Ranger driving strong Polaris sales in Q1, analyst says

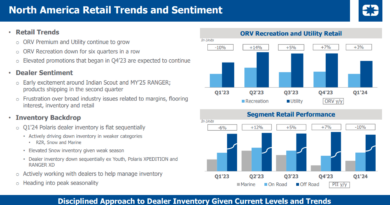

Polaris has experienced stronger-than-expected Q1 sales of off-road vehicles, in particular Ranger utility side-by-sides, according to BMO Capital Markets analyst Gerrick Johnson.

In a research note provided to Powersports Business, Johnson reports that BMO Capital Markets is raising its sales, margin and EPS estimates for Polaris for the first quarter of 2013.

“We believe the Street’s focus has been on the company’s rapidly growing RZR recreational side-by-side business, often overlooking the normally stable Ranger utility business,” Johnson writes.

“We are bullish on PII given its exposure to the hot recreational side-by-side (SxS) segment of the off-road vehicle industry (ORV), where PII is well positioned to capture sales from a rapidly growing market. We believe this trend still has a lot of room to run,” Johnson continues.

Difficult weather comparisons in Q1 — warm and dry in 2012; cold and wet in 2013 — have not hindered Ranger’s growth during the first three months of 2013, Johnson adds.

“We believe 1Q13 sales of Ranger utility vehicles are trending at close to 50 percent growth compared to 1Q12. The biggest boost appears to be coming from the two all-new utility models released last fall for model year 2013: the Ranger XP 900 and Ranger 800 mid-size, both the largest displacement vehicles in their classes,” Johnson reports.

BMO rates Polaris shares as “Outperform.”

Outtakes from Johnson’s report…

“We think there has been a growing investor concern about inevitable saturation of the recreational side-by-side market, with increasing competition, particularly on the very high-end, high-performance segment. We consider such concerns as overblown and premature, especially in light of recent strength in the Ranger utility segment, which represents about 40% of side-by-side sales and about 20% of total sales.”

“In the utility segment, we estimate that PII enjoys a 35% market share with fewer competitive pressures than the high-growth recreation segment. John Deere, and its legendary line of Gator utility vehicles, is the number two player, but we believe Deere’s utility sales are aided more by name recognition than actual product quality attributes. The remainder of the competition in the space, like Honda (Big Red), Kawasaki (Mule), and Arctic Cat (Prowler) have what we would consider more ‘commodity’ type utility vehicles.”