Q1 is shaping up nicely!

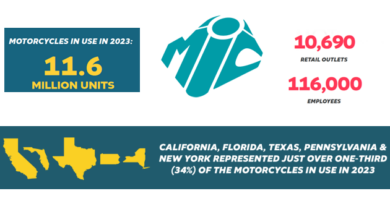

As we near the end of Q1, the powersports market is experiencing some encouraging positives. This is well-deserved good news after the past few years of only moderate growth, compared to the retail automotive sector. Pre-owned motorcycle inventories are growing, and lenders are investigating powersports financing options. While these signals point to a positive year, this is not the time to sit back and watch business walk through the door. In fact, only those powersports dealerships who strategically address this market will be successful. Let’s look at a few factors that will impact your success.

As we near the end of Q1, the powersports market is experiencing some encouraging positives. This is well-deserved good news after the past few years of only moderate growth, compared to the retail automotive sector. Pre-owned motorcycle inventories are growing, and lenders are investigating powersports financing options. While these signals point to a positive year, this is not the time to sit back and watch business walk through the door. In fact, only those powersports dealerships who strategically address this market will be successful. Let’s look at a few factors that will impact your success.

Pre-owned inventory up — plan accordingly

Post-recession, American consumers have found it difficult to set the necessary money aside to make a powersports purchase. This has led to an increase of pre-owned inventories and sales due to lower pricing, as well as increased pressure from manufacturers for dealers to sell new vehicles. We can expect manufacturers to increase subsidized financing incentives, especially in the second quarter.

Those large pre-owned inventories also give independent dealers ample opportunity to capitalize on the inventory influx and consumer demand. Today’s consumers are set in conservative financial decision-making, creating a strong market for used bikes. As such, we will see 2011 – 2013 model year bike sales volume increase significantly.

Recent research from EFG revealed that powersports consumers were interested in certified pre-owned (CPO) products — and that a CPO could sway the purchase decision. When asked, 95% of survey respondents said the availability of a CPO program would impact the dealer from which they purchased their motorcycle. In fact, 56% of survey respondents would drive over 30 miles. And, of those willing to drive over 30 miles, 33% would drive over 50 miles to buy a motorcycle that included a complimentary CPO package. Consider offering a CPO to capitalize on potential revenue from pre-owned inventory.

Keep tools sharp to achieve success

On the operational level, dealers are looking to bring their operations into the 21st century. Let’s all be honest, paper is still a majority mainstay in the industry’s back office. The powersports market is just beginning to integrate DMS systems within their operations. We can expect more powersports dealers to invest significantly in morphing the systems that worked so well for auto dealers for their business model.

Customer retention will also be a major area of focus for most powersports dealers. With fewer people looking to purchase, they need those who do purchase to become repeat customers and send referrals. Here again, powersports dealers starting this process will take a tried and true approach from auto by investing in their service department. The industry has largely not concentrated on the service drive as a customer retention tool. Going forward, this trend will be reversed and we will see more customer outreach stemming from the service drive.

Powersports dealers focusing on customer retention will also look into how incremental sales through service, gear purchases, and customizations can further that effort. Remember, the more a dealership can get a customer to rely on them for all their powersports needs, the more likely that customer will be to continue their relationship with the dealer and send referrals.

New lenders eyeing powersports opportunities

On the lending side, powersports lenders want to insulate their loans from the potential of default in a market highly dependent on disposable income. For this reason, lenders are more open to financing F&I products. However, as one lender stated at the first-annual Powersports Finance Conference, they are more likely to cherry-pick the products they finance. For example, they find products like a vehicle service contract (VSC) more beneficial in reducing risk because a VSC has the ability to allow customers to continue making their bike payments when a major mechanical failure occurs.

In addition, today’s powersports purchasers are more concerned with insulating themselves financially on larger purchases. This translates into increased consumer demand for quality F&I products. As dealers look to capitalize on F&I products, there will be an increased need for formal training around the sale of F&I products, and a disciplined approach to compliance.

2016 will be a time of significant change for the powersports industry. As the industry continues to deal with lackluster consumer demand, we’ll see dealers, manufacturers and lenders becoming more sophisticated in cultivating long-term consumer relationships through incentives, customer retention outreach efforts through the service drive, and providing F&I products that address consumer concerns. Make sure you are firing on all cylinders to have a great year.

Glenice Wilder is the vice president of Powersports for EFG Companies. A 33-year industry veteran, Glenice is responsible for growing and developing EFG’s action and powersports market channel. She combines her passion for motorcycles and her dedication to serving EFG’s customers to develop solutions that consistently exceed their expectations. Glenice acts as a strategic partner to assess her clients’ areas for improvement and how EFG can fill that role. She provides insight in how to increase productivity by pairing the right products within the right markets for the greatest return on investment.