Rollick partners with credit report provider

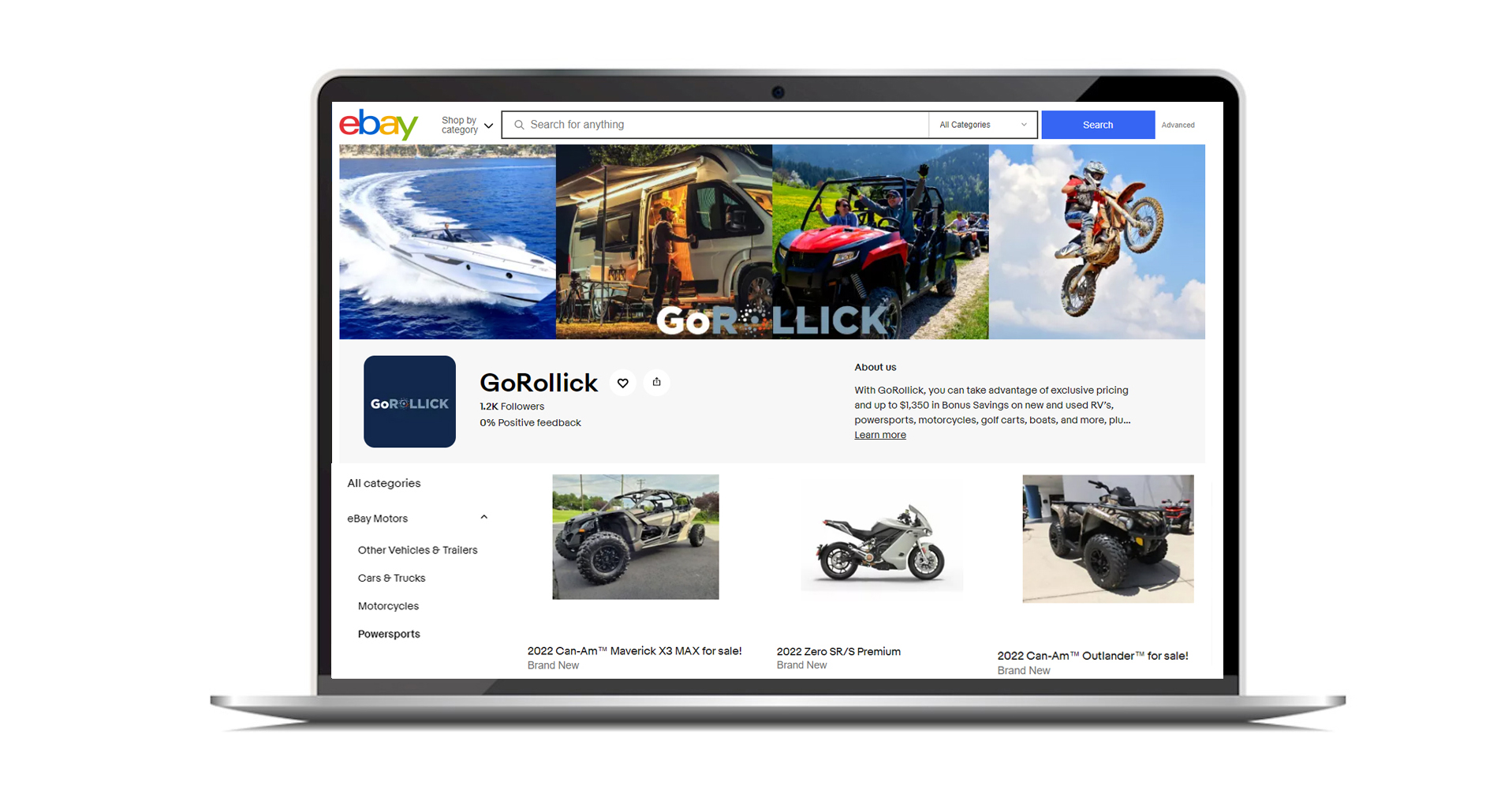

Rollick has announced that it now offers integration with 700Credit, a provider of credit reports, compliance and soft pull products. The integration enables consumers to prequalify for dealer financing via their 700Credit relationship while using the Rollick-powered digital retailing tool on dealer and GoRollick Marketplace websites. Known as RollickDR, the all-in-one “smart” lead generation tool adds deeper buyer context, speed and efficiency to the sales process for consumers, dealerships and lenders.

700credit works with more than 3,500 dealers in the recreation category. Many of these dealers overlap with Rollick’s network and have been asking for this integration since Rollick launched RollickDR last summer. Prequalified customers through RollickDR have proven to close 230% higher than a standard “Get a Quote” lead. Accordingly, Rollick seeks to make its tool accessible to all dealers, recognizing that many have already embraced 700Credit’s prequalification solution to understand a prospective customer’s creditworthiness before they arrive at the dealership.

“We’re excited to provide this integration so that dealers can now enhance the power of the RollickDR tool,” Ken Hill, managing director of 700Credit said. “Dealers will appreciate the seamless experience we’ve created, and potential buyers will quickly understand if they qualify for dealer financing and receive a more accurate payment estimate earlier in the sales process that is based on their actual FICO credit score. Dealers also benefit by being able to view the consumers FICO score and credit report at the top of the sales funnel.”

In addition to finance prequalification, RollickDR includes several other modules designed to engage shoppers based on where they’re at in the buying process and how much information they are willing to give to the dealer prior to visiting the store. Other modules include the ability to view special offers and available incentives, reserve a unit with a deposit via Rollick’s embedded payment partners such as Kenect, estimate a trade-in value, schedule an appointment, estimate monthly payments and request a price quote.

“With more than 20% of Rollick dealer clients already using 700Credit, we are happy to make it simple for them to get more use out of their prequalification partner via our integration,” Jason Nierman, co-founder and chief revenue officer of Rollick said. “We’re also excited by the opportunity to expose our dealer clients not already using 700Credit to their platform, as well as give their dealer clients not already working with Rollick the opportunity to improve their close rates by over 50% through our RollickDR solution. This is part of an overall effort to streamline and improve the buying experience for everyone — with the dealer as the centerpiece.”

700Credit’s consumer prequalification is a web-based lead generation solution that does not require a consumer’s SSN or DOB and has no effect on their credit file. Prequalifying a customer enables dealers to structure the right deal to get the consumer a payment they can afford sooner in the sales process. Together, Rollick and 700Credit drive more qualified sales leads from the web to dealer showrooms.