BRP offers several revenue drivers, analyst remains ‘bullish’

Analyst Martin Landry of Canada’s Stifel GMP provided Powersports Business with a research note following a desk update with BRP executives on Wednesday.

“While BRP’s shares have performed well, up 18% since the publication of the Q4/FY22 results on March 25, we see further upside. We believe that shares of BRP offer an appealing risk/reward profile to investors for the following reasons; (1) Deeply discounted valuation, DOO trades 8x our FY24 EPS estimate, ~6 multiple points lower than its historical average, (2) near term catalyst with the FY25 plan update in June, which should improve visibility and reassure investors, (3) healthy balance sheet providing flexibility to return capital to shareholders and (4) industry scanner data suggesting continued momentum with unit volumes at US dealerships up 13% YoY in February, the strongest growth rate of the last 7 months. We believe that the upcoming FY25 plan update could surprise to the upside as current expectations appear low, hence we would be buyers leading up to the investor day in mid-June.

“We hosted BRP for a desk update today which reinforced our bullish view on the company. Investors appear concerned about the company’s ability to grow EPS in coming years given potential economic turbulence and given the hockey stick EPS performance of the recent years. Our long-term FY26 scenario analysis suggests that the company could grow its EPS at a CAGR of 7-10% annually from FY23 levels. Under an assumption that valuation multiples return to historical averages in FY26, we could see BRP’s share price more than double from current levels. The following factors support our bullish stance on BRP:

“Several revenue drivers. (1) The introduction of the See-Doo Switch has been a highly successful product launch and will start contributing to revenues this year. Management expects that the Switch could generate upwards of $600 million in annual sales within 3 to 4 years of its launch, (2) BRP’s Ghost project expected to be unveiled this spring, which should bring BRP near its 2025 target of $1b in revenues in the marine segment, (3) The entry into the motorcycle segment which could results in upwards of $500 million annual revenues.

“Upcoming capacity increases. BRP is expanding its SSV manufacturing capacity in Juarez which is expected to support incremental revenues in excess of $1b. The company has also expanded its PWC capacity in Queretaro and announced a capacity expansion for its Alumacraft pontoons. Hence, the company is in a solid position to support continued revenue growth.

“Hybrid workplaces a driver of demand. COVID allowed people to rethink their working and living arrangements, thus resulting in a larger addressable market for the Powersport industry. Work from home trends and housing affordability issues created an urban exodus which resulted in customers having more time and space to enjoy Powersport products. BRP has seen sustained levels of new entrants who historically would not have had the ability nor the time to use BRP’s products. We believe both trends have created a “step-up” change for the Powersports industry and could help sustain high levels of demand in the future.

“Shares buyback. Management indicated being comfortable with a financial leverage of 2x EBITDA, which suggest that the company will not reduce its debt levels (leverage of 1.3x) and use expected free cash flows to buyback shares and increase dividends. We do not expect material acquisitions. We estimate that the company can buyback at least 5% of its float annually, making our EPS CAGR assumption of 7-10% that much easier to attain with potential for upside.

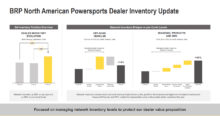

“Better positioned to face an economic downturn. BRP is better equipped to face a potential economic downturn than in the past for the following reasons (1) Inventory levels at dealerships are extremely low, which could act as a cushion to absorb a sell-through slowdown, (2) BRP offers products at low price points which could be appealing to customers with reduced spending budgets, (3) BRP has a broad range of products including SSVs, fishing boats and motorcycles which were not sold by the company during the last recession.”