Big 3 distributors generate big aftermarket sales

By Liz Hochstedler and Dave McMahon

ADP Lightspeed study shows $363 million in total annual sales for Parts, Tucker, WPS

Three aftermarket distributors — Parts Unlimited/Drag Specialties, Tucker Rocky/Biker’s Choice and Western Power Sports — accounted for more than $363 million in aftermarket sales in just over 1,600 dealerships from August 2011 to July2012.

An aftermarket accessory vendor study provided to Powersports Business by ADP Lightspeed shows that the sales of accessories from these vendors varies by region and from metric to V-twin dealerships. It also presents data showing that other distributors, such as RK Stratman Inc., VF Imagewear, Fox Racing and Helmet House are also big players in the industry.

Check out the dollar value of aftermarket sales performed by ADP Lightspeed dealers in the regions below by going to powerportsbusiness.com.

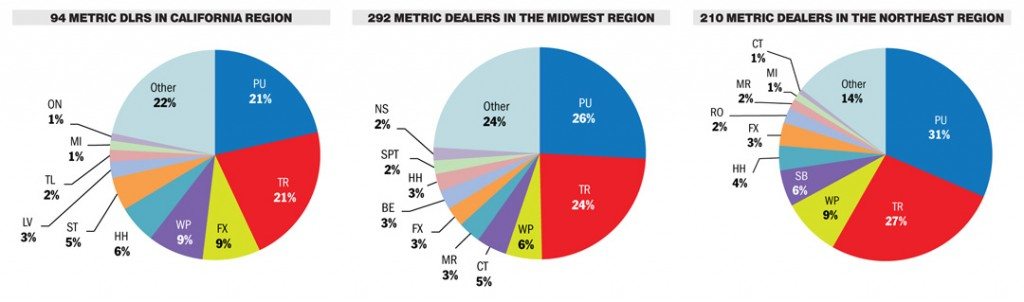

California metric dealers

The study, conducted from sales data, shows that among $142.3 million in sales during that time period for California metric dealers alone, Tucker Rocky and Parts Unlimited products had nearly equal consumer consumption. Both distributors secured 21 percent of sales by aftermarket vendors, with $15.3 million in sales by 94 metric dealers in the state.

Fox Racing and Western Power Sports — with 9 percent of the aftermarket accessory sales for the time frame — followed with $6.3 million in sales apiece. Helmet House claimed 6 percent of the metric aftermarket accessories business in the time period in California, with $4.2 million in sales. Southern Motorcycle Supply (5 percent, $3.6 million), Lynn Vick (3 percent, $1.8 million) and Troy Lee Designs (2 percent, $1.3 million) followed. Mid USA Motorcycle Parts and O’Neal claimed 1 percent, or just shy of $1 million each.

Midwest metric dealers

In the Midwest region, 292 metric dealers helped Parts Unlimited take the aftermarket accessories sales lead with 26 percent of aftermarket accessories sold, or $30 million in sales. Distributors claimed $116.1 million in sales from Midwest metric dealers during the Aug. 2011-July 2012 period.

Tucker Rocky followed with 24 percent of the accessories sold by metric dealers in the Midwest, or $27.7 million.

Western Power Sports again claimed the No. 3 spot, with 6 percent of the market, or $6.4 million in sales. Castle Sales Co. Inc. had 5 percent, or $5.4 million. Marshall Distributing ($4.0 million), Fox Racing ($3.5 million), Bell Industries ($3.4 million) and Helmet House ($3.1 million) all secured 3-4 percent of the aftermarket sales among Midwest metric dealers.

Spot Motorcycle Gear ($2.4 million) and Northern Wholesale ($2.3 million) rounded out the top 10 with about 2 percent.

Northeast metric dealers

Among 210 Northeast metric dealers, Parts Unlimited claimed 31 percent of the aftermarket accessories sales market, or $26.1 million in sales. Tucker Rocky followed with 27 percent, or $22.2 million in sales. Western Power Sports was again a solid third, with 9 percent of the share, or $7.3 million.

Sullivan’s grabbed 6 percent of the share, or $4.6 million, with Helmet House (4 percent, $3.1 million), Fox Racing (3 percent, $2.9 million), Romaha (2 percent, $1.9 million), Marshall Distributing (2 percent, $1.3 million), Mid USA Motorcycle Parts (1 percent, $900,000) and Castle Sales Co. (1 percent, $600,000) making up the remainder of the top 10 in aftermarket sales among Northeast metric dealers.

Total aftermarket sales in the region were $83 million.

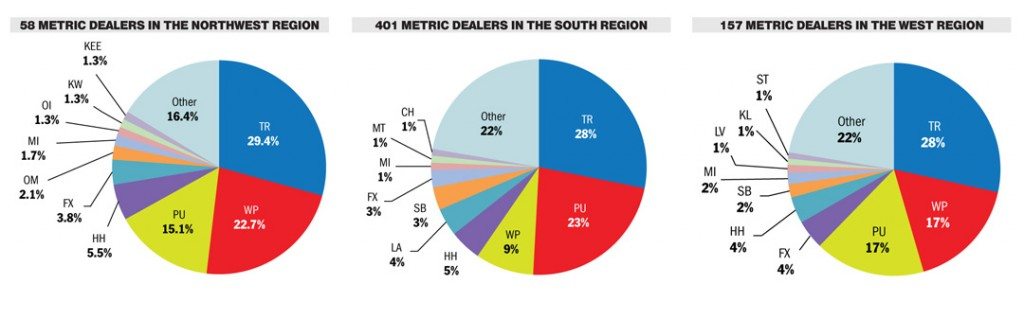

Northwest metric dealers

Among 58 Northwest metric dealers, Tucker Rocky claimed 29.4 percent, or $7 million, in aftermarket accessory sales, ahead of the 22.7 percent ($5.4 million) claimed by Western Power Sports. Parts Unlimited had 15.1 percent of the aftermarket share, or $3.6 million, among Northeast metrics. Helmet House was the only other company with more than $1 million in sales among the Northwest metric dealers, with 5.5 percent of the share, or $1.3 million.

Fox Racing (3.8 percent, $900,000), OMC (2.1 percent, $500,000) and Mid USA (1.7 percent, $400,000) checked in ahead of One Industries, Klim Aggressive Sled Ware and Keene Engineering, all of which had 1.3 percent, or $300,000.

Total aftermarket sales in the region were $23.8 million.

South metric dealers

Metric dealers in the South accounted for the highest number of accessory sales, reaching $170.1 million for the 12-month time period studied. Tucker Rocky took the lead in this region, with $47.9 million, or 28 percent of the sales. Parts Unlimited also had a strong showing, with $38.6 million, or 23 percent of sales.

WPS followed in a distant third with $14.9 million, or 9 percent of the sales. Helmet House ($8.1 million), MTA ($7.1 million), Sullivans ($5.8 million) and Fox Racing ($4.4 million) each eked out 3-5 percent of the southern market.

West metric dealers

As in the South, Tucker Rocky also mapped out 28 percent of accessory sales for metric dealers in the West, with $21.2 million. WPS and Parts Unlimited tied for second, each with over $12 million in sales, for 17 percent each.

Fox Racing ($3.3 million) and Helmet House ($3.0 million) each grabbed 4 percent of the western metric accessory sales, and Sullivans ($1.5 million) and Mid USA ($1.3 million) nabbed 2 percent each.

California V-twin dealers

V-twin dealers carved out a different pattern than their metric peers, relying less on the top three distributors and more on other vendors. In California, Parts Unlimited still took the top spot, with $3.0 million in sales, or 18 percent of the market, but RK Stratman Inc., a manufacturer of customized screen print products, followed closely behind with $1.7 million, or 10 percent.

Tucker Rocky accounted for 9 percent of sales with $1.5 million, and $1.3 million of VF Imagewear accessories were sold, for 8 percent of California V-twin dealer sales. Rotary was fifth in line with $1.0 million in sales, or 6 percent, and Drag Specialties accounted for $627,000, or 4 percent.

Midwest V-twin dealers

RK Stratman can boast the top spot for V-twin dealers in the Midwest, with $9.2 million, or 19 percent, in accessory sales. Parts Unlimited is next in line with $7.1 million, or 15 percent.

With 10 percent of the sales, or $4.6 million, VF Imagewear also brought in significant dollars, while Drag Specialties followed close behind with $4.1 million, or 8 percent. Tucker Rocky held 5 percent of the region, with $2.2 million. Kuyakyn and Global Products Intl, each with $1.2 million, grabbed 3 percent each.

Northeast V-twin dealers

For V-twin dealers in the Northeast, Parts Unlimited holds a third of the market with $3.1 million. RK Stratman grabbed a distant second at 15 percent, or $1.4 million.

VF Imagewear ($841,000) and Drag Specialties (almost $809,000) each has 8 percent of the region. Tucker Rocky grabbed 5 percent with $548,000, and Kuryakyn had $185,000 in sales for 3 percent.

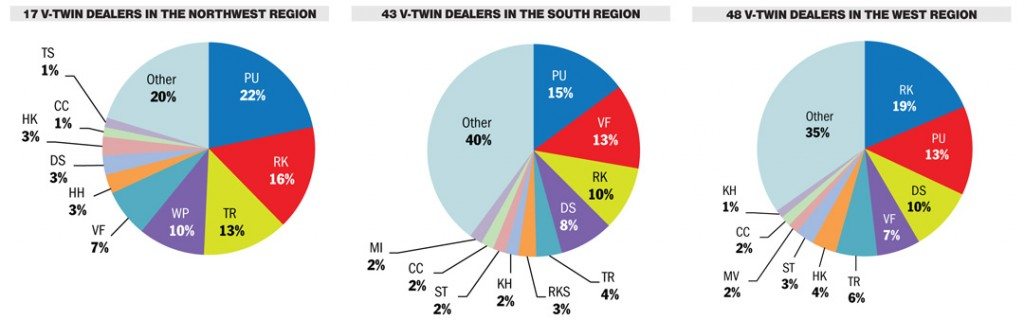

Northwest V-twin dealers

Just like in Claifornia and the Northeast, V-twin dealers in the Northwest sold the most Parts Unlimited accessories, followed by RK Stratman Products. Parts Unlimited accounted for 22 percent of sales, with $1.5 million, and RK Stratman took 16 percent with $1.1 million.

Tucker Rocky ranked third with 13 percent of the market, or about $858,000, and WPS has 10 percent, with about $700,000. About $508,000 of VF Imagwear products were sold, for 7 percent. And Helmet House ($244,000), Drag Specialties (almost $234,000) and VF Imagewear Print (nearly $174,000) each grabbed 3 percent of the pie.

South V-twin dealers

Dealers in the South sold the most accessories, with $25 million, when compared to their V-twin counterparts. Parts Unlimited led the charge with 15 percent of that total, or $3.8 million.

VF Imagewear was closely behind with 11 percent or $2.8 million, and RK Stratman was just below that at 10 percent, or $2.5 million. Drag Specialties accounted for 8 percent or $2.1 million, and Tucker Rocky brought in $1.0 million or 4 percent.

West V-twin dealers

In the West, RK Stratman again took the top spot for V-twin dealers, with 19 percent of the region for almost $6 million in sales. Parts Unlimited was next with 13 percent or $4.3 million, and its Drag Specialties counterpart has 10 percent or $3.1 million.

At 7 percent is VF Imagewear with $2.1 million, and Tucker Rocky is close behind at 6 percent with nearly $2 million. VF Imagewear Print took the sixth spot, with 4 percent or $1.2 million.

Good to see the powersports industry is growing! I see more and more people riding ATVs, and Motorcycles than ever before.