Polaris sees Q2 North American retail side-by-side sales rise

Polaris on Tuesday revealed reported and adjusted sales for the second quarter of 2019 increased 18 percent to $1.779 billion.

Reported net income was $1.42 per diluted share, down 1 percent over the prior year; adjusted net income for the same period was $1.73 per diluted share, down 2 percent over the prior year.

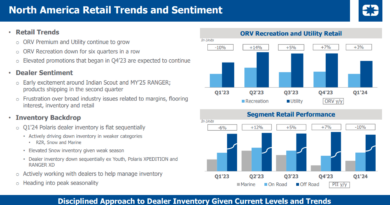

North American side-by-side retail sales increased low-single digits percent for the quarter compared to last year; Indian retail sales were down high-single digits percent, outperforming the industry and gaining share in an extremely challenging market.

Dealer inventory was up 1 percent year-over-year for the second quarter 2019, slightly below targeted inventory levels.

Polaris narrowed its full year 2019 earnings guidance by maintaining the upper end of the net income range and increasing the lower end of the range and now expects earnings to be in the $6.10 to $6.30 per diluted share range, which takes into account the China 301 list 3 tariff increasing from 10 percent to 25 percent. Full year 2019 adjusted sales growth guidance was also narrowed to up 12 percent to 13 percent over the prior year.

“Our second quarter results reflect the deft leadership and disciplined execution of our Polaris team,” said Scott Wine, chairman and chief executive officer of Polaris Industries Inc. “We worked diligently to overcome the impacts of tariffs, a very wet spring and an aggressive promotional environment, delivering financial results slightly favorable to expectations but trailing our long-term performance goals.

“The strength of our industry-leading brands and vehicles enabled us to gain share in Indian Motorcycles and drive growth in Side-by-Sides with RANGER and RZR, although our decision to assume price leadership did impact volume, specifically in our lower margin youth and value segments. We are encouraged by our market share gains and year-to-date growth in Boats, as well as the continued improvement at TAP, where retail store sales growth was up nicely. Our operational and dealer fundamentals are in good shape as we head into the critically important model year 2020 product introductions, and we anticipate improved retail performance during the second half of the year. We are excited to host our unrivaled dealer network at our 65th Anniversary dealer show later this month, and look forward to demonstrating how we will continue to be the global leader in powersports with our unwavering commitment to be a customer-centric, highly efficient growth company.”

Gross profit increased 13 percent to $436 million for the second quarter of 2019 from $385 million in the second quarter of 2018. Reported gross profit margin was 24.5 percent of sales for the second quarter of 2019 compared to 25.6 percent of sales for the second quarter of 2018. Gross profit for the second quarter of 2019 includes the negative impact of $7 million of restructuring and realignment costs. Excluding these costs, second quarter 2019 adjusted gross profit was $443 million, or 24.9 percent of adjusted sales. For the second quarter of 2018 adjusted gross profit of $390 million, or 25.9 percent of adjusted sales, excludes the negative impact of $6 million of restructuring and realignment costs. Gross profit margins on an adjusted basis were down 104 basis points reflecting tariff costs and the addition of Boats which has a lower gross profit margin, partially offset by increased productivity and higher average selling prices.

Operating expenses increased 13 percent for the second quarter of 2019 to $321 million, or 18.0 percent of sales, from $284 million, or 18.9 percent of sales, in the same period in 2018. Operating expenses in dollars increased primarily due to the Boat Holdings acquisition completed during the third quarter of 2018 and investments in strategic projects. Operating expenses as a percentage of sales, improved as the Boat segment has a lower operating expense to sales ratio compared to the legacy Polaris business.

Income from financial services was $20 million for the second quarter of 2019, down 7 percent compared with $21 million for the second quarter of 2018. The decrease is primarily attributable to lower retail sales and lower penetration rates during the quarter.

Interest expense was $21 million for the second quarter of 2019 compared to $9 million for the same period last year, primarily due to increased debt levels to finance the Boats acquisition and higher interest rates.

Equity in loss of other affiliates was $455 thousand for the second quarter of 2019 compared to $4 million for the same period last year. In the second quarter 2018, the Company recorded charges of approximately $4 million associated with the shut down of the Eicher-Polaris joint venture in India.

Other income, net, was $271 thousand in the second quarter of 2019 compared to $4 million in the second quarter of 2018. Other income is the result of foreign currency exchange rate movements and the corresponding effects on foreign currency transactions related to the Company’s foreign subsidiaries.

The provision for income taxes for the second quarter of 2019 was $26 million, or 22.9 percent of pretax income, compared with $20 million, or 18.0 percent of pretax income for the second quarter of 2018. The increase in the effective income tax rate is primarily due to a decrease in excess tax benefits related to stock-based compensation.

Off-Road Vehicles (“ORV”) and Snowmobiles segment sales, including PG&A, totaled $1,049 million for the second quarter of 2019, up six percent over $991 million for the second quarter of 2018 driven by increased average selling prices, particularly in side-by-side’s, and growth in PG&A. PG&A sales for ORV and Snowmobiles combined increased 9 percent in the second quarter of 2019 compared to the second quarter last year. Gross profit increased five percent to $313 million in the second quarter of 2019, compared to $297 million in the second quarter of 2018. Gross profit percentage declined 20 basis points during the quarter as higher average selling prices and increased productivity were more than offset by higher promotions and tariff costs.

ORV wholegood sales for the second quarter of 2019 increased 4 percent primarily driven by increased average selling prices. Polaris North American ORV retail sales decreased low-single digits percent for the quarter with side-by-side vehicles up low-single digits percent and ATV vehicles down high-single digits percent. Shipment unit volume was down during the quarter, in-line with retail sales declines as the Company’s retail flow management process (RFM) performed as designed. The North American ORV industry was up high-single digits percent compared to the second quarter last year partly driven by new competitive product not in the market a year ago.

Snowmobile wholegood sales in the second quarter of 2019 were $16 million compared to $4 million in the second quarter last year. Snowmobile sales in the Company’s second quarter are routinely low as it is the off-season for snowmobile retail sales and shipments.

Motorcycles segment sales, including PG&A, totaled $197 million, up 15 percent compared to the second quarter of 2018, driven by strength in Indian sales, particularly the new FTR1200 motorcycle which began shipping globally in the second quarter, offset by declines in Slingshot sales. Gross profit for the second quarter of 2019 was $27 million compared to $25 million in the second quarter of 2018. The increase in gross profit was primarily the result of higher volume mostly offset by increased tariff costs.

North American consumer retail sales for the Polaris Indian motorcycles decreased high-single digits percent during the second quarter of 2019 in a weak mid- to heavy-weight two-wheel motorcycle industry that was down low double digits percent. Indian outperformed the market with modest market share gains in North American during the quarter driven by retail sales of our new mid-size bike, the race inspired FTR1200, which has experienced strong initial demand both in North America and Internationally.

North American consumer retail sales for Polaris’ motorcycle segment, including both Indian Motorcycles and Slingshot, decreased mid-teens percent during the second quarter of 2019, while the North American Motorcycle industry retail sales for mid to heavy-weight motorcycles including three-wheel vehicles, was down mid-single digits percent in the second quarter of 2019.

Global Adjacent Markets segment sales, including PG&A, increased seven percent to $122 million in the 2019 second quarter compared to $113 million in the 2018 second quarter. Gross profit increased 21 percent to $34 million or 27.8 percent of sales in the second quarter of 2019, compared to $28 million or 24.8 percent of sales in the second quarter of 2018, due to increased volume and favorable product mix.

Aftermarket segment sales of $229 million in the 2019 second quarter increased one percent compared to $227 million in the 2018 second quarter. TAP sales in the second quarter of 2019 were $210 million, which was flat compared to the second quarter of 2018. The Company’s other aftermarket brands increased sales by 12 percent. Gross profit decreased to $55 million in the second quarter of 2019, compared to $58 million in the second quarter of 2018 due to higher tariff costs.

Boats segment sales, which consist of the Boat Holdings acquisition, which closed July 2, 2018, were $182 million in the 2019 second quarter. Gross profit was $40 million or 22.2 percent of sales in the second quarter of 2019.

Parts, Garments, and Accessories (“PG&A”) sales increased 10 percent for the 2019 second quarter primarily driven by growth across the Company’s segments.

International sales to customers outside of North America, including PG&A, totaled $231 million for the second quarter of 2019, up 13 percent from the same period in 2018. The increase in sales is primarily attributable to growth in Indian Motorcycles and Global Adjacent Markets.

For the full year 2019, the Company is narrowing its earnings guidance range by increasing the lower end to $6.10 per diluted share and maintaining the upper end at $6.30 per diluted share, including the impact of the China 301 list 3 tariff rate increasing from 10 percent to 25 percent effective May 2019, and the benefit of the Company’s tariff mitigation actions. The Company is also narrowing its full year 2019 sales guidance range and now expect sales to grow in the range of 12 percent to 13 percent compared to the prior year given only six months remain to year-end.