Oct. 17, 2005 – Finance Digest

Ducati first half sales slip 14.6%

Ducati Motor Holding S.p.A. reported a loss of Euro 3.5 million ($4.24 million) for the first six months of 2005, down from a profit of Euro 2.6 million during the first half of 2004, as sales slipped 14.6% to Euro 188.1 million from the same period last year.

Revenues from motorcycles for the period decreased 15.7% to Euro 147.4 million and accounted for 78.4% of revenues. Motorcycle-related products, including spare parts, accessories and apparel, were down by 7.7% to Euro 39.0 million over the comparable period in the previous year.

Gross margin for the first half of 2005 amounted to Euro 45.9 million or 24.4% of revenues versus Euro 59.4 million or 26.9% in the first half of last year. Ducati said the drop in margin came from a reduction in motorcycle volumes, a negative mix and adverse forex effects, only partially offset by product cost reductions.

Ducati said operating profit, at 2.4% of sales, was Euro 4.6 million, down 62.3% from Euro 12.1 million.

First half unofficial Ducati registrations were down 6.7% from the same period last year, although registrations in the U.S. were up by 18%. Registrations were down in Italy (-10%), Japan (-14%), Germany (-18%), Benelux (-25%), and the UK (-25%).

“While the first semester 2005 results seem negative in absolute terms, they are only slightly below our expectations which forecast a 2005 back-loaded to the last quarter, because of the shipping of approximately 4,000 pre-sold SportClassic bikes,” Federico Minoli, Ducati Chairman and Chief Executive Officer, said in a prepared statement.

“A prevision for 2005 will largely depend on our ability to deliver and invoice as many of the pre-sold SportClassic bikes as possible,” said Enrico D’Onofrio, Ducati Chief Financial Officer. “At the moment, we foresee is a pre-tax loss of around Euro 2 million and a net financial position in line with last year. An accurate forecast will be possible, once we announce our third quarter results, in mid-November, when the SportClassic deliveries will have been entirely planned.”

Ducati’s first half 2005 financial results were prepared for the first time under International Financial Reporting Standards (IFRS). The company has completed its process of transitioning from Italian accounting principles to IFRS.

The effect of this process is an increase of Euro 3.0 million in opening shareholders’ equity at January 1, 2004 (the transition date to IFRS) compared to that of the consolidated financial statements prepared in accordance with Italian accounting principles.

Shareholders’ equity at December 31, 2004, in accordance with IFRS, is Euro 7.9 million higher, and consolidated net result for 2004 is higher by Euro 4.3 million.

Furthermore, it resulted in the reduction of Euro 3.2 million in shareholders’ equity as of January 1, 2005, with regard to the accounting treatment of treasury stock, recognized as a reduction of reserves under IFRS.

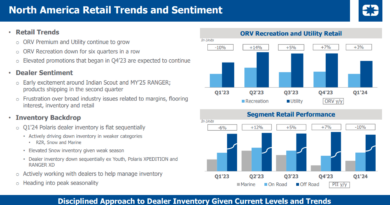

Honda Sales Down in North America

California-based American Honda Motor Co. sold 85,000 units in North America during the first quarter ended June 30, 2005, down from 126,000 units during the same period in 2004. First quarter motorcycle revenue from North America was approximately ¥51.1 billion ($447.5 million).

Japan’s Honda Motor Co., Ltd. said consolidated net income for the fiscal first quarter totaled ¥110.6 billion (approximately $1.0 billion), a decrease of 3.1% from the first three months of fiscal 2004. Basic net income per common share for the quarter amounted to ¥119.75 ($1.08), compared to ¥121.65. Two of Honda’s American Depositary Shares represent one common share.

Consolidated net sales and other operating revenue for the quarter amounted to ¥2,264.5 billion ($20.47 billion), an increase of 9.2% over the corresponding period. Revenue was negatively affected by the translation of foreign currency denominated revenue from Honda’s overseas subsidiaries into yen. Honda estimates that if the exchange rate of yen had remained unchanged from that in the corresponding period, revenue for the quarter would have increased approximately 9.5%.

Consolidated operating income for the fiscal first quarter totaled ¥170.3 billion ($1.54 billion), an increase of 6.5% compared to the corresponding period. Consolidated income before income taxes for the quarter totaled ¥144.3 billion ($1.31 billion), a decrease of 17.1% from the corresponding period.

With respect to Honda’s sales in the fiscal first quarter by business category, motorcycle unit sales, including ATVs, totaled 2.581 million units, which was approximately the same level as the corresponding period in 2004. Overseas unit sales totaled 2.486 million units, almost the same level as the corresponding period of last year.

Revenue from sales to unaffiliated customers decreased 4.0%, to ¥263.1 billion ($2.38 billion), offsetting the positive currency translation impacts of the appreciation of the Canadian dollar and the Euro, the company said.

Operating income decreased 40.0%, to ¥10.3 billion ($93 million), due mainly to decreased profit from lower revenue and increased R&D expenses, which offset the positive impacts of the appreciation of the Canadian dollar and the Euro, and ongoing cost reduction effects.

Honda’s investment in North American production, R&D and marketing operations in all categories will total more than $8.5 billion by the end of the year.

KTM Sales Up 12% in 2005

Supported by further expansion into the on-road motorcycle market, Austria’s KTM Sportmotorcycle sold 80,356 units worldwide in its latest fiscal year ended August 31, up from 76,815 units retailed in fiscal 2004. Group sales revenue for the year was EUR 452 million, up 12% from revenues of Euro 402.3 million during the previous fiscal year.

KTM North America President Jon-Erik Burleson said a number of factors combined to make fiscal 2005 a banner year for the manufacturer’s U.S. subsidiary. Among the major accomplishments, he said, were bringing fill rates to around 90.9%, bringing parts and accessories orders up 25% compared to the prior year, dropping order turnaround time to an average of one business day, reducing the dollar volume of backorders by 32.5%, reducing dealer stock in non-current SX models by 34%, and improving warranty credit turnaround time from more than 90 days to less than two weeks.

KTM sold 70,514 units worldwide in 2003; 61,723 units in 2002; and 45,648 units in 2001. The company’s top four nations in terms of sales are the United States, Germany, France and Australia.

Fairchild Appoints New CFO

The Fairchild Corporation, owner of California-based Fairchild Sports, has appointed James G. Fox as Chief Financial Officer and Senior Vice President, Finance, effective October 1, 2005. Fox replaces John Flynn, who resigned as Chief Financial Officer effective October 1, but remains with the company as a Senior Vice President, Tax.

Fox joined the company as Senior Vice President, Finance, on August 22, 2005. Before assuming his position at Fairchild, Fox was employed as Vice President, Finance, of the Energy Management Division of Invensys PLC, a London-based group of five controls and power companies.