really are looking for is a salesperson who’s helpful,” O’Hagan said. “What we’ve found is that the most successful salespeople build rapport with the customer very quickly.”

Because of that rapport, BMW salespeople were also able to focus on three to five memorable features 82 percent of the time, an increase from about 70 percent in 2013 and 2014.

KTM also stood out for its 8-point increase. Though KTM is the brand at the bottom of the PSI list, its dealers achieved a score of 95, which is well above its 2008 score of 86.

“I think it is a positive sign,” O’Hagan said of KTM’s increase.

KTM salespeople were more likely to build rapport in 2015, doing so 45 percent of the time, compared to 23 percent in 2013. They also asked how the motorcycle was going to be used and by whom 70 percent of the time in the 2015 survey, growing from about half the time in 2013.

“If you add those two together — the build rapport and ask how the vehicle’s going to be used — those are behaviors that are used by salespeople who know how to sell,” O’Hagan said.

All about the sales process

Overall, with the scores increasing for most brands, and even those toward the bottom posting some improvement, O’Hagan is optimistic about the 2015 results and what they mean for the industry.

“If you think about what a general manager or dealer principal faces, if you think about all of the factors that they face day to day — they have to worry about their employees; they have to worry about their facility; they have to worry about their customers — so much of what they face every day is very difficult for them to control, if they can even control it,” he said. “You can argue that a lot of it is out of their control — how’s the economy, how much is financing available, the brands of motorcycles that they carry, how hot are the products, are the products drawing customers, how’s the floor traffic. All of those things, if they can control it in any way, it’s very difficult for them to control.

“If you contrast that with, as a general manager or a dealer principal, requiring that your salespeople follow certain steps in how they sell, that’s completely easy in comparison. And the good news is the effort, if they just bothered to care about how motorcycles are sold in this dealership, their effort is so worth it because it results in incremental sales.”