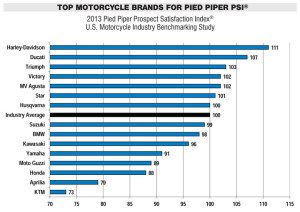

Harley dealers rank highest in PSI study

Pied Piper changes scoring system, and H-D stores remain on top

As a group, Harley-Davidson dealers excel at handling prospective customers. For the second year in a row, they topped Pied Piper Management Company, LLC’s Prospect Satisfaction Index, with a score of 111. And they did so despite Pied Piper changing the scoring system.

Since the inception of PSI in 2007, Pied Piper has measured 57 variables when grading dealerships. Though the company still measured those variables, it only scored about 40, with a focus more on selling and less on factors such as the facility. As a result, some OEMs moved down on the list, while others moved up. BMW dealers, for example, always rate well on facility scores, but after those categories were removed, the group’s overall score dropped.

“The industry average is still 100. The maximum PSI score for 2013 and beyond is 150, and the minimum is 50, so the individual dealer who is getting a PSI score approaching 150 is doing outstanding,” Pied Piper president Fran O’Hagan explained, adding that those dealerships with scores closer to 50 need improvement.

Category toppers

Though the scoring system changed, Harley-Davidson dealerships still outperformed the next-highest OEM, Ducati, by 4 points. Harley dealers led the others in 18 different sales activities.

“From 2007 to now, Harley-Davidson as a network, the dealers tend to be much more focused on process than the dealers for the other brands,” O’Hagan said.

Harley-Davidson dealers asked for contact information 61 percent of the time, exceeding the industry average of 47 percent. A typical Honda dealer, in contrast, only asked for that info 34 percent of the time.

Harley dealers also asked prospects to sit down at a desk 50 percent of the time. A BMW dealer only did that a quarter of the time.

But that’s not to say all Harley-Davidson dealerships excelled and all dealerships from other brands did not, O’Hagan explained.

“Harley-Davidson has a lot fewer dealers that do a lousy job at selling motorcycles than the other brands, but there are definitely examples in any of these brands of dealers that do an outstanding job,” he said.

The industry as a whole improved both how often it discussed features unique from competitors (which dealers now do 49 percent of the time) and when they encourage going through the numbers or writing up a deal (now 33 percent of the time).

Test rides

Demo ride rates also improved, as they were offered 19 percent of the time in 2013, an increase of 3 percentage points from a year ago.

“The group that offers them half the time sells 44 percent more motorcycles than those who do not,” O’Hagan reported.

BMW and Triumph topped the demo ride category, offering test rides 30 percent of the time, while Kawasaki, Honda and Yamaha came in at less than 10 percent each.

As far as offering a future test ride, Victory dealers topped that category with 32 percent. The industry average is 20 percent.

“In our experience, there’s about an 80 percent chance they’ll buy the bike if they come back — make a separate trip — bring their helmet and gear and test ride the bike,” O’Hagan said.

PSI also measured what they call the “poor man’s test ride,” which is asking a customer to sit on a bike. Harley-Davidson dealers, again, tipped the charts in this category, offering customers to sit on a bike 81 percent of the time. KTM dealers did the same 33 percent of the time.

Improving scores

Though the motorcycle industry as a whole improved in many areas, it struggled in others. Those behaviors that decreased in frequency in 2013 included conducting a walkaround demonstration, now done 70 percent of the time; overcoming shopper objections, now at 74 percent; and giving compelling reasons to buy now, which occurs 39 percent of the time.

But there’s hope. By improving sales processes, dealerships can make a big impact on their sales. Those in the top quarter of all dealerships in all brands sell 22 percent more motorcycles than those in the bottom quarter, and those who ask for the sale two-thirds of the time sell 34 percent more bikes than their counterparts.

“How simple it is to start thinking about and start caring about the process your salespeople use to sell? That’s something you can change right now,” O’Hagan said. “It’s one of the few pieces of the dealership business that you can change, and it does have some good payoff.”

The 2013 PSI study was conducted by 2,503 hired anonymous mystery shoppers throughout the U.S. from July 2012 to April 2013.