Report: Inflation lower than expected in March

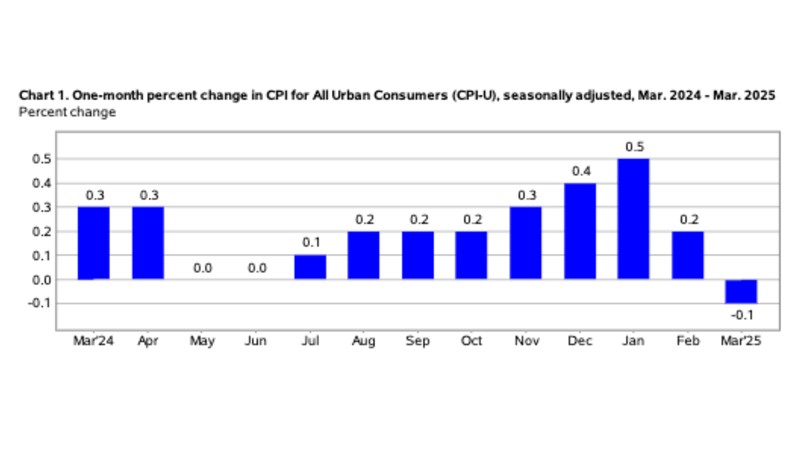

The Bureau of Labor Statistics reported that data on inflation came in lower than expected in March as President Donald Trump planned tariffs against U.S. trading partners.

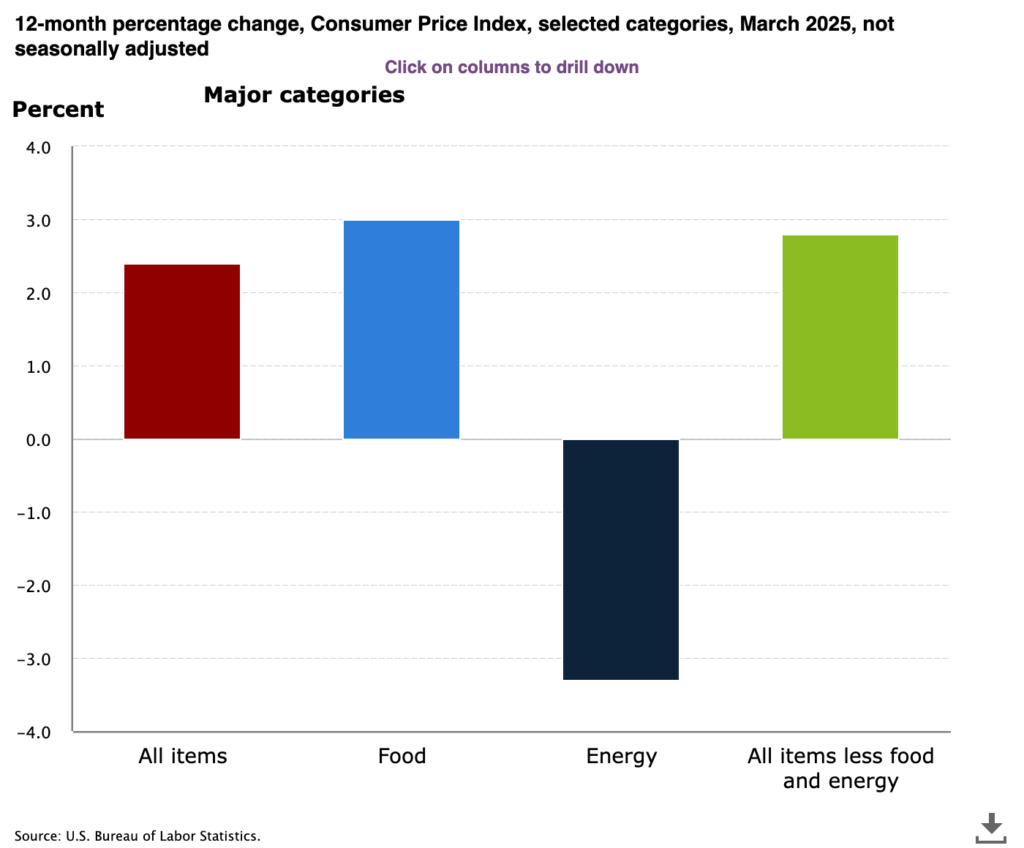

The consumer price index, which measures costs of goods and services across the U.S. economy, fell by a seasonally adjusted 0.1% in March, putting the 12-month inflation rate at 2.4%, a slight decline from the 2.8% recorded in February.

Core inflation ran at a 2.8% annual rate, with a slight uptick of 0.1% for the month. Core inflation excludes energy and food costs. According to CNBC, this was the lowest rate for core inflation since March 2021.

Energy prices helped to ease the inflation rate, as gas dropped 6.3%, leading to a more considerable decline in the energy index. Food prices climbed 0.4% on the month. Egg prices rose another 5.9% and were up 60.4% from a year ago.

New vehicle prices rose just 0.1%, while used vehicles dropped 0.7%, ahead of the tariffs expected to hit the auto (and motorcycle) industry hard. Airfares also fell 5.3% in March, with fewer travelers and lower demand.

The report came a day after the administration reversed parts of his tariff plan and delayed some duties against dozens of nations. However, the president held onto the announced 10% tariff on all imports, only pausing for 90 days to negotiate the higher tariffs.

The White House has called for the Federal Reserve to lower interest rates, but officials are reluctant to move with all the policy uncertainty. Reports point to the Fed waiting until June to lower rates any further.

While many economists believe that tariffs will cause inflation to jump, others are not so sure if the window of negotiation is open and the messaging is clearer.