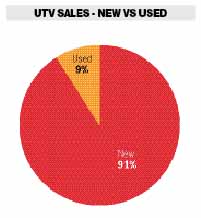

1 in 10 utility UTVs sold is pre-owned

CDK Global Recreation study shows 9 new units sold for every 1 used

Exclusive data provided to Powersports Business from CDK Global Recreation shows that utility side-by-side dealers who want to make sales should have a healthy stock of new product on their showroom floors and/or out back in storage.

The study, conducted by CDK Global staffers Aaron Carver, Jim Bradley, Ian Reese, Eric Johnson and Hal Ethington, shows that 91 percent of multi-purpose and work UTVs sold at dealerships in 2014 were new units.

The transactions were part of 124,952 new and pre-owned work and multi-purpose UTVs sold at 1,156 dealerships.

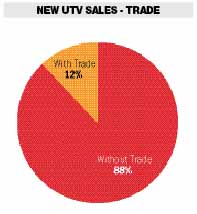

Only 9 percent of sales of multi-purpose and work UTVs were pre-owned. Further, 88 percent of UTV deals did not involve a trade-in of any kind. At least one trade-in was received on 12 percent of deals where a multi-purpose or work unit was sold.

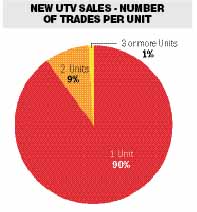

When a trade was present in a deal, 90 percent of the time there was only one trade unit involved. Nine percent of deals received two units in trade, and 1 percent of deals show three traded units. One transaction had 11 traded units, but only 0.3 percent of multi-purpose or work UTV deals involved more than three traded units.

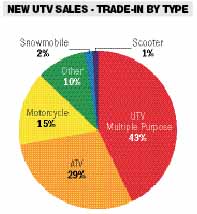

Units traded in on UTV purchases came from several different sources. The largest contribution came from within the UTV community (43 percent of trades) showing strong internal growth of the UTV market.

The second largest source of trades was ATV owners. Twenty-nine percent of trades came from this group, which shows a substantial shift from ATV to UTV. The reverse, movement from UTV to ATV, was beyond the scope of this study, and will be addressed at a later date by the CDK Global Recreation staffers.

The second largest source of trades was ATV owners. Twenty-nine percent of trades came from this group, which shows a substantial shift from ATV to UTV. The reverse, movement from UTV to ATV, was beyond the scope of this study, and will be addressed at a later date by the CDK Global Recreation staffers.

Motorcycles were used as trades in 15 percent of all trades received on UTV sales. While not as large a presence as ATV owners, this pattern does indicate that outdoor riding is transferable from two wheels to four and should not be ignored.

The final group of trades, 12.5 percent, came from automobiles, trucks, trailers, precious metals, livestock (yes), snowmobiles and scooters.

Again, each of these trade types indicate in interest in the UTV market that is much more widespread than has been seen in the motorcycle market over the past years.

I would like to see figures showing what percentage of the ATV and UTV market each of the major manufacturers have. One power sports distributor told me that their research indicated that Polaris had 78% of that market.