Dealers report varied ATV sales in Q1

One dealer says rising UTV prices spur ATV growth

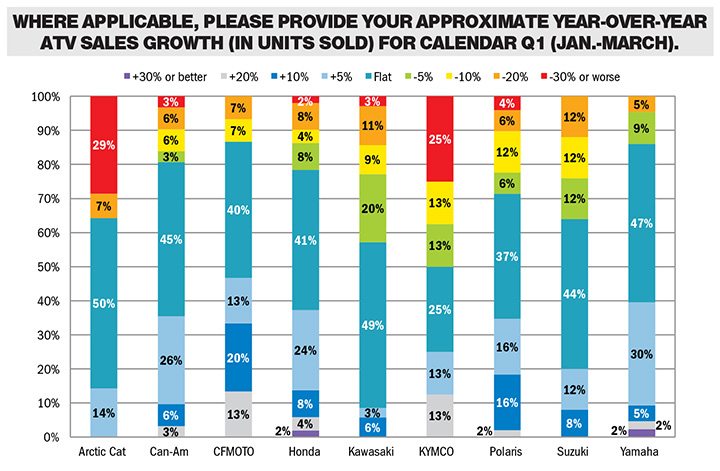

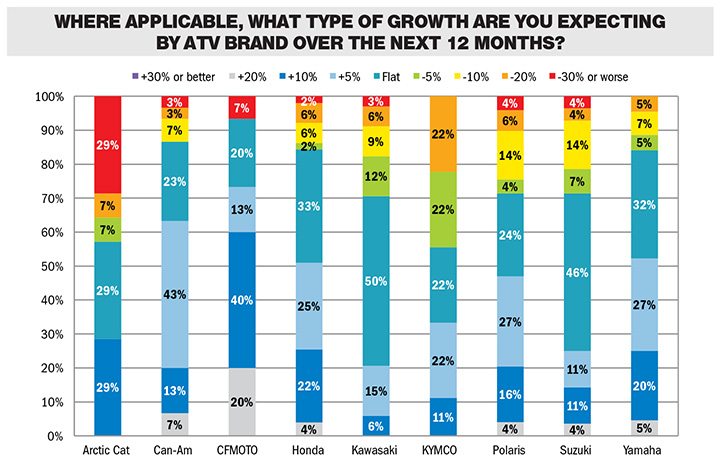

Year-over-year ATV sales for Q1 were flat for 27 percent of ATV dealers, while 36 percent of those surveyed saw an increase in sales. As far as future growth, 54 percent of dealers predicted a 5 percent or more sales increase over the next 12 months, and 28 percent expect to see flat sales.

Of the 120 dealers polled in the Powersports Business/RBC Capital Markets first quarter survey, 95 carry traditional ATVs in their dealerships. This is the second highest segment offered next to motorcycles at 84 percent and just above side-by-side units at 78 percent.

By brand, the majority of dealers for Arctic Cat, Can-Am, CFMOTO, Honda, Kawasaki, Polaris, Suzuki and Yamaha ATVs reported flat sales in Q1. Of KYMCO dealers, 51 percent saw a decrease in sales, with 25 percent reporting a decrease of 30 percent or more.

“Our ATV business is up probably 20 to 25 percent,” said Steve St. John, owner of Dreyer South Powersports in Whiteland, Ind. He added that the rising price of many UTVs has had a positive affect on his ATV business. “The price has jumped pretty dramatically on a lot of [side-by-sides], and I think that’s affecting my ATV business. People say, ‘I can buy two ATVs for the price of one of those.’

“Unfortunately for so many places the only thing they know is price drop. ‘Let’s drop price,’ instead of improving their efforts — dropping prices hurts everybody,” said St. John, who carries ATVs from CFMOTO and Honda. “In spite of economy, politics, all the stuff that people get sidetracked with, I firmly feel that there are too many dealers out there, either multi-line, single-line or independents, that need business education.”

Dreyer South Powersports saw an increase in overall buying interest in Q1, which may be a result of the dealership’s efforts to promote business in non-traditional forms. By supporting local racers and community events, St. John strives to introduce potential customers to units they may not have been exposed to.

“Whether its motorcycle or ATV racers, they will likely have either side-by-sides or ATVs as pit vehicles,” said St. John.

The dealership also sold an ATV to one of its local police agencies for animal control use. “We’re just trying some non-traditional outlets to find buyers for this stuff,” he added.

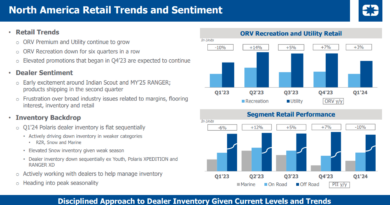

Inventory levels were a concern for ATV dealers in Q1, as some OEMs delivered product all at once instead of spreading out shipments. However, 64 percent of ATV dealers reported that their ATV inventory levels were about right, while 31 percent found them too heavy. In addition, 67 percent said OEM incentives and promotional activity were about the same as Q1 2015.

Steve Littlefield, owner of Central Texas Powersports in Georgetown, Texas, said that along with UTV business growth being relatively flat, ATV sales should also follow suit. “I would project that ATV and UTV business will be about the same as last year. There’s going to be a different model and make mix because there’s definitely more competition now.”

Central Texas Powersports carries ATVs from Can-Am, Honda, Kawasaki, Polaris, Suzuki and Yamaha.

Over the next 12 months, 43 percent of Can-Am dealers expect 5 percent sales growth, along with 27 percent of Yamaha and Polaris dealers. Honda, Kawasaki, Suzuki and Yamaha dealers all expect ATV sales to remain flat over the next 12 months.