BRP’s analyst and investor day offers Sea-Doo Switch seat time

BMO Capital Markets analyst Gerrick Johnson, who compiles the results of the Powersports Business Quarterly Dealer Surveys (complete your survey today!), is fresh off a two-day junket to Orlando for a BRP investor event.

He provided this research note to Powersports Business.

“We attended BRP’s (DOO) two-day investor event in Orlando, where management provided updates to its M25 financial plan, presented its case as to how it would achieve its targets, and showed off new products central to its growth plan, including the Sea-Doo Switch and the redesigned Manitou Pontoon utilizing DOO’s ‘Project Ghost’ hidden Rotax outboard engine. Management remains quite upbeat despite widespread investor concern about the economy, supply chain, and sustainability of outdoor recreational demand.

“Key Points

“This flash presents our high-level thoughts after DOO’s investor day. We will follow up with more details, analysis, and model review.

“DOO increased its FY25 revenue target to $12.0-12.5 billion and EPS target to $13.50-14.50, revised from a previous target of $9.5 billion in revenue and $7.50 in EPS. The prior targets were stale, as they had been introduced in October 2019, five months prior to the onset of the COVID-19 pandemic. The new targets represent +16% to +18% revenue CAGR and +11% to +13% EPS CAGR over the next three years.

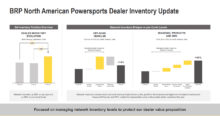

“DOO management remains confident despite widespread economic uncertainty, pointing to low-unemployment rates, continued strong powersports demand, and a $1.4 billion channel fill opportunity. Our checks confirm this outlook: dealers are experiencing continued consumer appetite for DOO’s vehicles with little or no pre-order cancellations.

“We think some investors might be critical of lower imbedded margin targets, as the plan implies FY25 EBITDA margins of 16.8%, 230 bps below FY22’s 19.1%, with an incremental margin of around 13%. We think these rates are realistic, given the eventual return of promotions and floorplan support, investments in new initiatives, and ORV mix shifts as DOO marches towards 30% market share (22% currently). Rather than focus on margin rate, we think investors should be pleased with the forecasted +38% to +44% growth in adjusted EBITDA over the next three years (+11% to +13% CAGR).

“While it was nice to get updated financial targets, we think the highlight of the event was the opportunity to see, and ride, the redesigned Manitou pontoon boat powered by the Rotax ‘Project Ghost’ hidden outboard engine. We also had the opportunity to ride and pilot the new Sea-Doo Switch pontoon. We were impressed with what we saw, and look forward to sharing more detailed thoughts soon.”