Polaris reveals Q4 earnings

“We ended the year with positive fourth quarter retail momentum in both Off-Road Vehicles and Motorcycles, supporting strong full year, broad-based sales growth of 12 percent,” said Scott Wine, Chairman and Chief Executive Officer of Polaris Inc. “While TAP grew modestly in the fourth quarter, non-TAP Parts, Garments and Accessories (PG&A) and aftermarket sales stole the show, eclipsing $1 billion for the first time in 2019. Our recent leadership changes were made to spur both tactical and strategic growth, and the 37 percent increase in Indian Motorcycle sales in the fourth quarter, driven largely by the Indian Challenger, demonstrates what is possible as Mike Dougherty takes over that important segment. Steve Menneto is aggressively moving to accelerate retail performance in Off-Road Vehicles and Snowmobiles, building off a strong year of financial performance in our largest business. In 2019, we delivered strong operational performance across Polaris, especially productivity and delivery, and we expect further gains to create value for customers and shareholders in the year ahead. Our commitment to being a customer-centric highly profitable growth company is unwavering, and I am extremely confident in this Polaris team to deliver on that promise.”

Those were Wine’s comments as Polaris released its fourth quarter and full year 2019 results today.

Here’s a look at the highlights:

Fourth Quarter & Full Year 2019 Highlights

- Fourth quarter reported and adjusted sales increased 7% to $1.736 billion

- Fourth quarter reported net income was $1.58 per diluted share; adjusted net income for the same period was $1.83 per diluted share

- Full year reported and adjusted sales increased 12% to $6.783 billion

- Full year 2019 reported net income was $5.20 per diluted share; adjusted net income for the same period was $6.32 per diluted share, exceeding the high-end of previously issued guidance

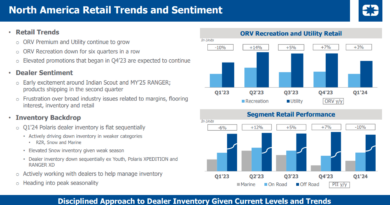

- North American retail sales increased 2% for the quarter compared to last year; ORV N.A. retail sales were up low-single digits percent, Indian motorcycles retail sales were up low-single digits percent

- Polaris announced full year 2020 sales and adjusted earnings guidance with full year sales growth in the range of 2% to 4% over the prior year and full year adjusted earnings in the range of $6.80 to $7.05 per diluted share.

And here’s the official scoop:

Polaris Inc. (NYSE: PII) (the “Company”) today released fourth quarter 2019 results with sales of $1.736 billion on a reported and adjusted basis, up seven percent from reported and adjusted sales of $1.627 billion for the fourth quarter of 2018.

The Company reported fourth quarter 2019 net income of $99 million, or 1.58 per diluted share, compared with net income of $91 million, or 1.47 per diluted share, for the 2018 fourth quarter. Adjusted net income for the quarter ended December 31, 2019 was $115 million, or $1.83 per diluted share compared to $113 million, or $1.83 per diluted share in the 2018 fourth quarter.

Gross profit increased eight percent to $423 million for the fourth quarter of 2019 from $391 million in the fourth quarter of 2018. Reported gross profit margin was 24.4 percent of sales for the fourth quarter of 2019, up 34 basis points compared to 24.0 percent of sales for the fourth quarter of 2018. Adjusted gross profit for the fourth quarter 2019 was $428 million, or 24.7 percent of adjusted sales compared to the fourth quarter of 2018 adjusted gross profit of $394 million, or 24.2 percent of adjusted sales. Adjusted gross profit margins were up 42 basis points during the quarter. Adjusted gross profit for the fourth quarter of 2019 excludes the negative impact of $5 million of restructuring and realignment costs, and adjusted gross profit for the fourth quarter of 2018 excludes the negative impact of $3 million of restructuring and realignment costs.

Operating expenses increased 13 percent for the fourth quarter of 2019 to $308 million, or 17.7 percent of sales, from $272 million, or 16.7 percent of sales, in the same period in 2018. Operating expenses in dollars and as a percent of sales increased primarily due to ongoing investment in research and development and strategic projects.

Income from financial services was $21 million for the fourth quarter of 2019, down 11 percent compared with $23 million for the fourth quarter of 2018. The decrease was driven by lower retail credit income.

Product Segment Highlights (Reported)

Off-Road Vehicles (“ORV”) and Snowmobiles segment sales, including PG&A, totaled $1,140 million for the fourth quarter of 2019, up seven percent over $1,060 million for the fourth quarter of 2018 driven by growth in side-by-side sales. PG&A sales for ORV and Snowmobiles combined increased seven percent in the fourth quarter of 2019 compared to the fourth quarter last year. Gross profit increased 12 percent to $315 million in the fourth quarter of 2019, compared to $282 million in the fourth quarter of 2018. Gross profit percentage increased 103 basis points during the 2019 fourth quarter due to favorable product mix.

ORV wholegood sales for the fourth quarter of 2019 increased 13 percent, primarily driven by positive mix. Polaris North American ORV retail sales were up low-single digits percent for the quarter with side-by-side vehicles up low-single digits percent and ATV vehicles up mid-single digits percent. The North American ORV industry was up mid-single digits percent compared to the fourth quarter last year.

Snowmobile wholegood sales in the fourth quarter of 2019 were down 10 percent compared to the fourth quarter last year. Snowmobile sales growth was pressured by a challenging comparable in the prior year period, due to the timing of pre-season SnowCheck order shipments.

Motorcycles segment sales, including PG&A, totaled $119 million, up 37 percent compared to the fourth quarter of 2018, led by strong sales of Indian Motorcycles. Slingshot reported a sales decline during the quarter. Gross profit for the fourth quarter of 2019 was negative $2 million compared to $2 million in the fourth quarter of 2018. The decrease in gross profit was primarily due to increased promotions and higher warranty costs.

North American consumer retail sales for Polaris Indian motorcycles increased low-single digits percent during the fourth quarter of 2019 in a weak mid to heavy-weight two-wheel motorcycle industry that was down high-single digits percent. North American consumer retail sales for Polaris’ motorcycle segment, including both Indian Motorcycles and Slingshot, decreased low-single digit percent during the fourth quarter of 2019, while the North American Motorcycle industry retail sales for mid to heavy-weight motorcycles including three-wheel vehicles, was down mid-single digits percent in the fourth quarter of 2019.

Global Adjacent Markets segment sales, including PG&A, decreased 1 percent to $120 million in the 2019 fourth quarter compared to $122 million in the 2018 fourth quarter primarily due to lower sales in the commercial, government and defense business. Gross profit increased six percent to $35 million or 29.1 percent of sales in the fourth quarter of 2019, compared to $33 million or 27.2 percent of sales in the fourth quarter of 2018, due to improved operational efficiency.

Aftermarket segment sales of $221 million in the 2019 fourth quarter increased 4 percent compared to $212 million in the 2018 fourth quarter. Transamerican Auto Parts (TAP) sales of $185 million in the fourth quarter of 2019 increased one percent compared to $183 million in the fourth quarter of 2018. The Company’s other aftermarket brands increased sales by 22 percent. Gross profit decreased to $49 million in the fourth quarter of 2019, compared to $52 million in the fourth quarter of 2018 due to higher tariff costs.

Boats segment sales decreased seven percent to $135 million in the 2019 fourth quarter compared to $145 million in the 2018 fourth quarter primarily due to negative product mix and planned dealer inventory reductions. Gross profit decreased one percent to $26 million or 19.0 percent of sales in the fourth quarter of 2019, compared to $26 million or 17.9 percent of sales in the fourth quarter of 2018.

Supplemental Data:

Parts, Garments, and Accessories (“PG&A”) sales increased seven percent for the 2019 fourth quarter driven primarily by growth in ORV, snowmobiles and global adjacent markets.

International sales to customers outside of North America, including PG&A, totaled $215 million for the fourth quarter of 2019, down 1 percent from the same period in 2018. The decrease was driven by negative currency rates.

Financial Position and Cash Flow

Net cash provided by operating activities was $655 million for the twelve months ended December 31, 2019, compared to $477 million for the same period in 2018. Total debt at December 31, 2019, including finance lease obligations and notes payable, was $1,694 million. The Company’s debt-to-total capital ratio was 60 percent at December 31, 2019 compared to 69 percent at December 31, 2018. Cash and cash equivalents were $157 million at December 31, 2019, down from $161 million at December 31, 2018.

2020 Business Outlook

The Company announced its sales and adjusted earnings guidance for the full year 2020. Sales are expected to increase in the range of 2 percent to 4 percent over 2019 adjusted sales of $6,783 million and adjusted net income is expected to be in the range of $6.80 to $7.05 per diluted share for the full year 2020 compared to adjusted net income of $6.32 per diluted share for 2019. While the negative impact of tariffs remains a significant headwind on an annualized basis, the year-over-year impact is expected to be minimal to the Company’s 2020 full year earnings guidance.