Analyst provides insight ahead of BRP’s quarterly earnings release

Prior to BRP reporting its third quarter fiscal 2022 results on Dec. 1, BMO Capital Markets analyst Gerrick Johnson has provided a research note to Powersports Business.

“We expect BRP (DOO) to report FY3Q22 normalized EPS of $1.59, down -25% from $2.13 in FY3Q21. Our estimate is higher than the Street consensus estimate of $1.31 (-38%). We think BRP has been doing a decent job of flowing inventory into the dealer channel, which should result in a return to market share gains during the quarter. However, we think there is a high degree of skepticism amongst investors, who fear that supply is not flowing quite as well as we think it is.

“Key Points

“We expect FY3Q22 sales to grow +2% to $1.71 billion, lower than the consensus of $1.72 billion (+3%).

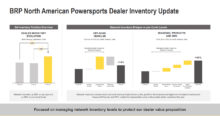

“We expect FY3Q22 North American powersports retail sales to be down about -15% y/y. Retail demand has remained strong, with any decline owing to a lack of retail inventory. We think customers have shrugged off price increases as manufacturers pass through cost inflation. Given the strong demand and slower replenishment, a lack of dealer inventory still remains the primary impediment to stronger retail sales.

“We estimate revenue to decline -3.5% in Year-Round Products, with SSV down -19%, but ATV sales up +20% and Roadster sales up +150%. We expect Seasonal Product revenue to grow +13% in the quarter on a +20% increase in PWC sales and +12% growth in snowmobile sales. We project the company’s marine segment will increase +6% (boat -8% and marine PAC +29%). Like ORV and PWC, boat demand has been robust, but also suffering from inventory shortages with many dealers selling production slots out into late 2022 and early 2023 in some cases.

“We expect the gross margin to contract -240 bps, to 26.7% from 29.1%, owing to rising input, labor, and logistics costs more than offsetting higher production levels, overhead absorption, and lower promotions. However, this could be an area of potential upside to our estimates.

“DOO’s current FY2022 guidance is for revenue of $7.56-8.04 billion (+27% to +35%), EPS of $8.25-9.75 (+53% to +81%), and normalized EBITDA of $1.3-1.47 billion (+30% to +47%).

“We are currently modeling revenue of $8.0 billion (+34%), EPS of $10.00 (+86%), and normalized EBITDA of $1.55 billion (+56%). The Street consensus revenue estimate is $7.79 billion (+31%), EPS is $9.39 (+75%), and normalized EBITDA is $1.41 billion (+43%).”