May 12, 2003 – Gross Margin: Yours to keep, or yours to lose

The words leaped off the page and hung in the air before my eyes, “…declining gross margin retention.” Chapter 5, page 9 of the Honda MAPS student guide for parts management hit it on the head. In brief, they said, you can sell yourself silly, but if you don’t maintain your margin, you’re just treading water.

So how have we done? With over 40 million point-of-sale records at my disposal, I thought I would explore that question, and see what popped up. The results tell a lot about us as an industry, and even more about the strengths and weaknesses of individual dealers.

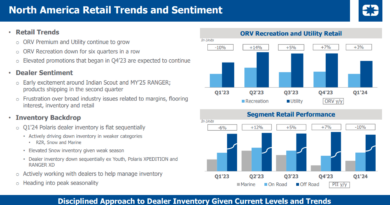

I divided the country up into three sections (California and the Northwest, the West and Midwest, and the Northeast and South), focused on 1998 through 2002, and then, just for fun, threw in January and February of 2003.

This added up to over $783 million dollars in parts and accessory sales, from all parts of the country, in just under 200 dealerships. This sample proved exceptionally stable as queries pulled out fact after fact. Overall, the data was amazingly consistent, and is summarized in the chart that appears on the previous page.

The averages came first, and we see that in 1998 all three sections of the country were grouped tightly around the 40% mark for parts and accessory gross margin. But, in the past five years, everybody except the folks on the West Coast have steadily risen to 42.6%, while West Coast dealers have declined to 37.5% — a spread of over 5%, or about 1% per year loss of margin.

Let’s see what this means in dollars and cents. In 1998 let’s say that two typical dealers, one in the West and one in the East, each sold $1.5 million in parts and accessories. They both made about the same amount.

But, in 2003, same sales in each store, our guy in the East, at 42.6% makes $639,000 in margin, while the West Coast fellow, at 37.5% makes $562,000. A difference of $76,500! Worth worrying about? Well, it sure helps pay the rent.

But the story doesn’t stop there. Look at the red line across the top. These are the top performing gross margin dealers from the whole country for each year.

Average is just average, you are as close to the top as you are to the bottom, but these guys are flying high. How do you get a 64% margin anyway? You can bet that they are working both ends, top and bottom. No, it’s not just how you buy, it is both how you buy and how you sell. Now we see what is possible.

And then there is that other group, the one on the bottom. Here you see the low man on the totem pole in each of our five. Are we running a charitable organization here? Or are we in business to pay our employees and hopefully make a buck for ourselves? Go figure.

Mark VanZeeland of Oshkosh, Wisc., said it best. When asked how he raised his major unit gross margin from 9% to 14% in just one year, he said, “I just asked for it!” By the way, our low man at 28.2% gross margin makes just $423,000 on that same $1.5 million in sales we talked about above. He is still wondering how those other guys made $216,000 more than he did!

West Coast dealers have a problem to solve. And to the rest of you who are enjoying your 42.6% margin… Watch it! It can disappear faster than you can say the word “discount.”

Gross Margin Retention. Put those words on the wall, and read them often.