Carryover inventory an issue for sled dealers

Q1 dealer survey shows plenty of leftover sleds

While winter snowfall — and the lack thereof — led to varying degrees of snowmobile sales success at dealerships over the winter, there’s one thing customers can count on as the spring season hits: There are plenty of new-model sleds still for sales at those dealerships.

A total of 52 snowmobile dealers responded to the recent Q1 2017 Powersports Business/BMO Capital Markets Dealer Survey, with heavy participation from dealers in Minnesota, Wisconsin and Ontario.

Overall, they trended alongside the overall dealer body, with 54 percent of snowmobile dealers reporting that they were either above or on their business plan for the quarter. About 12 percent of snowmobile dealers were above plan, compared to 14 percent of all dealers.

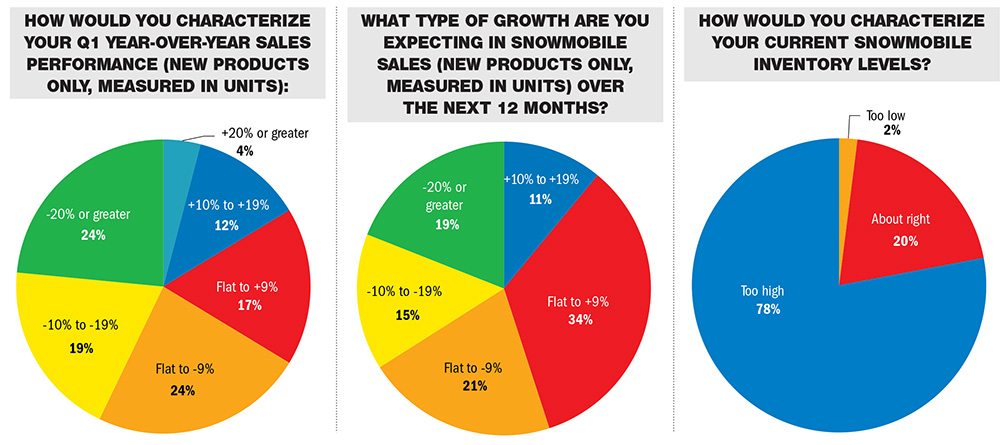

Inventory remains an issue for snowmobile dealers. A total of 78 percent of them reported that inventory is “too high” with 20 percent saying it’s “about right” and 2 percent replying “too low.”

As one dealer reported: “Carryover is greater than I’ve had in [decades]. There is very little, if any, interest in pre-orders.”

But there’s always the other side of the coin, adds another dealer: “We are in a better position than last year. 2018 model interest seems lower than 2017 mostly due to a lack of new product launch. Still very confident on 2018 sled sales though.”

As for sales performance, measured in sales of new sleds, in general it was a dismal quarter for snowmobile sales. About 66 percent of the snowmobile dealers survey described their sales as “flat to minus 20 percent or greater,” compared to the 34 percent who said their unit sales were “flat to plus 20 percent or greater.”

Even so, the outlook remains bright for many dealers. When asked what type of growth they were expecting for the snowmobile segment in the next year, snowmobile dealers report at a rate of 45 percent that they expect to see “flat to plus 10-19 percent” growth. The other 55 percent, however, expect sales in the next year to decrease by “flat to minus 20 percent or greater.”

Finally, we asked snowmobile dealers to describe consumer interest in the 2018 model pre-order sales events, many of which expired in April.

Here are some select replies:

• “Stinks.”

• “Very little interest.”

• “Interest is low.”

• “Strong interest.”

• “Very slow. 850 still has the most interest.”

• “Very little interest.”

• “Interest is low in most sleds, up in mountain segment.”

• “There isn’t any.”

• “About the worst I have seen.”

• “Very good interest.”

• “Arctic Cat released a new snowmobile with the new C-TEC engine. Our interest is very high. We will have a better year because of this release.”

• “Zero interest.”

• “Very little interest.”

• “Good interest after a horrible winter.”

• “Extremely low.”

• “Very poor interest level overall except for a slight uptick in Sidewinder.”

• “We have no [pre-order] units at all yet. This time last year we had 10.”

And when it comes to carryover inventory, there’s plenty to go around:

• “About 40 percent per brand.”

• “Polaris and Ski-Doo normal carryover.”

• “Tons of carryover.”

• “30 2017s.”

• “16 2017s.”

• “I have enough 2016 and 2017 inventory to last equal to 1.5 years worth of sales.”

• “Less than usual.”

• “Very high carryover.”

• “Way too much 2017 inventory.”

• “Too many carryover sleds.”

• “Inventory level is OK. OEs asked for big orders for 2018. Not reasonable.”

• “At current sales rates I have a 2-year supply of carryover snowmobiles.”

One definition of commodity: a good or service whose wide availability typically leads to smaller profit margins and diminishes the importance of factors (such as brand name) other than price….

The above definition is perfect regarding the state of the snowmobile industry….too much product at the dealer level has everyone shopping price. Your (name a brand/model) is identical to the dealer down the street with the only thing separating them is how much money you’re willing to lose. The industry needs to limit production to create a “shortage” of sorts in order to create demand and give the buyer a reason to buy. H-D did this very successfully for years.

While you may have lost $$ on a machine in the past, you used to be able to make a little by selling ancillary items, but the internet and multi-level buying programs have allowed those with deep pockets to capitalize on additional savings and the “little guys” left holding the bag.