BRP reports fiscal Q4 results, 25% YOY retail growth

BRP has reported its financial results for the three- and twelve-month periods ended January 31, 2021. All financial information is in Canadian dollars unless otherwise noted.

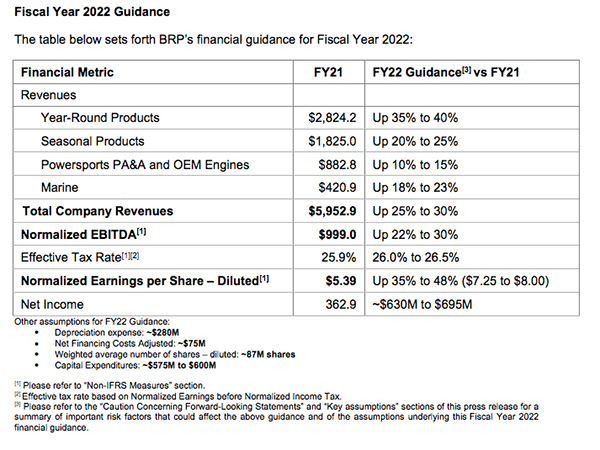

“We are very pleased with our fourth quarter results which ended Fiscal 2021 on a strong note. We reported record results for the year thanks to our team’s ability to quickly implement initiatives to mitigate the impact of the pandemic while at the same time positioning the business to take advantage of the surge in consumer demand. Our strong start to the year was accelerated by an influx of new customers to our business. This unprecedented demand level led to a 25% year-over-year retail growth for our powersports products in North America,” said José Boisjoli, President and CEO. “Fiscal 2022 is off to a strong start as well. We are seeing continued strong retail demand across all our product lines. In addition, we are making strategic investments in new products, production capacity and the electrification of our current product portfolio, which bodes well for the future. We are well positioned to deliver another strong year with an anticipated growth of 35% to 48% in diluted Normalized EPS… I would like to thank our employees, suppliers and dealers for their agility, dedication and resilience during this past year. Their hard work allowed us to deliver exceptional results in Fiscal 2021. We are excited about the future with many projects in motion, including our investment in electric vehicles.”

Highlights for the Three- and Twelve-Month Periods Ended January 31, 2021

Revenues increased by $199.2 million, or 12.3%, to $1,815.1 million for the three-month period ended January 31, 2021, compared with $1,615.9 million for the corresponding period ended January 31, 2020. The revenue increase was mainly driven by a higher volume of products sold and lower sales programs due to a strong retail environment, partially offset by an unfavorable foreign exchange rate variation of $19 million.

The Company’s North American retail sales for powersports vehicles increased by 30% for the three-month period ended January 31, 2021 compared with the three-month period ended January 31, 2020. The increase was mainly driven by snowmobile, SSV and ATV. North American boat retail sales increased by 48% compared with the three-month period ended January 31, 2020.

Gross profit increased by $118.2 million, or 30.8%, to $501.9 million for the three-month period ended January 31, 2021, compared with $383.7 million for the corresponding period ended January 31, 2020. The gross profit increase includes an unfavorable foreign exchange rate variation of $21 million. Gross profit margin percentage increased by 400 basis points to 27.7% from 23.7% for the three-month period ended January 31, 2020. The increase was primarily due to positive pricing and sales programs variation due to the strong retail environment and a higher volume of Seasonal Products sold, partially offset by higher freight and logistic costs and an unfavorable foreign exchange rate variation.

Operating expenses increased by $66.5 million, or 35.7%, to $252.8 million for the three-month period ended January 31, 2021, compared with $186.3 million for the three-month period ended January 31, 2020. This increase was mainly attributable to the reversal in Fiscal 2020 of $40.5 million of provisions related to a favorable litigation decision, higher variable employee compensation expenses and continued product investments.

Revenues decreased by $99.8 million, or 1.6%, to $5,952.9 million for the twelve-month period ended January 31, 2021, compared with $6,052.7 million for the corresponding period ended January 31, 2020. The revenue decrease was primarily attributable to a lower volume of Year Round Products and Seasonal Products due to the temporary suspension of production during part of the first half of Fiscal 2021 following government measures adopted in response to COVID- 19, and to a lower volume of Marine products sold due to the wind-down of the Evinrude E-TEC outboard engines production. The decrease was partially offset by lower sales programs due to a strong retail environment, higher volume of Powersports PA&A and a favorable foreign exchange rate variation of $3 million.

The Company’s North American retail sales for powersports vehicles increased by 25% for the twelve-month period ended January 31, 2021 compared with the twelve-month period ended January 31, 2020, mainly due to an increase in SSV, ATV and snowmobile. North American boat retail sales increased by 10% compared with the twelve-month period ended January 31, 2020.

Gross profit increased by $18.3 million, or 1.3%, to $1,472.3 million for the twelve-month period ended January 31, 2021, compared with $1,454.0 million for the corresponding period ended January 31, 2020. The gross profit increase includes an unfavorable foreign exchange rate variation of $21 million. Gross profit margin percentage increased by 70 basis points to 24.7% from 24.0% for the twelve-month period ended January 31, 2020. The increase was the result of a positive pricing and sales programs variation due to the strong retail environment. The increase was partially offset by the under-absorption of fixed costs resulting from the temporary suspension of production, the costs related to the wind-down of the Evinrude E-TEC outboard engines production and higher labor, freight and logistic costs.

Operating expenses increased by $157.0 million, or 18.5%, to $1,006.7 million for the twelvemonth period ended January 31, 2021, compared with $849.7 million for the twelve-month period ended January 31, 2020. The increase was mainly attributable to the impairment charge recorded during the first quarter of Fiscal 2021 for the Marine segment and the restructuring costs for a total of $214.4 million, partially offset by cost reduction initiatives to mitigate the COVID-19 impact.

QUARTERLY REVIEW BY SEGMENT

Powersports Year-Round Products

Revenues from Year-Round Products increased by $54.6 million, or 7.7%, to $759.7 million for the three-month period ended January 31, 2021, compared with $705.1 million for the corresponding period ended January 31, 2020. The increase resulted mainly from a favorable product mix in SSV and lower sales programs due to a strong retail environment. The increase was partially offset by a lower volume of 3WV sold due to a change in the production schedule compared to the fourth quarter of Fiscal 2020 and an unfavorable foreign exchange rate variation of $8 million. North American Year-Round Products retail sales increased on a percentage basis in the high-30s range compared with the three-month period ended January 31, 2020.

Seasonal Products

Revenues from Seasonal Products increased by $128.7 million, or 23.7%, to $671.4 million for the three-month period ended January 31, 2021, compared with $542.7 million for the corresponding period ended January 31, 2020. A higher volume of snowmobile drove the increase and PWC sold, by lower sales programs due to a strong retail environment and by favorable pricing. The increase was partially offset by an unfavorable foreign exchange rate variation of $9 million.

North American Seasonal Products retail sales increased on a percentage basis in the mid-20s range compared with the three-month period ended January 31, 2020.

Powersports PA&A and OEM Engines

Revenues from Powersports PA&A and OEM Engines increased by $41.5 million, or 19.2%, to $257.1 million for the three-month period ended January 31, 2021, compared with $215.6 million for the corresponding period ended January 31, 2020. The increase was mainly attributable to a higher volume of PA&A in SSV, ATV and snowmobile coming from strong unit retail sales and higher replacement parts revenue driven by an increased usage of products by consumers.

Marine

Revenues from the Marine segment decreased by $28.2 million, or 17.9%, to $129.2 million for the three-month period ended January 31, 2021, compared with $157.4 million for the corresponding period ended January 31, 2020. The decrease was mainly due to the wind-down of the Evinrude E-TEC outboard engines production resulting in a lower volume of outboard engines sold.