You won’t believe how powersports retail is tracking in May month-to-date

That crazy high sales increase the average powersports dealership has been experiencing this month? It’s not just at your shop. Apparently, the average U.S. powersports dealership is riding a sales wave in May like no other.

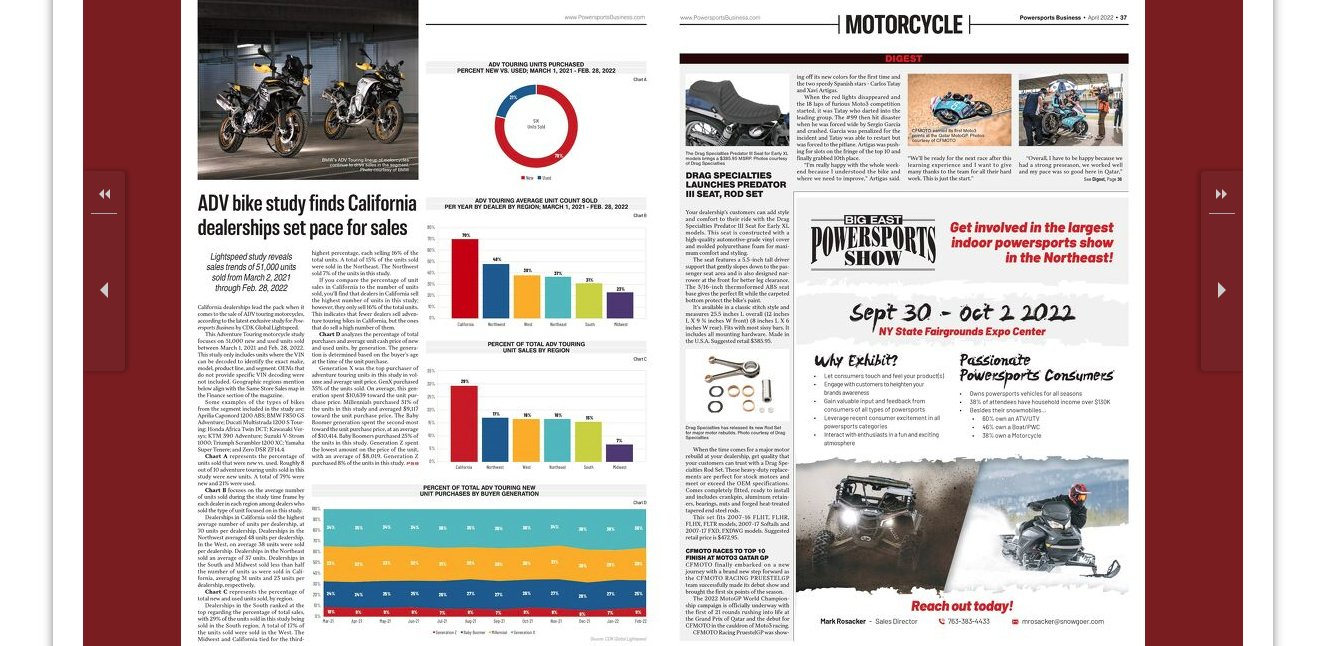

According to a research note provided to Powersports Business by Wells Fargo Securities analyst Tim Conder following a conference call with CDF colleagues, powersports retail is leading both marine and RV, with 50 percent retail sales growth in May month-to-date vs. the year-ago period.

Conder reports that retail “appears to have bottomed late-March/early-April with $ trends sequentially improving led by core Powersports (+50% May MTD) followed by Marine (tracking +LDD% May) and then RV (down high 20% May MTD). Retail performance varies by geography given operating restrictions and weather (Southeast collectively best), but recent strength has been more broad-based as states reopen. Canada and Europe recovery is lagging the U.S. Inventories were generally clean ahead of the COVID-19 onset and are in even better shape now as moderate retail continued while OEM production was paused. We have not heard of any major supply chain issues for OEMs and very minimal logistical constraints (limited to RV). We do not anticipate much dealer attrition given OEM/lender/PPP support, controlled channel inventories, and quickly recovering retail. Retail financing is marginally tighter in some cases, but is still readily available/affordable and not impeding consumer purchases. It appears the emerging primary concern is potential product shortages during the remainder of Q220 as OEMs ramp up production to meet better-than-anticipated demand.”

As part of the call with floorplan lender CDF, Conder reports that “their commentary further confirmed our view that risk is increasingly tilted to the upside, with Street consensus for 2020 retail and OEM EPS likely conservative.

“Across the Marine, Core Powersports, and RV sectors, retail trends are recovering faster-than-expected with increased interest from both existing and new customers seeking relief from “stay-at-home” orders.

“Core Powersports. Liquidation $ troughed March 23-April 10 (40%). April liquidations (11%), but May-to-date +52% including +>80% over the past 7 days. ORVs/dirt motorcycles outperforming, while on-road motorcycles lag but are seeing recent strength. CDF has high confidence in near-term retail through June, as well as long-term momentum given new entrants, but mid-term visibility is limited. A majority of dealers have reopened with a significant increase over the last 3 weeks. Dealer inventories at lowest level since August 2017, with April/May wholesale down significantly, but starting to pick up.”

— Dave McMahon, editor, dmcmahon at powersportsbusiness.com